Diving Into the Options Market

Investors in the tech giant, Advanced Micro Devices Inc (Symbol: AMD), embraced a fresh wave of opportunities today as new options surfaced for the February 2025 expiration. The lure of time value beckons as these contracts, with 227 days left until expiration, tantalize potential sellers with the promise of juicier premiums compared to nearer expirations.

The Put Play

The $175.00 strike put contract dances with a bid of $21.50, seducing prospective investors with the proposition to snag shares at $175.00 while pocketing the premium. With an eye on acquiring AMD stock, this move could present a compelling substitute to the current $177.54/share market price—a tantalizing prospect, indeed.

Market Dynamics

Peering into the analytical crystal ball, the odds foresee a 62% chance of the put contract fading into worthlessness. Should this prophecy materialize, the premium translates to a gratifying 12.29% return on the cash outlay, or 19.75% annually—a potent concoction Stock Options Channel labels the YieldBoost.

Casting a Gaze Back in Time

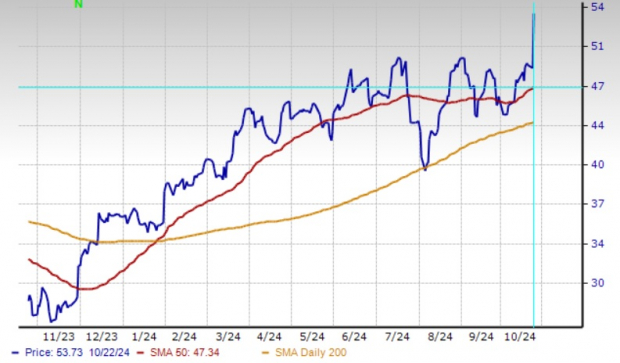

A visual symphony unfolds as we chart the trailing twelve-month saga of Advanced Micro Devices Inc, highlighting the $175.00 strike in a swath of green amidst its historical tapestry.

The Call Mantra

Circling the calls arena, the $190.00 strike call contract croons with a $23.10 bid, enticing investors to dance a “covered call” waltz. This tantalizing tango involves selling stock at $190.00, culminating in a tempting total return of 20.03% by the February 2025 expiration, barring any dividends—a siren song not to be dismissed lightly.

Foreseeing Potential

With the $190.00 strike flaunting around a 7% premium, the possibility of the call contract expiring fruitlessly looms large. In such an outcome, investors retain both shares and premium, a dance where everybody is a winner. Current statistics forecast a 46% chance of this scenario, promising a 13.01% surge in returns or a 20.92% annual hustle coined the YieldBoost.

Volatile Whispers

The implied volatility for both put and call contracts echoes at a resounding 48%. Meanwhile, the past year’s unbridled excitement, pegged at 45%, sets the stage for an electrifying spectacle. To unearth more hidden gems in the world of options, StockOptionsChannel.com stands as a beacon for the intrepid explorer.

Embrace Exploration

![]() Unearth the Top YieldBoost Calls of the Nasdaq 100 »

Unearth the Top YieldBoost Calls of the Nasdaq 100 »

Also see:

Institutional Holders of NSCS

Institutional Holders of PANL

VBLT Videos