Technology Giants Surge in Pre-market as AI Sector Heats Up

Palantir Technologies and Arista Networks see a boost in equity value, paving the way for a resurgence in the technology market. These companies are at the forefront of utilizing artificial intelligence to drive practical outcomes, fueling optimism among investors.

AI Sector Poised for Massive Growth, UBS Analysts Predict

UBS forecasts a substantial expansion in the AI sector, estimating a market value of $225 billion by 2027 compared to $2.2 billion in 2022. This staggering growth projection hints at a paradigm shift, with AI revolutionizing various industries, including the foreign exchange market.

NVIDIA Faces Skepticism Amidst AI Stock Valuation Concerns

Despite a recent uptick in NVDA stock, doubts loom over the sustainability of its growth trajectory. Analyst downgrades and warnings from investment banks about soaring AI stock valuations raise questions about the sector’s resilience in the face of market corrections.

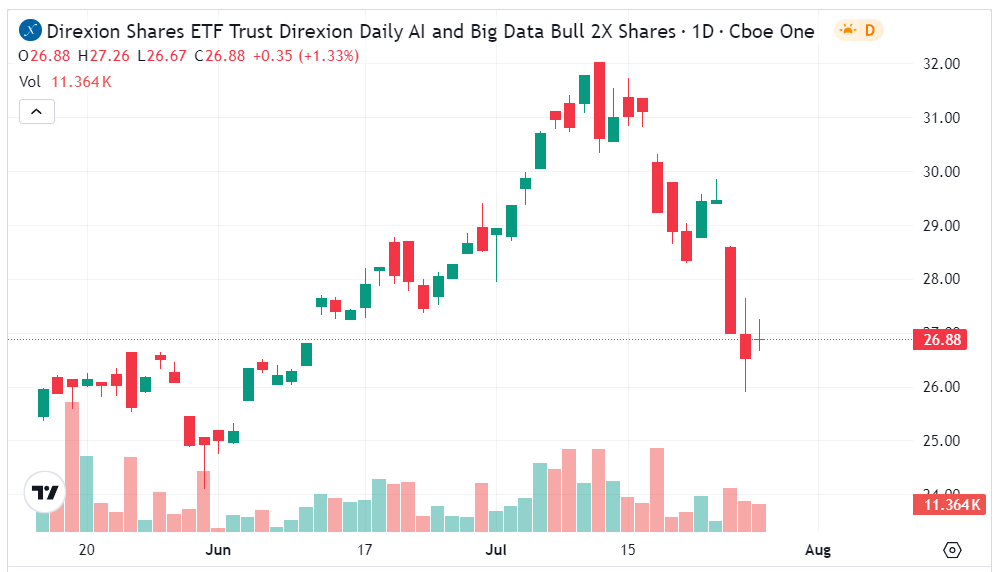

Direxion’s Leverage ETFs Offer Opportunities Amidst AI Market Volatility

For risk-tolerant traders navigating the uncertainties of the AI market, Direxion’s Daily AI and Big Data Bull 2X Shares and Bear 2X Shares present compelling options. These leveraged ETFs track the performance of the Solactive US AI & Big Data Index, catering to both bullish and bearish sentiments.

Short-term Exposure Strategy Key for Direxion’s AI-focused ETFs

Investors eyeing AIBU and AIBD should approach these funds with short-term goals in mind to mitigate the daily compounding effect. While the potential for quick gains exists, prolonged exposure may erode returns over time, underscoring the importance of strategic investment tactics.

Market Analysis: AIBU and AIBD Performance Amidst Tech Sector Fluctuations

As the tech sector faces turbulence, the AIBU ETF mirrors the market’s instability, hinting at potential recovery signs. On the flip side, AIBD capitalizes on market downturns, showcasing resilience and garnering positive returns amidst tech sector challenges.

Looking Ahead: Implications for AIBU and AIBD Fund Investors

With contrasting performance trajectories, AIBU and AIBD investors must stay vigilant in navigating market fluctuations. While AIBU seeks stability and recovery, AIBD thrives in adversity, highlighting the value of diversified investment strategies in the AI and big data market.