A Tale of Exponential vs. Linear Growth

Nvidia and Microsoft emerge as behemoths in the realm of artificial intelligence, benefitting immensely from the AI revolution. While both companies have shown resilience and prowess in capitalizing on AI technologies, a careful analysis of their trajectories unveils intriguing nuances that might tip the scales in favor of one over the other.

Nvidia’s Meteoric Rise

Step aside Big Tech titans, Nvidia has been hogging the limelight on Wall Street. Surging by a staggering 2,998% over the past five years, Nvidia has cemented its position as the stock market’s darling, even outshining household names like Microsoft and Apple. The company’s meteoric growth, fueled by the unabated fervor surrounding AI, positions it as a frontrunner in the tech race.

Nvidia’s financial metamorphosis is a tale worth retelling. From a revenue standpoint, the company has witnessed an unprecedented surge from $6.91 billion in 2017 to a colossal $60.92 billion by January 2024. Not just stopping there, Nvidia has efficiently optimized its operating profit margins, soaring from 24% in 2017 to a commendable 48.8% currently. Talk about a profit margin power play!

The future seems even brighter for Nvidia, with a projected 97% revenue growth by January 2025 and an additional 32% uptick by 2026. This trajectory underscores Nvidia’s unbridled potential in the AI landscape, painting a compelling picture of sustained growth.

Nevertheless, the specter of stagnation looms overhead. With forward EV/EBITDA metrics at 38x, Nvidia treads a precarious path, where any semblance of growth deceleration could trigger a market turmoil. Despite the valuation acrobatics, Wall Street remains a cheerleader for Nvidia, with the majority of analysts maintaining a Strong Buy recommendation, fueled by an optimistic price target of $135.09.

Microsoft’s Ascending Trajectory

If Nvidia symbolizes an explosion, Microsoft embodies a slow-burning blaze, steadily illuminating the tech landscape with consistent growth. Surging by 245% in the past five years, Microsoft’s trajectory, though not as stratospheric as Nvidia, exudes a sense of sustainable growth and market resilience.

The numbers speak volumes for Microsoft’s growth narrative. Over the past decade, the company has witnessed a tripling of revenue from $96.5 billion in 2017 to a formidable $211.9 billion by 2023. While Nvidia basks in the glory of exponential growth, Microsoft’s steady ascent paints a picture of resilience and long-term vision.

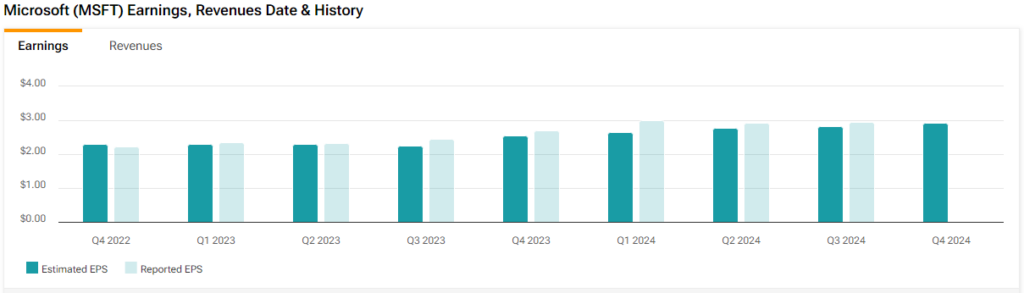

Profitability emerges as Microsoft’s forte, with profit margins surging from 26.3% to a commendable 34.1% in the past year. Unlike Nvidia’s roller-coaster trajectory, Microsoft’s growth narrative unfolds as a testament to consistent market value creation.

However, Microsoft’s premium valuation raises eyebrows, perched at a forward 13x EV/Sales and 36x forward non-GAAP P/E ratio, the highest in five years. This valuation acrobatics underscores the market’s confidence in Microsoft’s long-term growth trajectory, particularly in the AI domain.

Microsoft’s bullish stance on future growth is further corroborated by a relentless push in CapEx, witnessing over 50% year-over-year escalation in the last three quarters of 2024 to fortify its cloud and AI infrastructure for the impending tech revolution.

Amid the contrasting growth trajectories and valuation jigsaws, investors are left at a crossroads, choosing between Nvidia’s fiery ascendancy and Microsoft’s steadfast resilience. As the AI investment saga unfolds, the battleground is set for an epic clash between the tech titans, each armed with its unique growth narrative and market promise.

The Dominance of Nvidia and Microsoft in the AI Landscape

Analysts’ Consensus and Price Target

Out of the 35 analysts covering the stock, only one maintains a Hold recommendation, while all others have reiterated a Buy rating for the stock. The average price target among analysts stands at $500.71, implying a potential upside of 10.57%.

Analyst Insights and Price Targets

Truist Financial’s Joel Fishbein, a distinguished five-star analyst per Tipranks ratings, stands out as the most bullish analyst with a price target of $600 on Microsoft stock. Fishbein suggests that Microsoft’s guidance could be conservative, citing numerous tailwinds and the capability to surpass expectations with the expansion of AI projects, particularly highlighting growth in Azure.

In-Depth Analysis of AI Landscape Domination

Nvidia and Microsoft emerge as the dominant forces in the current AI landscape, with Nvidia excelling in hardware and Microsoft leading in software development. Together, they create a formidable synergy that not only controls the AI sphere but also propels industry advancement and nurtures ongoing innovation.

Both companies are witnessing robust demand with minimal concerns. However, Nvidia’s growth has been meteoric, contrasting Microsoft’s consistent and linear progress. This dichotomy suggests that any obstacles in the path may impact Nvidia more severely than Microsoft. Despite my optimism for both companies, my inclination leans towards Microsoft as a more favorable investment choice.