Exploring Enhancements in ETF Shares

Examining changes in shares outstanding among various ETFs, a standout performer is the iShares Expanded Tech Sector ETF (Symbol: IGM), showcasing an approximate $88.0 million dollar inflow – a notable 2.0% increase from the prior week (from 51,150,000 to 52,150,000 units). Within IGM’s key components, trading today reveals Alphabet Inc (Symbol: GOOG) up by 1.5%, Netflix Inc (Symbol: NFLX) by 1.7%, and Qualcomm Inc (Symbol: QCOM) up by a substantial 2.6%.

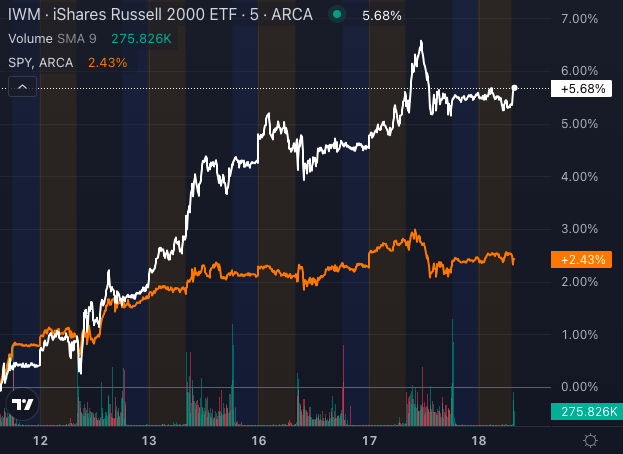

Comprehensive Look at Historical Price Performance

Illustrated in the chart below is the one-year price performance of IGM juxtaposed against its 200-day moving average:

Considering the data, IGM has fluctuated between a low of $60.69 per share and a high of $90.30 in the past 52 weeks – a range that falls slightly below its last trading price of $89.24. Assessing the current share price against the 200-day moving average unveils a beneficial technical analysis approach.

Understanding ETF Mechanics

ETFs operate akin to stocks, with investors transacting in ”units” rather than traditional ”shares”. These ”units” mirror stocks’ trading process but also permit creation or destruction based on investor trends. Weekly monitoring of shares outstanding changes enables the identification of ETFs witnessing remarkable inflows (indicating new unit creation) or outflows (reflecting old unit elimination). The inception of new units prompts the acquisition of the ETF’s underlying assets, while unit dissolution involves offloading these assets, potentially affecting the individual components within the ETF.

![]() Discover the nine other ETFs with noteworthy inflows »

Discover the nine other ETFs with noteworthy inflows »

Further Reading:

Top Stocks Held By Jim Simons

MTRX Stock Predictions

Explore VG shares outstanding history