When it comes to trading stocks, investors often lend an ear to broker opinions. The Wall Street maestros wield their influence over the market with their recommendations. But are these notes of wisdom truly melodious?

Before delving into the reliability of brokerage suggestions and how they can conduct the investment orchestra for your benefit, let’s first take a glance at the symphonic masterpiece called Eaton.

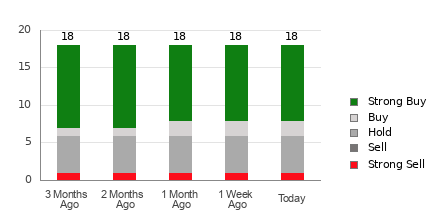

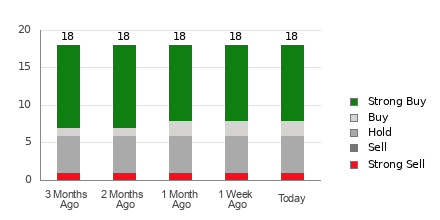

Eaton is currently sung to an average brokerage recommendation pitch of 1.89, harmonized on a 1 to 5 scale – from Strong Buy to Strong Sell. This score orchestrates the actual recommendations – Buy, Hold, Sell, among others – crescendoed by 18 brokerage ensembles. An ABR of 1.89 plays a tune between Strong Buy and Buy.

Out of this concerto of 18 voices, 10 chant Strong Buy and two echo Buy. These sonorous expressions account for 55.6% and 11.1% of all the melodious refrains.

Brokerage Notations for Eaton: An Ensemble of Opinions

While the ABR score suggests buying shares of Eaton, it would be imprudent to play this investment symphony solely based on these notes. Many research studies have opined that brokerage recommendations hold little merit in guiding investors towards stocks with the highest crescendo potential.

Why, you ask? Well, brokerage firms, tethered to the stocks they cover, tend to serenade them with a positive bias. Our investigations unveil that for every solemn “Strong Sell,” brokerage firms shower a stock with five “Strong Buy” accolades.

These harmonies played by institutions may not always be in tune with retail investors, leaving them in the dark about a stock’s future melody. It is wiser to use this information to harmonize your own analysis or to select a proven instrument that can predict stock movements with precision.

Zacks Rank, a melodic tool with a decorous track record, categorizes stocks into five movements, from Zacks Rank #1 (a Strong Buy) to Zacks Rank #5 (a Strong Sell). It paints an elegant picture of a stock’s future tune. Thus, corroborating the ABR with the Zacks Rank could orchestrate a harmonious investment.

ABR and Zacks Rank: The Divergent Melodies

The ABR and Zacks Rank, though they both sing in a 1 to 5 scale, play two different ballads.

Broker notations compose the ABR symphony, typically sung in decimals (like 1.28). The Zacks Rank, however, dances to a quantitative tune, revolving around earnings estimate revisions, painted in whole numbers – from 1 to 5.

Broker analysts, historically exuberant in their recommendations, often lead investors astray with their sweet serenades. In contrast, the Zacks Rank dances to the tune of earnings revision, a melody strongly correlated with stock movements, per empirical studies.

Furthermore, while the ABR may echo an outdated melody, Zacks Rank dances to the rhythm of analysts updating their earnings estimates in real-time, thereby painting a vivid portrait of future melodies.

Unraveling Eaton’s Tune: Should You Tune In?

Listening closely to Eaton’s tune, the Zacks Consensus Estimate for the current year has risen by 1.4% over the past month to $10.61.

Analysts, united in their upbeat rhythm of revising EPS estimates skyward, indicate a crescendo in the stock’s near-term melody. This, coupled with significant harmonic changes in the consensus estimate, leads Eaton to serenade at a Zacks Rank #2 (Buy).

Hence, Eaton’s serenade of a Buy-equivalent ABR could be music to the ears of investors.

© 2024 Benzinga.com. Benzinga refrains from offering investment serenades. All rights reserved.