Examining Q2 Earnings Report

The Q2 earnings season has painted a picture of stability and positive growth, with a promising outlook ahead. Despite a generally upbeat sentiment from management teams, estimates for the current period are showing signs of weakening quicker than in previous periods.

Among the 431 S&P 500 companies that have reported Q2 results, total earnings have seen a remarkable rise of +10.6% from the same period last year, coupled with a +5.2% increase in revenues. Notably, 79.8% of these companies have surpassed EPS estimates, and 59.2% have outpaced revenue estimates.

Projections for the Upcoming Quarter

Looking ahead to 2024 Q3, S&P 500 earnings are expected to climb by +4.7% year-over-year, supported by a +4.7% uptick in revenues. However, there has been a decline in estimates since the quarter commenced, with the current pace of earnings growth revised down from +6.9% in early July.

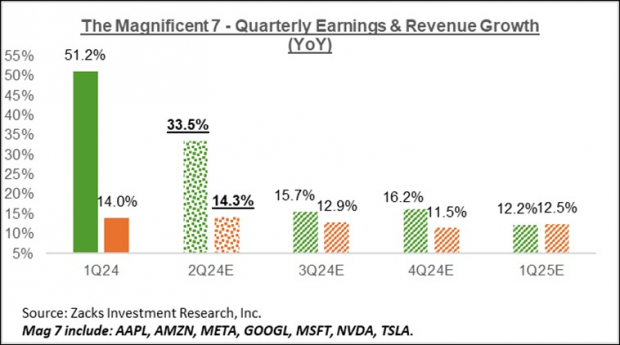

The much-discussed ‘Magnificent 7’ companies are forecasted to witness a remarkable +33.5% earnings surge from the same period last year on the back of a +14.3% rise in revenues. Excluding these top performers, the rest of the index shows a dip in Q2 earnings growth to +6.2% from +11.0%.

Market Reaction to Key Tech Players

Top players, like Microsoft, Alphabet, Amazon, Apple, Meta Platforms, Tesla, and Nvidia, have been under scrutiny following their Q2 releases. Although these companies fell short of market expectations, particularly in the AI investment domain, it underscores their commitment to staying ahead in a rapidly evolving tech landscape.

Despite market concerns over escalating capex levels, these investments are crucial for these giants to retain their competitive edge in an ever-changing business environment.

Optimistic Outlook for the Tech Sector

Beyond the ‘Mag 7,’ the Tech sector at large is poised for a robust +20.6% earnings growth in Q2 compared to the previous year. The sector’s positive revisions trend underscores its crucial role in driving nearly 30% of all S&P 500 earnings in the upcoming four-quarter period.

With Tech sector earnings anticipated to climb by +17.5% for full-year 2024, bolstered by an optimistic outlook for the following year, the industry’s relentless march towards higher-margin software and services is a key factor in this positive trajectory.

Charting Earnings Trajectory

Historical data reveals record-breaking margins in the Tech sector, with expectations set to surpass the previous year’s levels. The ongoing trend underscores the sector’s relentless pursuit of innovation, with AI poised to play a pivotal role in enhancing productivity.

As the earnings landscape unfolds, it becomes evident that the Finance sector’s revenue weakness is offset by robust margin gains, signifying a balanced growth narrative.

A Glimpse into the Future

As 2024 Q3 approaches, S&P 500 earnings are predicted to rise by +4.7%, accompanied by a similar increase in revenues. Despite recent downward adjustments to estimates across various sectors, the positive revisions in the Tech and Finance industries stand out, indicative of a sector-wide recalibration.

Please note that this year’s earnings growth of +8.4% primarily stems from the Finance sector’s revenue challenges. Excluding this sector, the earnings growth story strengthens, paired with an improved revenue growth rate, illustrating the diverse forces at play in shaping the earnings landscape.

Exploring Margin Expansion Across 16 Zacks Sectors

Margin Expansion Forecast

Forecasting an uplifting trajectory for investors, key insights reveal that 11 out of the 16 Zacks sectors are set to witness bolstered margins in 2024 compared to the previous year. Among the frontrunners driving this margin ascension are Tech, Finance, and Consumer Discretionary.

Potential Stock Surges

Drawing attention to a silver lining amid the market’s dynamics, the prospect of five stocks poised to potentially double in the near future emerges from the expertise at Zacks. These selected stocks hold the promise of surging by over 100% within the duration of 2024. While not every stock can emerge victorious, the track record boasts significant wins, such as gains reaching +143.0%, +175.9%, +498.3%, and even +673.0%. This selection of under-the-radar stocks offers a captivating opportunity to get in on the ground level.