We find ourselves in an era where the battleground of streaming video is fierce and unforgiving. Competing platforms scramble to capture viewers’ attention in a landscape where disposable income for entertainment is limited. E-commerce behemoth Amazon (NASDAQ:AMZN) recently unveiled its aggressive game plan, causing a slight dip in its stock during Tuesday’s trading session.

The rivalry between Amazon and streaming powerhouse Netflix (NASDAQ:NFLX) is well-known, with Amazon strategically targeting advertising rates to outmaneuver its competition. By slashing advertising prices, Amazon is making Prime Video an irresistible choice for advertisers, challenging the dominance of Netflix.

Amazon’s foray into the ad-supported realm has led to a price war as its competitors are compelled to reduce rates owing to the vast ad inventory held by Amazon. The sheer volume of ad spots available dilutes the justification for premium pricing. With diversified revenue streams, Amazon can fuel its market penetration strategy, evident through its aggressive pricing approach.

The Twitch Conundrum

On a different front, Amazon’s acquisition of the streaming platform Twitch in 2014 for approximately $1 billion is currently proving to be a financial burden. Despite its substantial investment, Twitch has struggled to generate significant profits. Concerns deepen as reports indicate a slowdown in user growth, hinting at the platform nearing saturation and its revenue potential ceiling. Consequently, Amazon may be compelled to trim costs and streamline operations in pursuit of profitability. While Twitch remains an enticing asset, its wavering financial performance raises valid apprehensions.

Analyzing Amazon’s Stock

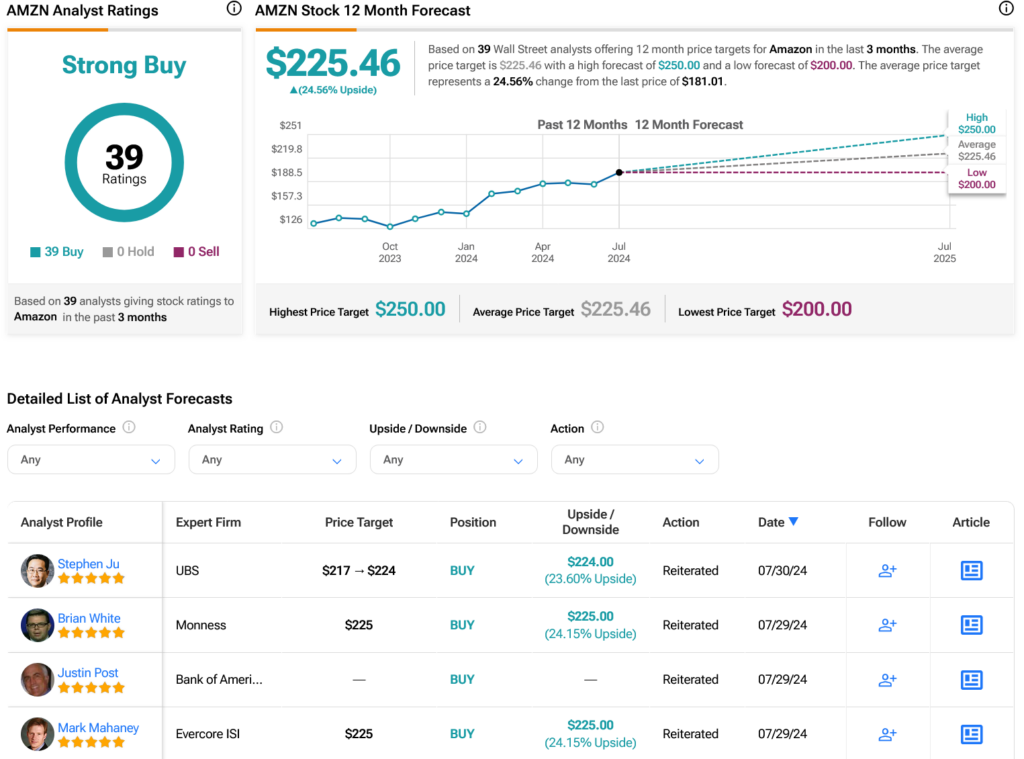

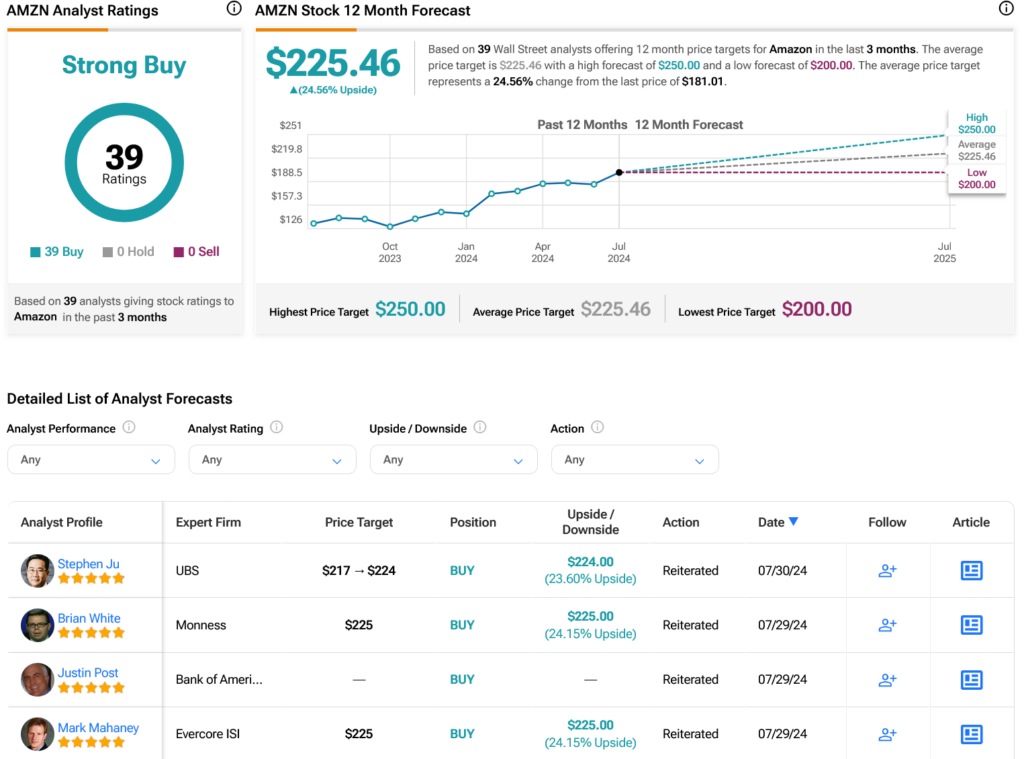

Shifting focus to Wall Street sentiments, analysts have bestowed a Strong Buy consensus rating on AMZN stock, backed by 39 Buy recommendations in the last quarter. Following a notable 35.53% surge in its share price over the past year, the average price target for AMZN of $225.46 per share signifies a promising 24.56% upside potential.