Apple Soars to 52-Week High: Can AI Focus Propel AAPL Stock Higher?

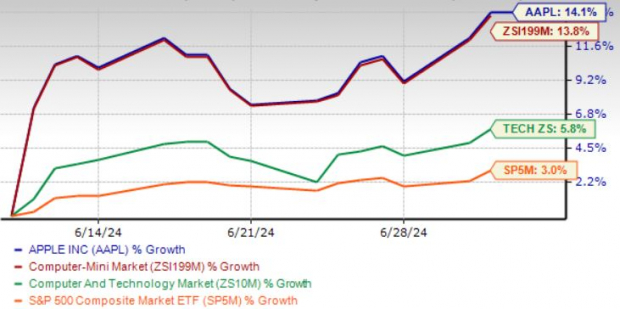

Apple’s stock (AAPL) hit a 52-week high of $220.38 on July 2, ultimately closing at $220.27, marking a 14.4% increase year to date. Since the unveiling of Apple Intelligence, an advanced AI system introduced at the Worldwide Developers Conference (WWDC) on Jun 10, Apple’s shares have surged 14.1%, outperforming its industry peers like Alphabet, Microsoft, and Amazon.

AI Focus Boosts AAPL’s Long-Term Potential

During the fiscal second-quarter earnings call, Apple’s CEO Tim Cook expressed optimism about the prospects of Generative AI (GenAI), citing Apple’s unique advantage in AI innovation due to integrated hardware, software, and services, along with a strong focus on privacy.

Apple Performance Post-WWDC

Apple Intelligence, powered by GenAI models, aims to enhance user experience by leveraging robust language and image understanding, promising streamlined tasks while upholding strict privacy protocols. Siri, enhanced by Apple Intelligence, offers improved contextual awareness and multi-request understanding.

Strong Liquidity Supports AAPL’s Shareholder Initiatives

Apple’s solid financial position with substantial cash reserves and robust cash flow allows for significant shareholder returns, including dividend payouts and share repurchases, reflecting a commitment to shareholder-friendly initiatives.

Challenges Ahead for AAPL Amidst Competition and China Concerns

Despite its recent successes, Apple faces challenges in the Chinese market due to stiff competition and government directives favoring local manufacturers over Apple products. This environment has led to a decline in iPhone sales, necessitating price adjustments and impacting Apple’s GenAI capabilities.

Positive Outlook Amidst Valuation Concerns

While Apple’s valuation may seem stretched, the company’s AI advancements, particularly in services like Apple TV+ and Apple Arcade, present promising growth opportunities. With a vast user base and a bullish trend in stock performance, Apple remains a compelling investment option.

Apple’s Resilience Amidst Market Volatility

Trading above its 50-day moving average, Apple demonstrates resilience in the face of market uncertainties, bolstered by a Zacks Rank #2 (Buy) designation, indicating confidence in the company’s future growth potential.