While the S&P 500 Index has been basking in the glow of solid gains, PayPal (PYPL) finds itself in a different hemisphere, recording a modest year-to-date increase of a mere 4.4% as of 2024. The company has been stumbling in the dark for the past few years, with 2021 witnessing a downturn in its fortunes. Despite a slight rebound, PayPal’s market capitalization has nearly vanished.

The core of PayPal’s struggle lies in its stunted growth both in revenue and profit. Its first quarter of 2024 saw a sluggish 9% YoY revenue growth, with a projected 7.5% and 8.1% increase for 2024 and 2025. Profit margins are dwindling, compounded by heightened competition causing a squeeze on its processing fees. The operating margin plummeted from 18.1% to 15.2% between Q2 2020 and Q1 2024.

The Forecast and Valuation

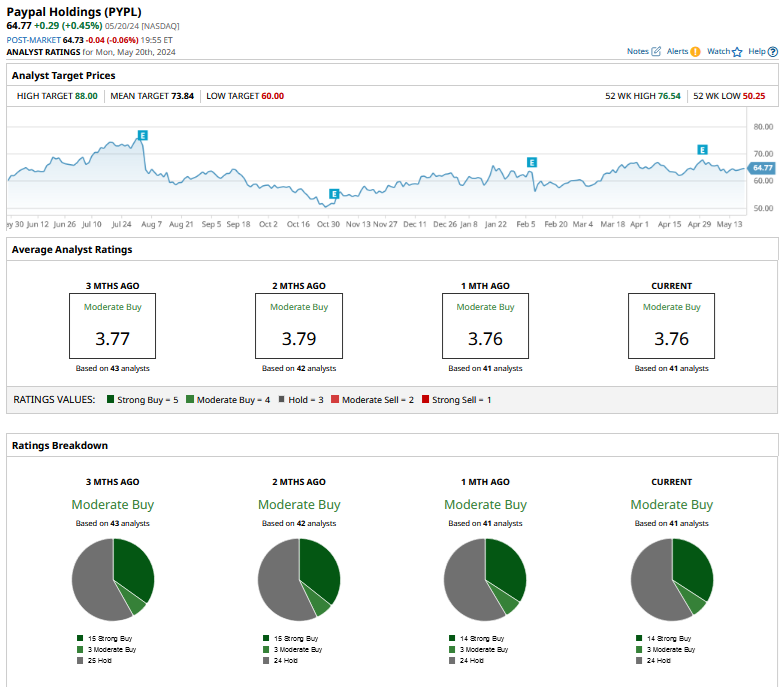

Wall Street analysts are cautiously optimistic about PYPL stock, labeling it a “Moderate Buy.” While some foresee a price surge of up to 37.3%, PayPal’s current position as a ‘value stock’ marks a stark departure from its high-growth past. The company now trades at a considerably lower price-to-earnings multiple than before, hovering at 15.7x for the next 12 months.

Dividend Contemplation Amidst Market Movement

The tides are turning in the tech sector, with Meta Platforms and Alphabet recently joining the dividend bandwagon. In light of these shifts, Morgan Stanley suggests PayPal might follow suit and distribute dividends, leveraging its sturdy financial stance with positive free cash flows and minimal debt.

In an era where dividends are gaining traction, particularly among yield-seeking investors, PayPal could attract a new wave of interest. Initiating a dividend could enhance its investor appeal, especially against a backdrop of underperformance spanning several years.

Considering the Better Capital Strategy

Despite the dividend allure, it might not be the propitious moment for PayPal to venture down that path. An internal “transition” phase beckons as the company navigates through significant strategic evolvements. Prioritizing business transformation over dividends seems prudent at this juncture.

Bolstered by discounted valuations, a focused share repurchase plan could offer greater merit. PayPal’s projected $5 billion share repurchases in 2024 closely align with its expected free cash flows, making it a viable capital allocation strategy for now.