The Ties that Bind: Nvidia’s History of Stock Splits

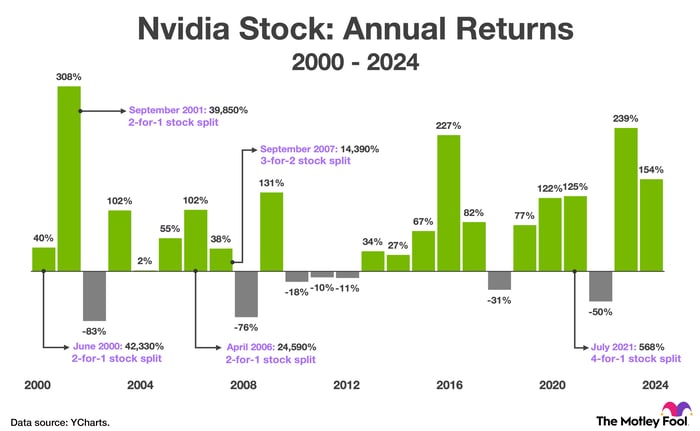

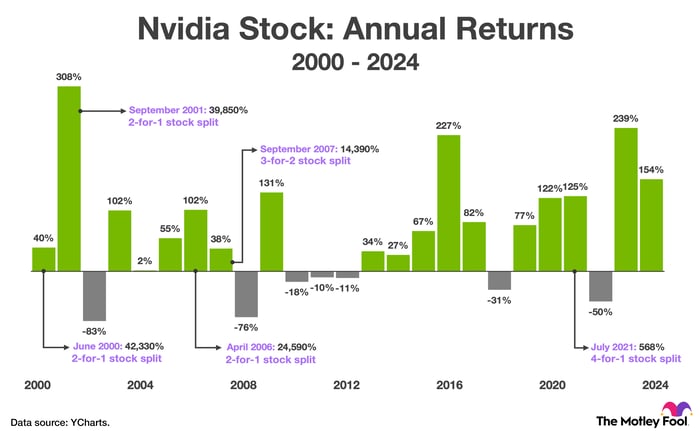

With Nvidia’s most recent 10-for-1 stock split hot off the press, a historical refrain begins to echo through the market chambers. For Nvidia shareholders, the aftermath of such splits has often charmed the stock southward. Over the years, Nvidia has danced the split tango five times before this recent act, and without fail, the company’s stock has pirouetted towards decline. The charts speak a blunt truth – shares floundered, with average dips of 23% in the 12 months following splits, and a lingering 3% drop after 24 months. A cautionary tale hangs in the air – the portent of a potential cliff awaiting the unwary investor at the stock split’s end.

Weathering the Storms: Nvidia’s Resilience Amid Market Busts

Four out of Nvidia’s last five stock splits yawned into existence amidst the tumult of bear markets. A sobering backdrop was painted as the S&P 500 weathered a 49% decline post the dot-com bubble and a 57% tumble during the global financial crisis. Yet, a silvery shimmer peeked through the storm clouds for steadfast investors. Despite the turbulence, Nvidia shares rallied post each split, unfurling a tapestry of grand returns over the long term. A testament to the market’s capricious whims, but also to the steadfast resolve of Nvidia as a beacon in a tempestuous sea of tickers.

Chart displaying Nvidia’s annual returns since 2000 juxtaposed against stock splits.

Looking ahead, Nvidia’s fate as an investment hinges on two pivotal pegs – the pace of its earnings growth and the market’s willingness to pay for these earnings.

The Armor of Advantage: Nvidia’s Monopoly in GPU Dominance

Amidst the rising tide of competitors in the semiconductor arena, Nvidia stands tall with a near-monopoly in graphics processing units (GPUs) for accelerated computing. Its prowess in AI and data analytics is unmatched, boasting performance accolades and market dominance above 90% in data center GPUs and 80% in AI chips. Dismal forecasts from Nvidia naysayers glance over the bulwark of strength that Nvidia’s full-stack strategy provides. CEO Jensen Huang’s resonant words resonate a truth – Nvidia is not just a chipmaker but a symphony of full-stack computing, touting CPUs, networking hardware, and a constellation of AI-focused software and services. The ace up Nvidia’s sleeve is CUDA, a proprietary programming language that sets Nvidia apart in the chip-making vanguard – a jewel that no competitor can flaunt.

Morningstar’s Brian Colello echoes the chorus, painting a picture of high barriers to entry fortified by CUDA’s proprietary embrace – a fortress insurmountable by Nvidia’s rivals in AI, fortifying the path to continued dominance.

The Balancing Act: Nvidia’s Valuation Conundrum

Still, the market quivers, whispering doubts amid Nvidia’s meteoric rise. With Nvidia perched at its elevated valuation, Wall Street appears skeptical about the future trajectory. As expectations mount for earnings growth, the yardstick of affordability becomes a beacon for the discerning investor, casting a shadow of doubt over Nvidia’s current price tag.

The Future is Bright: A Deep Dive into Nvidia’s Growth Trajectory

Evaluating Nvidia’s Growth Potential

Looking ahead, Nvidia is poised to experience robust growth at 31.7% annually over the next three to five years. The current price-to-earnings multiple of 75.8 translates into a price/earnings-to-growth (PEG) ratio of 2.4, displaying a discount compared to the three-year average of 3.2. However, the valuation remains relatively high.

Expanding Horizons with AI

Projections suggest that investment in AI hardware, software, and services will surge by 36.6% annually until 2030. Nvidia is well-positioned to match or even surpass this growth trajectory. Therefore, the current valuation may seem quite reasonable or potentially undervalued in retrospect.

The Investor’s Dilemma

Investors face a challenging decision, but following Joseph Moore’s advice from Morgan Stanley might be prudent. Moore highlights the relevance of AI exposure in the current landscape, with Nvidia standing out as the premier choice to gain such exposure based on recent client correspondence.

Unveiling Investment Opportunities

Before plunging into Nvidia stocks, consider a few factors. The Motley Fool Stock Advisor team recently outlined the top 10 stocks for potential investment opportunities, with Nvidia not making the cut. However, historical data reveals that an investment of $1,000 in Nvidia back in April 2005 would have amounted to an astonishing $794,196, underscoring the company’s growth potential.*

The Power of Stock Advisor

Stock Advisor provides investors with valuable insights and strategies for success, boasting significant returns compared to the S&P 500 since 2002. Their service has proven to outperform conventional benchmarks, offering a compelling case for considering Nvidia as a strategic investment.*

Concluding Remarks

As Nvidia navigates the dynamic landscape of AI technologies, investors are presented with a unique opportunity to capitalize on its growth potential. Despite the challenging valuation metrics, the company’s strategic positioning and market relevance could pave the way for substantial returns in the future.