Are you eager to witness your financial acorns grow into mighty oaks? Delving into the world of stock markets might just offer you the golden ticket. Yet, the burning question remains—which stocks possess the Midas touch?

Experienced investors often recommend focusing on companies that lead in their industries. Here arises a dilemma, particularly in the technology sphere, dominated by a handful of giants with towering stock prices and capped growth potential due to their vast size.

Advanced Micro Devices (NASDAQ: AMD) might not rule the roost in computer processors or graphics processors. Nevertheless, both the company and its stock are currently riding a wave of success. Can this momentum potentially transform a $50,000 investment in AMD into a million-dollar fortune in your lifetime? Let’s dig deeper.

The Unlikely Triumph of Advanced Micro Devices: 2 Factors

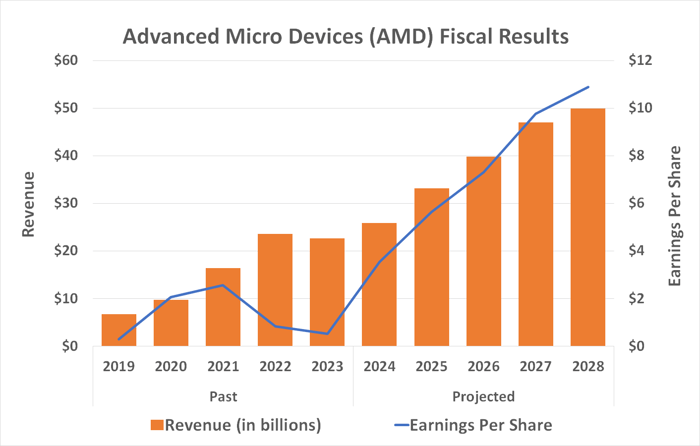

True, Advanced Micro Devices isn’t the frontrunner in any particular market. Nvidia (NASDAQ: NVDA) trumps it in graphics processing and data center processors, whereas Intel (NASDAQ: INTC) enjoys an 80% slice of the CPU market, as reported by Canalys. However, Advanced Micro Devices is on a remarkable growth trajectory. Its revenue is forecasted to surge by 13% this year before accelerating to 28% next year, followed by sustained double-digit growth for years to come. Earnings are poised to follow suit.

Data source: StockAnalysis.com. Chart by author.

But how is this perennial runner-up achieving such stellar growth against entrenched industry leaders?

There are two intertwined factors at play. Firstly, technology and intellectual property act as great levelers. Consider Alphabet‘s Google—a latecomer to the search engine scene that surged ahead thanks to superior algorithms delivering relevant results. While Advanced Micro Devices may never match the giants in sheer output, its technology and IP enable efficient production of cost-effective processors tailored for specific applications.

Secondly, the burgeoning demand offers ample space for all players. With the rise of artificial intelligence (AI), CEO Lisa Su predicts an estimated annual spend of $400 billion on AI accelerator tech by 2027. To put this in context, Advanced Micro Devices had a $23 billion turnover last year.

The AI boom not only fuels demand for data center hardware but also propels the need for high-performance computers. Su revealed during an earnings call that Ryzen processors power over 90% of existing AI-enabled PCs.

AMD: The Competition Conqueror

The lingering question is whether AMD holds the potential to turn a $50,000 investment into a million-dollar windfall.

While never say never, it seems improbable.

Don’t despair if you’ve staked your claim on Advanced Micro Devices with grand aspirations. Growing $50,000 into $1 million requires a staggering 2,000% return—a 20-fold leap post the realization and pricing in of the underlying opportunity driving such growth. This colossal task may span a lifetime to accomplish. In comparison, the average yearly gain of the S&P 500 hovers around 10%.

However, though AMD might not be your ticket to millionaire status, it remains a top prospect in the semiconductor world.

Substantiate this claim. In the last quarter, AMD made impressive strides in desktop processor sales, increasing its market share to a multi-year high of 23.9%. Simultaneously, its server processor market share climbed to 23.6%, predominantly at Intel’s expense.

Furthermore, AMD is making headway in the artificial intelligence hardware domain. Although Nvidia’s supremacy in this field is unchallenged, data center operators like Meta Platforms and Microsoft are turning to AMD due to cost efficiency. Consequently, the company witnessed an 80% year-on-year surge in data center revenue for the quarter ending in March.

This growth springs from a relatively nascent product portfolio targeted at the AI market. Recently, Advanced Micro Devices unveiled its new MD Instinct MI325X AI accelerator chip, boasting 30% enhanced bandwidth and double the total memory compared to similar-priced products from Nvidia.

Anticipate AMD’s successive launches of cutting-edge AI tech to match Nvidia’s yearly pace moving forward.

Connect the dots. The AMD of today has undergone a metamorphosis from a decade ago. Its current form starkly contrasts with its self of just a few years prior. The broader market may fail to grasp the extent of AMD’s readiness to erode the market share of the leading players in its core sectors.

The Roller Coaster Ride of Advanced Micro Devices Stock

Analyst Optimism Despite Volatility

Despite a significant dip in Advanced Micro Devices (AMD) shares, analysts are rallying behind the growth company, with a consensus price target of $190.02 per share – more than 20% above the current price. Out of 49 analysts tracking the stock, 35 rate it as a strong buy. The signs are clear – investors should pay attention.

The Turbulent Journey Ahead

Investors eyeing AMD should brace themselves for continued volatility in the stock’s value. The roller coaster ride is expected to persist, potentially leading to further dips before stability prevails.

Hidden Gems and Missed Opportunities

While AMD may be experiencing peaks and valleys, the broader market may not be fully acknowledging its true potential. This oversight presents a unique opportunity for astute investors to capitalize on the untapped value.

Historical Perspectives and Investment Insights

Reflecting on history, where Nvidia featured in a list of top stocks in 2005, a $1,000 investment back then could have ballooned to $801,365. Such examples highlight the potential gains that strategic investments in tech companies can yield over time.

For investors seeking to make informed decisions, services like Stock Advisor provide valuable guidance and stock recommendations that have outperformed the S&P 500 by significant margins. This data underscores the importance of making well-informed investment choices based on thorough analysis and market trends.

Final Considerations

As the market continues its dance of ups and downs, discerning investors have an opportunity to ride the roller coaster alongside Advanced Micro Devices. While the journey may be fraught with uncertainty, the potential rewards for those who navigate the twists and turns wisely could be substantial.