Analyst Upgrades Affirm as Stock Gains Traction

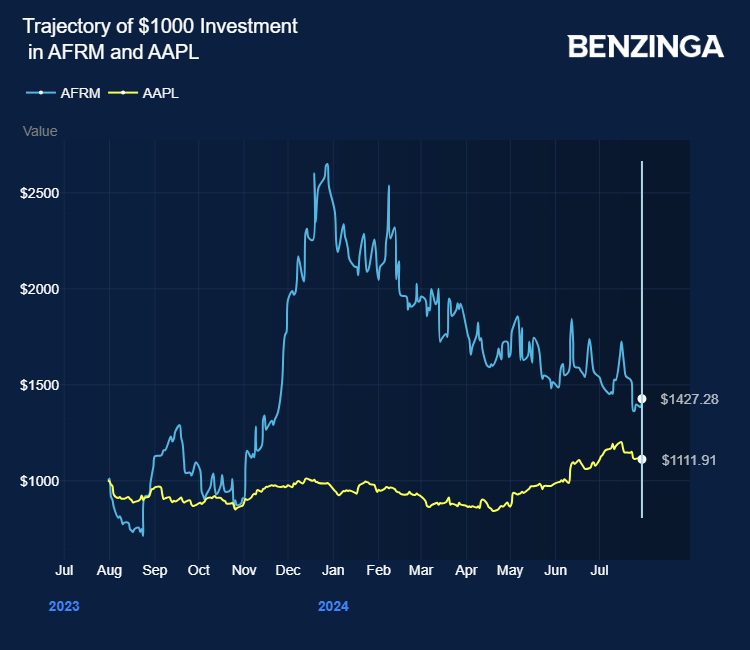

The recent surge in Affirm Holdings Inc stock following an upgrade by B of A Securities analyst Jason Kupferberg has drawn attention to the company’s promising future. The shift from Neutral to Buy, accompanied by a price target of $36, reflects optimism in the stock’s trajectory. Kupferberg’s optimism stems from the potential proximity of GAAP profitability and positive fourth-quarter prospects, which could act as a catalyst for further growth.

Market Dynamics and Growth Drivers

A lower interest rate environment, endorsed by Kupferberg, is expected to fortify Affirm’s revenue streams and drive partnerships, such as with tech giants like Apple Inc. The analyst’s confidence in the well-controlled credit risk and the company’s prudent expense management underlines the potential for sustained growth.

With resilience in credit risk management, Affirm Holdings has demonstrated a robust framework for profitability that aligns with the market’s expectations. Notably, Kupferberg highlighted misinterpretations in modeling warrant and stock-based compensation expenses, potentially paving the way for earlier GAAP profitability realization than previously anticipated.

Strategic Moves and Financial Outlook

Positioning itself strategically for market fluctuations, Affirm Holdings’ decision to adjust its merchants to a 36% APR cap on loans signifies a proactive approach towards securing sustainable growth. This, alongside the expectations of a lower interest rate climate, bodes well for the company’s financial stability and loan profitability metrics.

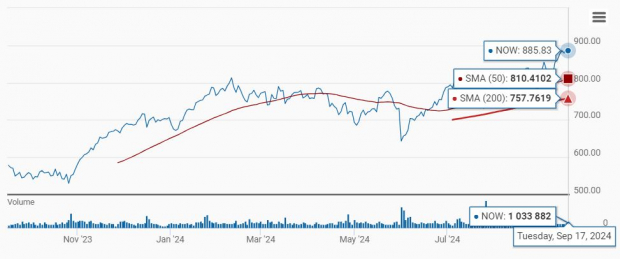

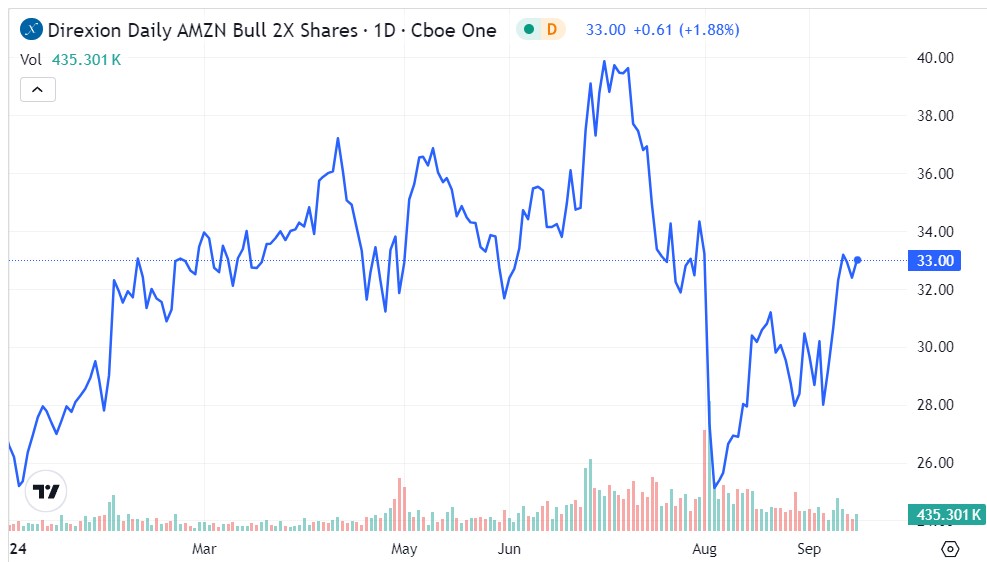

The company’s potential for enhanced profitability, emphasized by Kupferberg, might see fruition through upcoming partnerships with leading entities such as Amazon.Com Inc and Shopify Inc. These collaborations, coupled with the scaling of the Affirm Card and possible geographical expansions, are anticipated to boost the company’s fiscal outlook for 2025 and beyond.

Financial Projections and Stock Performance

The analyst’s forecasts predict a promising sales trajectory for Affirm Holdings, with projected sales figures of $2.27 billion for fiscal 2024, $2.75 billion for fiscal 2025, and $3.24 billion for fiscal 2026. The current market response to these projections is reflected in a 2.31% increase in AFRM shares, which closed at $27.46 on Tuesday.