Microsoft recently unveiled its fiscal fourth-quarter earnings, causing ripples of excitement and trepidation in the investor community. The tech behemoth flaunted impressive financial results, surpassing revenue and EPS estimates. With a revenue spike of 15% year-over-year to $64.73 billion and an EPS ascent of 10% to $2.95, it seemed all was well in the Microsoft haven.

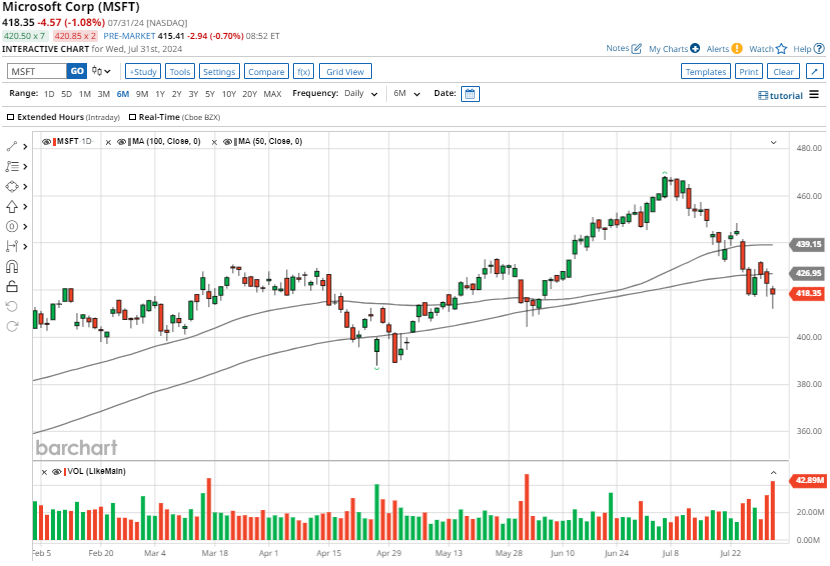

However, the euphoria was short-lived as Microsoft’s stock took a dip post-earnings release, culminating in a 1% decrease by the market close on July 31.

The Investor’s Quagmire

The market’s jubilation morphed into apprehension as investors scrutinized Microsoft’s Intelligent Cloud division’s growth trajectory, specifically Azure. While the division registered an impressive $28.52 billion in revenue, marking a 19% uptick year-over-year, it fell shy of analysts’ prognostications, sparking concerns. Azure’s revenue growth of 29% in the quarter, although robust, missed the expected 31% surge, signaling subdued momentum.

Conversely, Google’s Cloud segment flaunted stellar performance, propelled by AI ventures, breaching the coveted $10 billion landmark for the first time. Notably, Google exhibited an accelerated year-over-year growth rate of 29%, showcasing an upward trajectory compared to prior quarters.

Nevertheless, burgeoning investments in fortifying AI infrastructure inflicted a toll on Microsoft’s Cloud margins. The company, akin to its peers Amazon and Alphabet, engaged in substantial capital outlays to bolster AI infrastructure and allure more clientele. Despite Microsoft assuring investors of the longitudinal benefits of these investments over 15 years and beyond, any deceleration in growth augurs disquiet among stakeholders.

Moreover, Microsoft’s prognostication of a tepid 28% to 29% Azure revenue growth in constant currency for the fiscal first quarter, slightly below market anticipations, further compounded investor unease. Capacity limitations added another layer of complexity, impeding the fulfillment of AI-driven demands and sustaining revenue proliferation.

The Silver Linings

So, should MSFT stakeholders brace for an impending storm or bask in fleeting sunlight? Delve deeper, and you would discover glimmers of hope amidst the gloom. AI services emerged as the lighthouse guiding Azure’s revenue surge in the preceding quarter.

Of Azure’s overall growth, a notable 8% stemmed from AI services, hinting at encouraging prospects. With Azure AI now boasting over 60,000 customers, a meteoric 60% year-over-year surge, and a burgeoning average spend per customer, the grounds seem fertile for exponential growth. The unremitting demand for Azure AI services outstripping available capacity signals that Microsoft’s capacity expansions might yield bountiful returns in the near future.

Microsoft accentuated market share inroads across diverse business verticals, with record Cloud platform commitments and commercial bookings exceeding expectations. An upswing in high-value contracts underscored bullish growth sentiments shared by Microsoft’s leadership.

Ultimately, Microsoft’s fortitude in the Cloud and AI domain appears unwavering, painting a portrait of sustained long-term expansion bolstered by judicious investments.

Embracing the Microsoft Tapestry

Microsoft emerges as a beacon of promise in the tech realm, flaunting a diverse product portfolio, profound foothold in the AI arena, and sagacious investments.

Buoyed by a robust Cloud focus, Microsoft is poised to capitalize on evolving tech trends like generative AI and digital metamorphosis. Forecasts depict Azure’s ascendancy in market share as clientele harness its suite of platforms and tools to craft transformative AI solutions.

Armed with a plethora of AI accelerators from industry stalwarts like Nvidia and Advanced Micro Devices, Microsoft’s allure in the enterprise sector continues to burgeon. Azure OpenAI Service’s adoption by major Fortune 500 conglomerates mirrors its ascendancy in the corporate echelons. Microsoft’s global data center expansion across four continents symbolizes a strategic long-term investment primed for exponential growth over the coming decade.

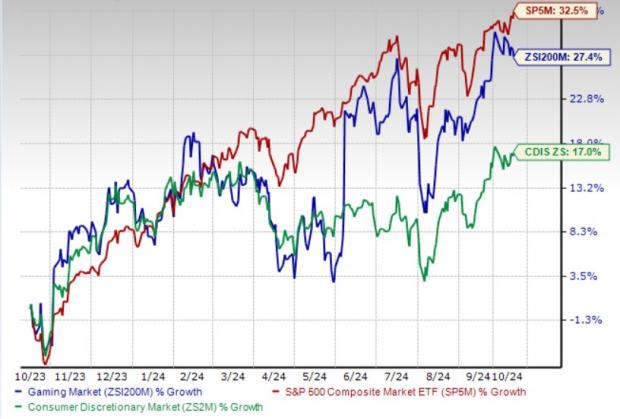

With Microsoft reigning supreme in productivity software and witnessing a surge in gaming revenue, its fiscal posture is robust with promising growth prospects. Analysts echo this bullish sentiment, with an overwhelming majority endorsing the stock as a “Strong Buy.”

The average price target for Microsoft perches at $501, translating to a potential upside of approximately 17.4% from current levels.