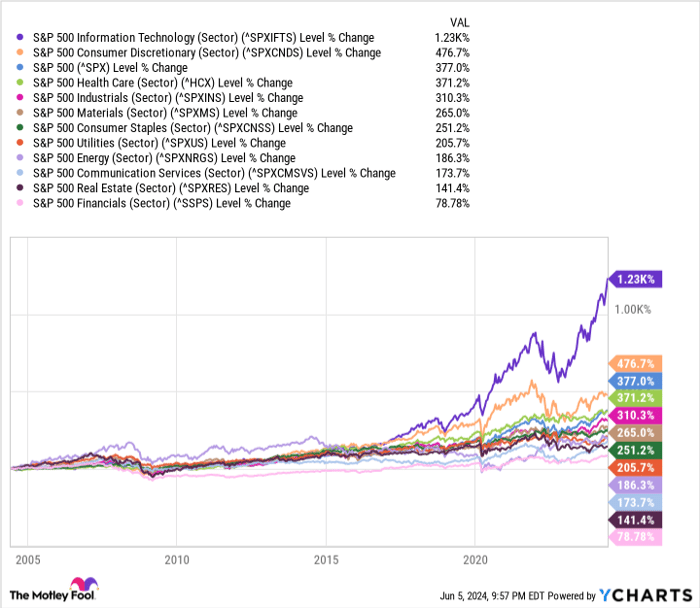

Charting a Decade of Outperformance in Information Technology Sector

When it comes to market sectors, information technology emerges as the undisputed champion over the past 20 years. It stands tall as the sole sector outperforming the S&P 500 in the last decade and one of just two sectors topping the index over two decades. The sector’s exceptional performance has been driven by digital transformation, encompassing cloud computing, cybersecurity, e-commerce, mobile devices, social media, and streaming services. This era of technological evolution has paved the way for extraordinary returns, with the next growth catalyst being artificial intelligence.

Spectacular increases in spending across AI hardware, software, and services are predicted, with a 37% annual surge expected until 2030. AI is poised to revolutionize revenue generation and cost reduction across diverse industries, making technology companies supporting AI – chipmakers, cloud providers, and software developers – prime beneficiaries of this transformative trend.

Leveraging the Vanguard Information Technology ETF for Maximizing AI Opportunities

The Vanguard Information Technology ETF encompasses 313 technology stocks, classified into internet services and infrastructure, technology consulting, hardware and equipment providers, and semiconductor and semiconductor equipment manufacturers. The top 10 holdings of the ETF, which include tech giants like Microsoft, Apple, Nvidia, Broadcom, and Salesforce, are strategically positioned to reap the rewards of the AI revolution.

Furthermore, with an incredibly low expense ratio of 0.1%, costing just $1 annually for every $1,000 invested, the Vanguard Information Technology ETF stands out for its cost efficiency compared to the industry average of 0.98%. However, despite its allure, the ETF’s highly concentrated composition, with five stocks accounting for 50% of the fund’s weight, introduces a risk factor. While this concentration may usher in transient market fluctuations, an extreme scenario could result in underperformance if heavily weighted stocks falter.

Therefore, potential investors should approach the Vanguard Information Technology ETF as a component of a diversified portfolio, blending it with other stocks and index funds, notably an S&P 500 index fund. Maintaining a moderate exposure to the ETF within the broader investment framework can help mitigate risks while harnessing the potential for substantial returns in the dynamic landscape of technological advancements.

Investing in Vanguard World Fund – Vanguard Information Technology ETF: A Wise Move or Missed Opportunity?

As you weigh the prospect of investing in Vanguard World Fund – Vanguard Information Technology ETF, consider this:

The esteemed analyst team at Motley Fool Stock Advisor has meticulously pinpointed what they believe to be the top-performing stocks for investors at present, and alas, Vanguard World Fund – Vanguard Information Technology ETF failed to secure a spot. The top 10 stocks earmarked by these astute analysts showcase the potential for monumental returns in the foreseeable future.

Reflect on the historical triumph of Nvidia, which clinched a position on the list back on April 15, 2005. If you had heeded the recommendation at that juncture and allocated $1,000, it would have burgeoned into a staggering $750,197 by now!*

Stock Advisor acts as a beacon for investors, offering a straightforward roadmap to prosperity, encompassing counsel on portfolio construction, regular analyst updates, and a duo of fresh stock picks monthly. Since its inception in 2002, the Stock Advisor service has outperformed the S&P 500 index by more than a quadruple!*.

*Stock Advisor returns accurate as of June 3, 2024