AI powerhouse Nvidia (NASDAQ: NVDA) has recently hit a snag, shedding about 15% of its value since reaching a monumental $3.3 trillion market cap mere weeks ago. Despite this setback, the stock has soared over 100% in the last year. In the world of investing, it’s not uncommon for a stock that has climbed dramatically in a short period to experience bouts of volatility.

Yet, Nvidia’s current decline should give investors pause. As the company gears up to disclose its second-quarter earnings in the near future, uncertainties loom large.

Challenges in the AI Market

The AI race kicked off in early 2023, propelled by the sensational debut of ChatGPT, a leading artificial intelligence platform. Nvidia’s GPUs, known for their ability to optimize AI applications through proprietary software, swiftly claimed a significant market share. Estimates suggest Nvidia’s dominance in the AI sphere ranges from 70% to a staggering 95%. Findings from TechInsights indicate that Nvidia commanded a whopping 98% of total data center GPU revenue in 2023.

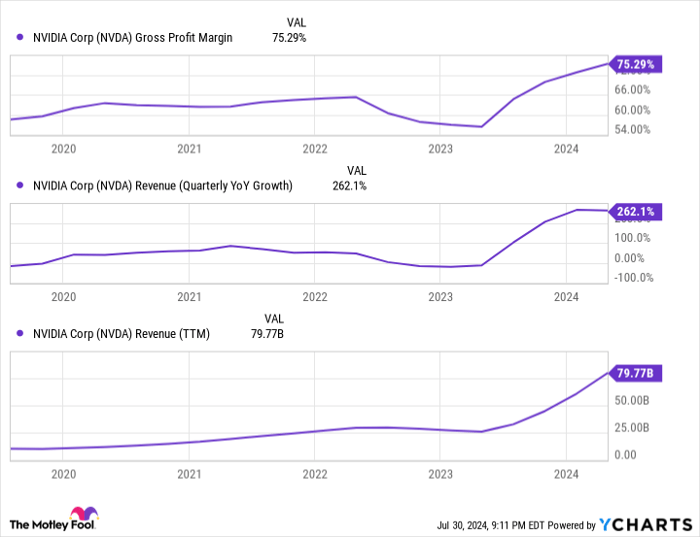

Nvidia’s financials mirror this dominance; revenue growth has surged close to 300%. Industry bigwigs like Elon Musk have openly vouched for Nvidia’s chips, citing insatiable demand. This high demand has bolstered Nvidia’s pricing power, propelling gross profit margins to over 75%:

NVDA Gross Profit Margin data by YCharts

Despite Nvidia’s remarkable run, formidable competitors like Intel and AMD are advancing alternative solutions. Tech titans such as Amazon, Alphabet, and Meta Platforms are also delving into customized AI chips, posing a threat to Nvidia’s market supremacy.

Notably, Alphabet may have dealt Nvidia a significant blow. Apple (NASDAQ: AAPL) recently unveiled its utilization of 2,048 of Alphabet’s TPU v5p chips for developing AI on iOS devices. For its server AI infrastructure, Apple opted for 8,192 TPU v4 processors. These tensor processing units (TPUs) are expressly designed for training AI models. While Apple didn’t explicitly exclude Nvidia chips, its silence on Nvidia products in hardware and software discussions is conspicuous.

Earnings Anticipation amid Elevated Expectations

Apple’s collaboration with Alphabet holds considerable weight for several reasons.

Firstly, Apple’s AI initiative is of paramount importance, and despite Nvidia’s assumed leadership in the industry, Apple opted for Alphabet’s chips. While this is just one scenario, it raises doubts about the breadth of Nvidia’s AI stronghold.

Secondly, analysts retain highly bullish revenue projections despite looming competitive pressures. Projections for 2024 and 2025 are at all-time highs:

NVDA Revenue Estimates for Current Fiscal Year data by YCharts

Lastly, authentic competitive threats could potentially erode Nvidia’s gross profit margins, which have surged beyond 75% (as illustrated in the initial chart). Historically, Nvidia’s gross margins have averaged 63% over five years. Even if Nvidia retains a substantial share of the AI chip market, sustaining this position may entail price concessions to remain competitive.

Investment Strategy in the Face of Uncertainty

The specter of dwindling revenue and gross margins should give investors pause. This isn’t to say that Nvidia will be dethroned as the premier AI chip provider. However, the rise of affluent competitors raises the possibility of market share loss. Many of the prominent tech firms developing tailor-made AI chips currently rank among Nvidia’s leading clients!

It’s plausible that Nvidia could sustain growth while relinquishing some market share due to the surging demand for AI chips. The peril lies in the scenario where Nvidia’s AI revenues hit a zenith and subsequently dwindle as a flood of competing AI chips saturate the market. While Q2 earnings might deliver another exceptional performance, investors are advised to closely monitor management’s guidance on full-year projections to gauge future sales momentum.

Nvidia’s stock may undergo turbulence as investors mull over these uncertainties. It might be prudent to hold off on aggressive share purchases until Q2 earnings are disclosed. Consider employing a dollar-cost averaging approach to Nvidia investments. This strategy entails investing a fixed sum at regular intervals, effectively lowering your average share price over time. It equips you to purchase more during price dips, offering a tactical advantage in volatile markets.

Initial Investment in Nvidia Stock Considerations

Prior to committing $1,000 to Nvidia stock, deliberate on the following:

The reputable Motley Fool Stock Advisor analysts recently unearthed what they deem