Pet store giant Petco Health and Wellness Co. (NASDAQ: WOOF) witnessed a lukewarm response from investors following the appointment of a new CEO on July 18, 2024. Initially surging to $3.69, the stock later dipped by 6% in the subsequent days. This lackluster reaction may partly stem from the fact that the incoming CEO, Joel Anderson, previously helmed Five Below Inc. (NASDAQ: FIVE), a company that faced a tumultuous period with a 63% YTD decline attributed to an earnings warning. In the midst of a critical turnaround, Petco seeks a skilled leader in Anderson to steer the ship. Investors may be undervaluing Anderson’s potential impact on the company’s trajectory.

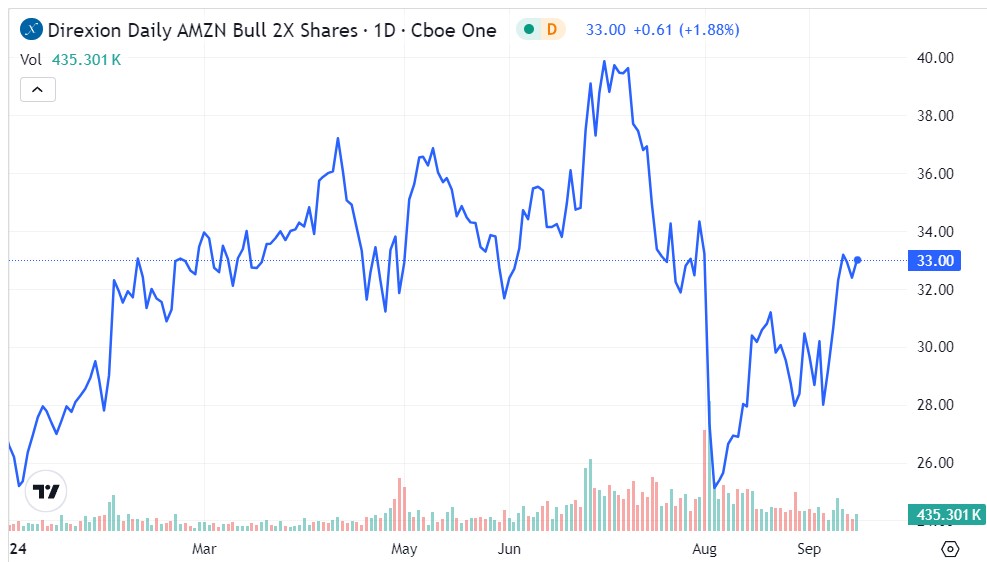

Operating in the retail/wholesale sector, Petco competes with industry players such as Chewy Inc. (NYSE: CHWY), Amazon.com Inc. (NASDAQ: AMZN), Target Co. (NYSE: TGT), and Walmart Inc. (NYSE: WMT).

New Visionary Leadership: Anderson’s Track Record of Transformation

With an extensive 30-year stint in the retail sector, Joel Anderson brings a proven track record of success to Petco. Previously assuming leadership roles at Walmart.com, culminating in his tenure at Five Below until July 16, 2024, Anderson played a pivotal role in elevating Five Below to a household name. Under his guidance, the company expanded its store footprint from 366 to over 1,500 outlets, propelling revenue growth from $500 million to over $3.5 billion and driving the stock price up by a remarkable 650%. Echoing past successes, Anderson is slated to take the reins at Petco on July 29, 2024, succeeding interim CEO Mike Mohan.

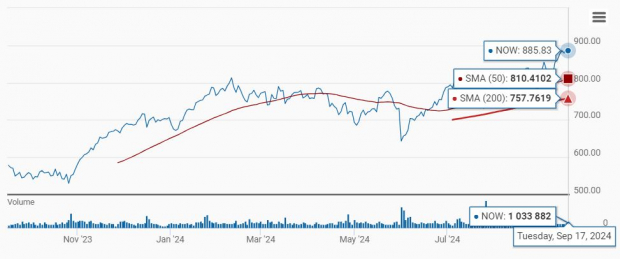

Treading Water: Charting Petco’s Trading Patterns

An analysis of WOOF’s daily candlestick chart reveals a distinct rectangle channel pattern. Preceded by a notable pennant breakout post-Q1 2024 earnings, which saw shares catapult to $4.38 before settling into the current range-bound pattern. Noteworthy meme stock influencer Roaring Kitty’s positions in CHWY also catalyzed sympathetic buying interest in WOOF. The defined rectangle range boasts an upper trendline resistance at $4.14 and lower trendline support at $3.13, with the daily RSI oscillating between the 50 and 60 bands. Key support levels stand at $3.13, $2.70, $2.34, and $2.15.

Financial Performance Snapshot: Q1 2024 Earnings Analysis

In Q1 2024, Petco reported an EPS loss of 4 cents, surpassing consensus estimates by 2 cents. While revenues exhibited a 1.7% YoY decline to $1.53 billion, outpacing the projected $1.51 billion mark. Comparable sales witnessed a 1.2% YoY dip but displayed a resilient 4.1% growth over a two-year period. Notably, the GAAP net loss widened to $46.5 million from $1.9 million in the prior-year period. Adjusted EBITDA retreated to $75.6 million versus $111 million recorded in the same period last year. The company’s liquidity remains solid at $617 million, buoyed by an expanding line of credit on its revolver.

Exploring Growth Avenues: Unpacking Petco’s Strategic Initiatives

Petco’s growth engine is fueled by its veterinary clinics, grooming services, and mobile clinics, propelling Services & Other segment growth by 4% YoY and Services & Vet division up by 10% YoY, respectively. Notably, Consumables sales remained steady, while Fresh Frozen offerings surged by 11% YoY. Sales of Supplies and companion animals saw a 7% YoY uptick. The company remains on track to deliver $150 million in run-rate savings by the close of fiscal 2025, with an initial $40 million savings achieved in the debut year.

Guiding the Path Ahead: Second Quarter Projections

Petco projects a Q2 2024 EPS loss of 2 cents, aligning with consensus estimates. Revenue forecasts for Q2 2024 hover around $1.525 billion, slightly outperforming the consensus of $1.52 billion. The company anticipates an adjusted EBITDA of approximately $80 million. Looking ahead, full-year 2024 net interest expense is anticipated at $145 million, with capital expenditures earmarked at $140 million.

Charting the Turnaround Route: Insights from the Interim CEO

Interim CEO Mike Mohan unveiled key transformative strategies aimed at reinvigorating Petco’s path to profitability. Initiatives include revamped store operating models at pet care centers to enhance service quality and engagement with customers. A thorough reassessment of pricing and assortment strategies is underway to uplift store traffic, basket metrics, and sales quality. Marketing realignment focuses on heightened engagement with pet parents to bolster in-store footfall. Petco prioritizes inventory management efficiencies across its supply chain for sustained operational excellence.

Mohan reaffirmed, “Amidst substantial organizational shifts, our unwavering commitment to our long-term strategy remains steadfast. Our integrated services ecosystem, extensive nutrition and merchandise offerings, along with a robust omnichannel delivery model, present a competitive edge over online-exclusive and mass-market competitors.”

For detailed analyst coverage and price targets on Petco Health and Wellness, additional insights are available via MarketBeat.