Netflix Expectations

As the 2024 Q2 earnings season bursts forth, notable companies like Netflix, Taiwan Semiconductor, and Johnson & Johnson stand poised for their quarterly releases. Netflix, a streaming behemoth, is set to unveil its financial performance on Thursday, July 18, following the market’s close. Despite a recent dip in share prices after the previous earnings report, Netflix has rebounded impressively, now hovering near its peak.

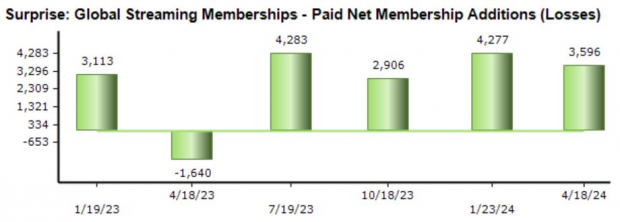

The standout metric on investors’ minds remains the subscriber count, although it’s crucial to note that Netflix plans to discontinue reporting quarterly member numbers from next year. In the most recent release, the company boasted a 16% uptick, with total subscribers standing at 269.6 million. Notably, Netflix has outperformed subscriber addition expectations for four consecutive quarters.

In terms of earnings and revenue, expectations have largely remained stable, with projections pointing to a 43% surge in earnings per share and a 17% rise in sales. The company’s profitability has seen an uptick, reflecting operational efficiencies through improved margins over recent periods.

Taiwan Semiconductor Outlook

On the flip side, Taiwan Semiconductor (TSM) has ridden the semiconductor wave, witnessing an 80% increase in its shares amid the broader industry’s growth in 2024. The artificial intelligence boom has been a significant boost for semiconductor firms, with a race underway to develop AI chips.

While earnings predictions stagnated for a while, recent upticks are visible, with estimates projecting a 20% surge in earnings per share to $1.37. Revenue forecasts are even sunnier, expecting a 5% rise to $20.2 billion, signaling a substantial 29% year-over-year increase.

Notable for investors is TSM’s announcement of a 10% dividend increase following its recent results – a move that has solidified its position as a prime choice for income-focused investors seeking tech exposure.

Johnson & Johnson Performance

Moving to a stalwart in the consumer staples sector, Johnson & Johnson, while not seeing much share price movement over the past three years, has showcased robust earnings, surpassing consensus EPS estimates in the last ten quarters. Despite sideways trading, the company managed to outperform expectations consistently.

Interestingly, estimates have shifted slightly negative for the impending release, with Zacks Consensus EPS estimate dipping 1% to $2.71 since mid-April. Revenue projections, however, remain steady at $22.4 billion, indicating a 12% dip from the previous year.

Johnson & Johnson’s report is scheduled for Wednesday, July 17, ahead of market opening.

The Bottom Line

As the 2024 Q2 earnings season heats up, investors would do well to keep an eye on crucial reports from Netflix, Taiwan Semiconductor, and Johnson & Johnson. While each company faces distinct challenges and opportunities, the financial landscape remains fraught with anticipation and potential. Will these giants continue to deliver or stumble in the face of changing market tides?