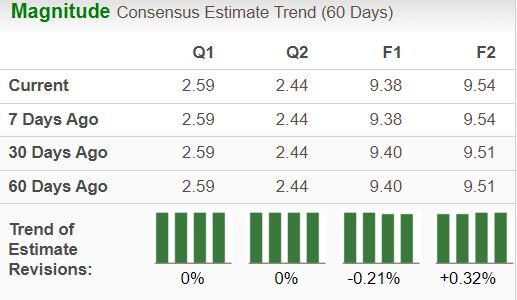

Stability in Estimates

Ahead of its second-quarter 2024 results release on Jul 23, General Motors (GM) remains steadfast in its projections. The Zacks Consensus Estimate places earnings at $2.59 per share and revenues at $45 billion, showcasing a 35% year-over-year growth in earnings.

Historical Performance

In the past four quarters, GM consistently outpaced EPS estimates, boasting an average earnings surprise of 17.75%. This trend underscores the company’s resilience and ability to navigate the market with success.

Market Conditions and Expectations

Despite a positive U.S. sales outlook, the slowdown in China poses challenges. The contrasting North American sales performance versus the struggles in China accentuate the volatility in GM’s revenue streams.

Stock Performance and Valuation

GM’s year-to-date surge of 44% indicates investor confidence. Beyond mere numbers, the company’s attractive valuation, with a forward sales multiple below its historical median and industry average, positions it favorably in the market.

Strategic Considerations

GM’s diverse portfolio, encompassing EVs and traditional models, coupled with its focus on cost reduction initiatives, paints a picture of a company striving for balance amidst market shifts. However, challenges such as meeting ambitious EV production targets loom on the horizon, adding complexity to its growth trajectory.

Final Thoughts

While GM showcases robust fundamentals and an attractive valuation, cautious optimism may be warranted. Recent sentiments regarding EV production goals introduce a shade of uncertainty. Investors keen on GM should await further insights from the upcoming earnings release on Jul 23.

Unveiling the Intriguing Dynamics of Investing Before Earnings Reports

The Thrill of Pre-Earnings Investments

Investors often find themselves at a crossroads, debating whether to dive into the stock market before or after key earnings reports. The anticipation of these reports can lead to a sense of cautious optimism. It’s like waiting for a cake to finish baking – the aroma permeates the house, creating eagerness for the final product.

Strategic Investment Choices

Amidst the whirlwind of decisions, it might be wise to exercise patience and strategic acumen by awaiting the upcoming earnings report. This act is akin to a skilled sailor surveying the seas before embarking on a daring voyage, ensuring that all conditions are favorable for a smooth journey.

Unveiling Lucrative Opportunities

The financial landscape is dotted with promising options, each presenting an opportunity for substantial gains. It’s like stumbling upon a gold mine, where each investment possibility gleams with the promise of prosperity. The key lies in choosing the right moment to strike, ensuring maximum returns.