Investors often turn to Wall Street analysts for guidance on stock investments. However, do these recommendations truly hold weight in the ever-evolving financial markets?

Before delving into the depths of brokerage recommendations and their reliability, let’s explore how industry experts view Blue Bird (BLBD).

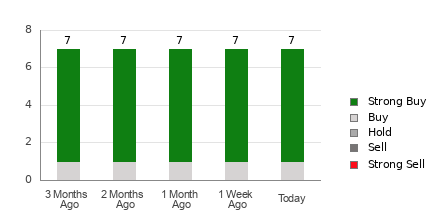

Currently, seven brokerage firms collectively rate Blue Bird with an average brokerage recommendation (ABR) of 1.14, falling between a Strong Buy and Buy on a scale of 1 to 5. The majority of these ratings lean heavily towards Strong Buy, with only one recommendation veering towards Buy.

While the ABR may indicate a favorable outlook for Blue Bird, putting all your eggs in this basket may not be prudent. Studies suggest that brokerage recommendations often lack efficacy in predicting a stock’s potential for price appreciation.

Why the skepticism? Analysts at brokerage firms tend to exhibit a positive bias towards stocks they cover, leading to potentially inflated ratings. This misalignment of interests can skew recommendations and misguide retail investors seeking guidance on stock selections.

Validating with Zacks Rank

Zacks Rank, a tool with a proven track record, categorizes stocks based on earnings estimate revisions. This model has demonstrated a strong correlation between earnings estimate trends and stock price movements, offering a more data-driven approach to stock analysis.

While the ABR focuses solely on broker recommendations, the Zacks Rank reflects earnings estimate revisions, providing a more objective perspective on stock performance, devoid of potential biases seen in brokerage recommendations.

Understanding the Difference

Broker recommendations compute the ABR, often influenced by vested interests, while the Zacks Rank relies on earnings estimate revisions, offering a fresh and timely indicator for investors.

The Zacks Rank, ranging from #1 (Strong Buy) to #5 (Strong Sell), aligns more closely with fundamental stock analysis, steering clear of biases that can cloud brokerage recommendations.

Should You Invest?

For Blue Bird, the Zacks Consensus Estimate for the current year stands at $2.73, reflecting steady analyst views on the company’s earnings prospects. This consistency has earned Blue Bird a Zacks Rank #3 (Hold), indicating cautious optimism.

While the brokerage ABR leans towards Buy-equivalent ratings for Blue Bird, relying solely on this may warrant a second look at the Zacks Rank for a more balanced and informed decision.

Conclusion

When stepping into the volatile world of stock investments, relying on a blend of broker recommendations and data-backed tools like the Zacks Rank can offer a more comprehensive view of a stock’s potential. Blue Bird’s stock outlook presents an interesting case study on the significance of leveraging multiple indicators for making informed investment choices.