Unveiling Dell’s Role in AI

In the captivating realm of artificial intelligence, big tech giants like Nvidia and Tesla often steal the spotlight, resembling the flashy headliners at a rock concert. But investors who dig deeper can uncover hidden gems, much like unravelling the intricate threads of a Renaissance tapestry.

One such gem is Dell Technologies (NYSE: DELL), an underdog that has seen its stock soar by a whopping 76% since the beginning of 2024, only to take a 20% dip post-earnings announcement on May 30. Let’s peer into how Dell slots into the grand narrative of AI and why now might just be the perfect moment to seize the opportunity.

Dell’s Crucial Role in the AI Ecosystem

Dell delineates its financial prowess into two key compartments – the infrastructure solutions group (ISG) and the client solutions group (CSG). While CSG revolves around hardware sales and services, it’s Dell’s ISG that serves as the beating heart of its AI landscape presence.

This segment encapsulates the company’s foray into storage solutions, data center services, and the intricate web of network infrastructure, portraying a vital cog in the AI machinery.

Image source: Getty Images.

Unraveling Dell’s Financial Performance

Peering into Dell’s fiscal quarter ending May 3, 2025, unveils an ISG business that churned out a robust $9.2 billion in revenue, marking a 22% year-over-year boost. Servers and networking revenue surged by a remarkable 42% year-over-year, clocking in at $5.5 billion. However, a slight hiccup was witnessed as storage solutions revenue remained flat year-over-year and saw a 16% decline from the previous quarter.

In the symphony of financials, Dell continues to hold a lion’s share in storage systems, outshining its competitors. Notably, the PowerEdge XE9680 server emerges as the fastest-growing solution in Dell’s storied history, pointing to its stronghold in the server and networking domain.

This resilience not only establishes Dell as a stalwart in the AI arena but also hints at a promising future, fueled by long-term secular trends that continue to shape demand.

The Enthralling World of Dell’s Valuation

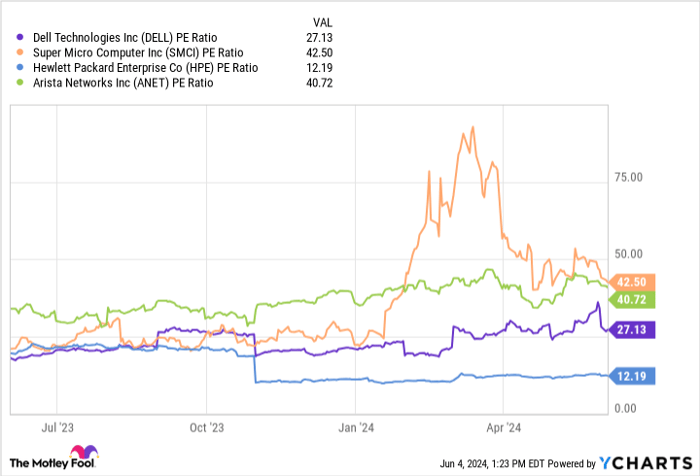

A glance at the chart plotting Dell’s price-to-earnings (P/E) ratio against its peers evokes a sense of intrigue, with outliers like Super Micro Computer and Arista Networks flaunting P/E multiples surpassing 40.

DELL PE Ratio data by YCharts

The anomaly in valuation multiples beckons to investors to adopt a prudent approach like dollar-cost averaging, recognizing Dell’s P/E of 27 as a compelling bargain amidst competitors. While the stock’s momentum surges, Dell’s stealthy charm positions it as an under-the-radar gem, with immense potential waiting to be unearthed.

Seizing the Opportunity with Dell

The current sell-off in Dell’s stock presents a tantalizing opportunity for investors to scoop up shares. With its ISG business showing no signs of stumbling or facing fierce competition turbulence, Dell silently carves a niche for itself in the AI landscape, emerging as a beacon of promise.

It’s a time akin to stumbling upon a buried treasure chest – a moment ripe with potential gains for savvy investors who can look past the surface and recognize Dell’s steady ascension in the AI domain.