Investors today find themselves in the midst of a raging technological storm, with artificial intelligence (AI) as its tempestuous heart. This meteoric rise of AI, marked by the epoch-defining launch of OpenAI’s ChatGPT, has cast a mesmerizing spell over Wall Street, reshaping the investment landscape.

The darlings of this AI revolution, Nvidia (NASDAQ: NVDA) and Amazon (NASDAQ: AMZN), have emerged as colossi, witnessing their stocks ascend to stratospheric heights – soaring 222% and 45%, respectively, since the previous June. These titans, one reigning over chips, the other over software, stand poised for further ascent in an AI market projected to burgeon at a compounded annual growth rate of 37% through 2030.

Nvidia – The Power of Chips

Amidst the roar of accolades following its meteoric surge, Nvidia unveiled a dazzling 10-for-1 stock split on June 10, rendering its shares more accessible, a siren call for investors. Analysts, dancing in unison, lifted their price targets, endorsing this opportunity for stock acquisition.

The ace up Nvidia’s sleeve lies in its unassailable dominance, boasting an estimated 90% stranglehold on AI’s lifeline – graphics processing units (GPUs) essential for AI model training. By pivoting to an annual chip release cadence, Nvidia flaunts its agility, a move that has compelled rivals like AMD to follow suit.

Amazon – The Cloud Titan

In a parallel universe, Amazon orchestrates its own AI symphony. Nestling the world’s largest cloud realm – Amazon Web Services – within its bosom, Amazon outshines azure skies with its brilliance, eclipsing rivals Microsoft’s Azure and Alphabet’s Google Cloud in market hegemony.

The crescendo of Amazon’s success crescendoed in a recent earnings aria, with AWS tuning revenue crescendos of 17% year-on-year, soaring on a gossamer breeze of 84% in operating income. Awash with affluence, AWS has metamorphosed into Amazon’s golden goose, laying 60% of its operating eggs.

Choosing the Champion

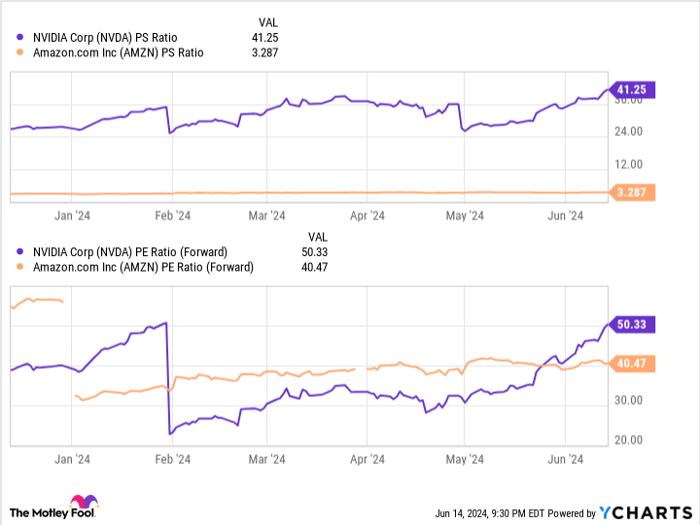

Nvidia and Amazon’s AI odyssey has seen them cresting towering waves of success, with their future exploits poised for unveiling. Contemplating their valuations, discerning investors may find Amazon’s stock, trading at a relative discount to Nvidia, a lustrous pearl amidst the market’s tumultuous sands.

While Amazon’s present allure may cast a spell, the astute eye remains vigilant, knowing that Nvidia, with a storied past of astronomical returns, may yet script another saga of financial wizardry.

The Nvidia Enigma

Delving deeper into the enigma of Nvidia, the Motley Fool Stock Advisor unveils its mystical stock allegory. While Nvidia doesn’t grace its elite list of stocks, the historical tapestry reveals the alchemy of investments past. A mere $1,000 planted in Nvidia’s garden on April 15, 2005, blossomed into a resplendent $802,591, a saga of riches spun from the loom of fortuitous financial acumen.

With an enchanted blueprint for success, astounding the S&P 500 with returns quivering in the shadows, the spectral allure of Nvidia beckons, a siren song for the wise and the bold.

Data by YCharts