Advanced Micro Devices (NASDAQ: AMD) has captured investors’ attention, with its stock price skyrocketing over 115% since the beginning of 2023. The surge reflects the heightened interest in artificial intelligence (AI) technologies permeating the market.

Initially overshadowed by AMD’s rival, Nvidia, which dominated the AI hardware scene with its GPUs, AMD swiftly emerged as a formidable player. With a solid No. 2 market share in GPUs and strategic partnerships with leading tech giants, Wall Street soon turned its focus to AMD.

Rising Star: AMD’s Diverse Position in AI

In the past year, AMD has impressed investors with its range of AI GPUs, including the upcoming MI325X model set to debut in Q4 of 2024. Earning nods from tech titans like Alphabet, Microsoft, Oracle, and Amazon as chip clients further underscored AMD’s AI prowess.

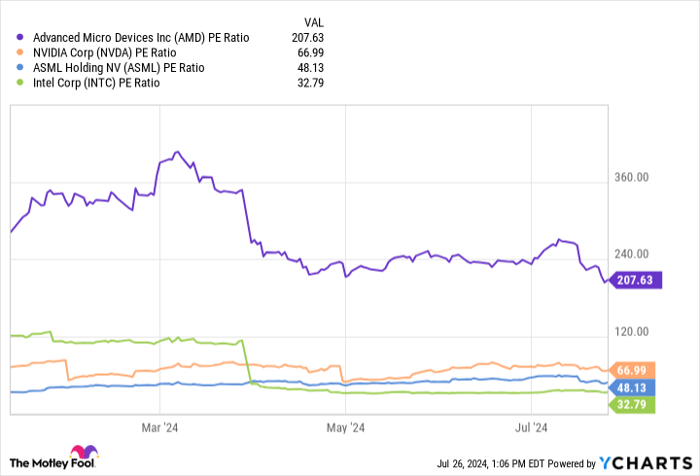

Despite its burgeoning potential, AMD’s financial performance trails its stock surge. While the chipmaker reported an 80% revenue boost in its AI-centric data center segment in the first quarter, declines in other segments held back overall revenue growth to a mere 2% year-over-year. This discrepancy inflated AMD’s price-to-earnings (P/E) ratio to a hefty 207, prompting investors to seek out undervalued alternatives in the chip sector.

The Intel Edge: A Revival Story in AI Chips

Intel (NASDAQ: INTC) has weathered a tumultuous period in recent years, with its stock plummeting 41% since 2021, contrasting AMD’s 51% ascent. Surprisingly, sentiment has shifted lately, with Intel’s shares swelling by 2% while AMD’s have dipped over 10%.

After facing setbacks in the chip industry and ending a lucrative Apple partnership, Intel is poised for a comeback. Embracing new customers like Bosch, IBM, and Seekr for its Gaudi line of AI chips, Intel signals a reinvigorated focus on AI and manufacturing.

Intel’s foray into AI is underscored by the launch of AI-enabled chips like the Xeon 6 processors and Gaudi 3 processors, designed to tackle robust data-center workloads and AI-model training. The company’s upcoming Lunar Lake chips tailored for AI-driven PCs further diversifies its AI product portfolio.

Investment Potential: Intel’s Undervalued Stock

Bucking the trend of inflated valuations in the chip market, Intel’s stock trades at a modest price-to-earnings (P/E) ratio of 33, contrasting sharply with AMD’s towering ratio of 207. This stark dichotomy positions Intel as a compelling value play for investors seeking AI exposure in the chip industry.

Beyond valuation, Intel’s expanding footprint in the foundry market boosts its appeal. Amid escalating U.S.-China tensions affecting chipmakers reliant on foreign foundries, Intel’s ongoing domestic expansion efforts signal resilience and growth potential in the AI chip sector.

Intel’s strategic positioning could herald a lucrative future in AI, bolstered by the promising trajectory of Intel Foundry, which posted significant operating income gains in the first quarter of 2024. These strides reinforce Intel’s emerging stature as a premier AI chip manufacturer.

Seizing Opportunity: Intel’s Valuable Stock Proposition

While AMD commands attention with its GPU market share dominance and high-profile partnerships, Intel’s renaissance beckons as a chance to capitalize on a resurgent underdog in the AI chip space. Investors eyeing Intel stand to benefit from a recalibrated market narrative, poised to reap rewards from the company’s AI-centered revival in the upcoming decade.

As Intel’s stock maintains an attractive valuation compared to peers, the company’s multifaceted AI strategy presents a compelling investment thesis. Embracing Intel’s transformation narrative could unlock long-term value and growth for astute investors seeking exposure to the burgeoning AI chip market.

An In-Depth Analysis of Stock Advisor’s Remarkable Returns

The Power of Long-Term Investment with Stock Advisor

Imagine a financial world where a humble $1,000 injection could balloon into a jaw-dropping $692,784. Sounds too good to be true? Not for those who heeded the call of Nvidia back on April 15, 2005. That moment in history would mark the genesis of a financial fairy tale, a saga of smart investments and unparalleled returns.

A Testament to Success

Stock Advisor stands as this narrative’s architect, ushering investors into a realm where dreams transcend into reality. Launched with a mission to deftly guide investment enthusiasts towards the pot of gold, this service offered a blueprint for prosperity. Regular updates, expert analysis, and the allure of two hand-picked stock gems every month set the stage for remarkable financial growth.

Outperforming the Norm

The numbers speak louder than words. Since its inception in 2002, the Stock Advisor service has triumphed where others falter. With returns that make the S&P 500 seem like child’s play, this platform has proudly declared a whopping quadrupling of the benchmark since its genesis. A feat that not only defies convention but redefines the very fabric of financial success.

Embracing the Future

Investment horizons may ebb and flow, but the legacy of Stock Advisor remains unwavering. As we gaze towards the future, it’s not just about returns but a testament to the power of informed decisions. Each pick, each analysis, and each moment spent within this financial ecosystem serves as a beacon of hope for those daring to dream big.

Conclusion

While the journey of Stock Advisor is merely a chapter in the grand saga of finance, its pages echo with the resonance of triumph. It beckons investors, whether novice or seasoned, to embrace the concept of enduring investments. So, as the drumbeat of financial growth continues its steady rhythm, may we find solace in the knowledge that with the right guidance, the future is as bright as a midsummer’s day.

Author’s Note: Historical data has been a witness to tumultuous market shifts, yet amidst the chaos, the beacon of Stock Advisor shines bright. Let us tread the path of financial wisdom, guided by the light of informed choices and unwavering dedication.