Alibaba Group Holdings: Driving Cloud Innovation

China-based e-commerce giant, Alibaba Group Holdings, has been a key player in the digital transformation of the Olympic Games since 2017. Through its Alibaba Cloud Intelligence platform, the company is revolutionizing the games’ infrastructure, enhancing the experience for both athletes and fans worldwide. By leveraging its association with the Olympics, Alibaba aims to captivate younger audiences and bolster the Olympic Movement.

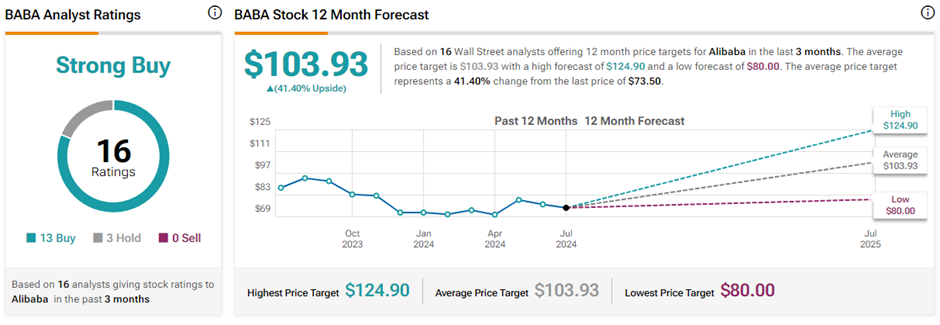

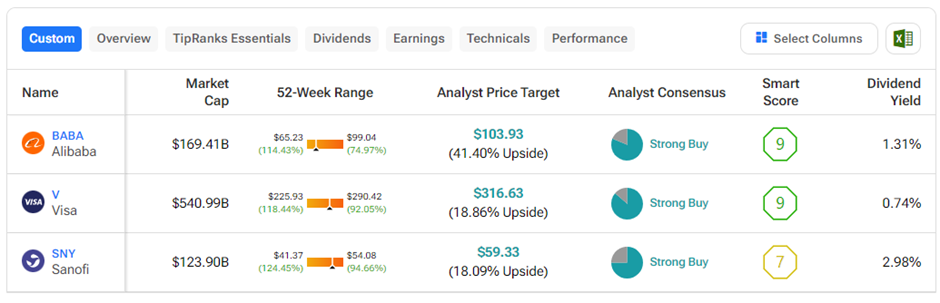

Additionally, Alibaba’s commitment to its shareholders is evident through its substantial share repurchase program and annual dividend payouts. With a Strong Buy consensus rating on TipRanks and a potential 41.4% upside, Alibaba’s stock presents an enticing opportunity for investors.

Visa: Pioneering Payment Technology

As the exclusive payment technology partner of the Olympics since 1986, Visa stands at the forefront of digital payment solutions, catering to a global audience. By providing cutting-edge payment solutions to viewers and Organizing Committees, Visa ensures a seamless and secure transaction experience during the Games. Furthermore, Visa’s longstanding support for over 500 Olympic and Paralympic athletes underscores its commitment to empowering sports personalities.

With a track record of regular dividend payments, stock buybacks, and upcoming Q3 FY24 results, Visa remains a solid investment choice. Boasting a Strong Buy consensus rating and an anticipated 18.9% upside potential, Visa’s stock is poised for growth in the coming months.

Sanofi: Leading Healthcare Innovation

Paris-based pharmaceutical and healthcare company, Sanofi, has strategically aligned itself with the Paris 2024 Olympic and Paralympic Games as their Premium and Official Partner. Leveraging this partnership, Sanofi aims to amplify its efforts in combatting diseases like Meningitis, while also revitalizing its brand image to appeal to a younger demographic.

By nurturing talent, supporting athletes, and driving healthcare innovation, Sanofi is actively engaging with the spirit of the Olympics. With upcoming Q2 FY24 results and a history of annual dividend payments, Sanofi’s stock offers investors a compelling opportunity for growth in the evolving healthcare landscape.

Exploring the Potential of Sanofi Stock Amidst Olympic Games

Analysis of Sanofi Stock Performance

Sanofi, a prominent player in the pharmaceutical industry, has recently captured the attention of investors with a notable annual dividend yield of 2.98%. This substantial yield has positioned the company as an attractive option for those looking to diversify their investment portfolios.

Is Sanofi Share a Good Buy?

Market analysts have expressed optimism regarding the outlook for Sanofi stock, with a Strong Buy consensus rating on TipRanks, comprising of three Buy ratings and one Hold rating. The current average price target of $59.33 for Sanofi implies a potential upside of 18.1% from the current trading levels.

Exploring Investment Opportunities During the Olympic Games

As the world gears up for the upcoming Olympic Games, investors are presented with a unique opportunity to capitalize on the stocks of partner and sponsor companies associated with this global event. The quadrennial extravaganza serves as a platform for these companies to showcase their offerings to a vast global audience, potentially increasing their customer base and revenue streams. This period might be an auspicious time for investors to explore the potential benefits of investing in companies aligned with the Olympic Games.

Uncover hidden gems and fortify your investment portfolio by considering the potential of three Olympic stocks highlighted above. As the Olympic Games unfold, these companies stand to gain from increased visibility and consumer interest, potentially translating into enhanced returns for investors.

Expand your investment horizons and navigate through the dynamic market landscape. Harness the power of global events such as the Olympics to make informed and strategic investment decisions that align with your financial goals.