While taking a stroll through the financial landscape, one cannot ignore the intriguing tale of Apple (AAPL) and Nvidia (NVDA), two “Magnificent 7” constituents who have ventured down divergent paths in recent times. In the year 2023, Nvidia soared to new heights, crowned as the best-performing, a title it proudly continues to clutch onto in 2024. On the contrary, Apple, despite its valiant 49% surge, struggled and ended up as the weakest link in the Magnificent 7 chain last year. Fast forward to the present, Apple has managed to claw its way back from the depths of 2024 but is scarcely above water, with a meager sub-1% year-to-date rise as of Monday’s closing bell. To add fuel to the fire, Nvidia’s market cap flirted with dwarfing Apple’s valuation just last month, only to witness a chill in its post-earnings rally. As for Apple, its coveted $3 trillion market cap and the throne of the world’s largest company slipped through its fingers, comfortably settling in Microsoft’s (MSFT) hands since last year.

What forces are steering this rift between Apple and Nvidia, and which of these tech giants shines brighter as an AI investment prospect today? Let’s delve into the nitty-gritty of this quandary.

Examining the Divergence in Apple and Nvidia’s Performances

A corporation’s stock value ultimately mirrors its earnings trajectory and growth potential. Apple weathered a storm of year-over-year revenue declines across all four quarters in the past fiscal year, battling sluggish iPhone sales – especially in China, where Huawei’s resurrection posed a formidable challenge to the iPhone titan.

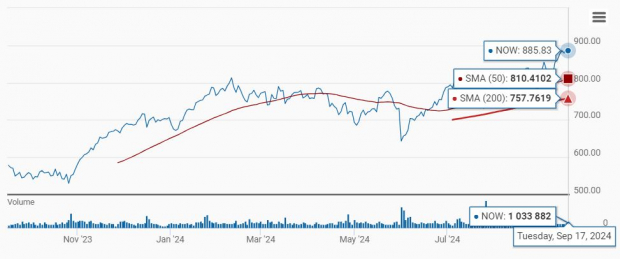

Meanwhile, Nvidia emerged as the star of an epic growth narrative, witnessing a staggering 126% surge in revenues during the previous fiscal year. Although Apple and Nvidia dance to different fiscal year tunes, these numbers paint a vivid picture of their diverging growth trajectories.

Nvidia stands tall as the primary beneficiary of the skyrocketing artificial intelligence (AI) expenditure, with analysts anticipating revenue figures of $119 billion in the ongoing fiscal year – a colossal leap of almost 11 times from its 2020 fiscal year revenues. The projections forecast Nvidia’s revenues nearly doubling year-over-year, in stark contrast to Apple’s modest 1% revenue uptick expectations.

Apple: A Sluggish Participant in the AI Arena

Since basking in the glow of its fiscal Q1 2024 earnings bonanza back in May 2023, Nvidia has solidified its stake in the AI domain. However, Apple found itself lagging behind in the AI race, with scant mentions of the magical acronym in its earnings dialogues. Apple’s CEO Tim Cook finally broke the silence on AI during the fiscal Q1 2025 earnings call in February, hinting at unveiling more AI-centric details later in the year.

During the fiscal Q2 earnings call, Cook expressed unwavering optimism about Apple’s prospects in generative AI, underlining the transformative potential of AI and Apple’s unique advantages poised to set them apart in this new era.

Choosing Between Apple and Nvidia: The Investment Conundrum

Gene Munster, the sage managing partner of Deepwater Asset Management, foresees Apple outshining Nvidia in the coming year. While paying homage to Nvidia’s CEO Jensen Huang as the “godfather of AI,” Munster expressed skepticism among investors regarding Apple’s untapped AI prospects.

Stock Forecast Faceoff: AAPL Versus NVDA

On the prediction front, analysts appear sway towards Nvidia’s trajectory. Apple garners a “Moderate Buy” assessment, with about two-thirds of analysts endorsing it as either a “Strong Buy” or “Moderate Buy.” On the flip side, 30% of analysts remain neutral on Apple, opting for a “Hold” outlook, while a lone voice rings out with a “Strong Sell” caveat.

Contrastingly, Nvidia gleams with a gleaming “Strong Buy” consensus, endorsed by over 92% of analysts who favor either a “Strong Buy” or “Moderate Buy” rating. A mere handful tip towards a “Hold” insignia or its analogous counterparts.

Apple’s mean target price sets an ambitious course at $205.96, standing 6.1% above Monday’s close. In stark contrast, Nvidia treads a more modest path, with its mean target price of $1,152.04 tightly aligned with its recent trading patterns. Nvidia’s stock has often flirted with exceeding consensus targets over the past year, fostering a constant game of catch-up among analysts following every earnings spectacle.

Following the fiscal Q1 earnings extravaganza last month, several analysts revisited Nvidia’s target price. Benchmark analyst Cody Acree upped the ante from $1,000 to $1,320, mirroring Bank of America’s Vivek Arya, who also adjusted his target from $1,100 to $1,320.

Can Apple Rise Above Nvidia?

Munster’s faith in Apple’s AI prospects finds resonance among other industry voices. JP Morgan analyst Samik Chatterjee envisions an AI-driven iPhone upgrade wave, reminiscent of the momentous 5G surge. As Apple gears up for the Worldwide Developers Conference (WWDC) slated for June 10-14, anticipations run high for new product unveilings or enhancements. With generative AI taking the center stage, a hardware sales supercycle might be on the horizon, especially following a lackluster sales spell in the past year. Interestingly, HP (HPQ) shares witnessed an uptick after the company hinted at an impending PC refresh cycle fueled by AI PCs.

In summary, placing my bet alongside Munster, I foresee Apple outshining Nvidia in the near term – largely due to Nvidia’s lofty valuations that leave little room for surprises, at least within the short to medium timeframe.