Undoubtedly, Ford Motor’s formidable reputation in the automobile industry is as well-known as Henry Ford is to the very history of American innovation. Founded way back in 1903, this stalwart from Dearborn, Michigan, stands tall as one of Detroit’s famous “Big Three,” a global titan in vehicle design, manufacturing, and service. With iconic brands like Lincoln, Mustang, F-Series trucks, and Explorer SUVs under its belt, Ford’s legacy is etched deep into automotive lore.

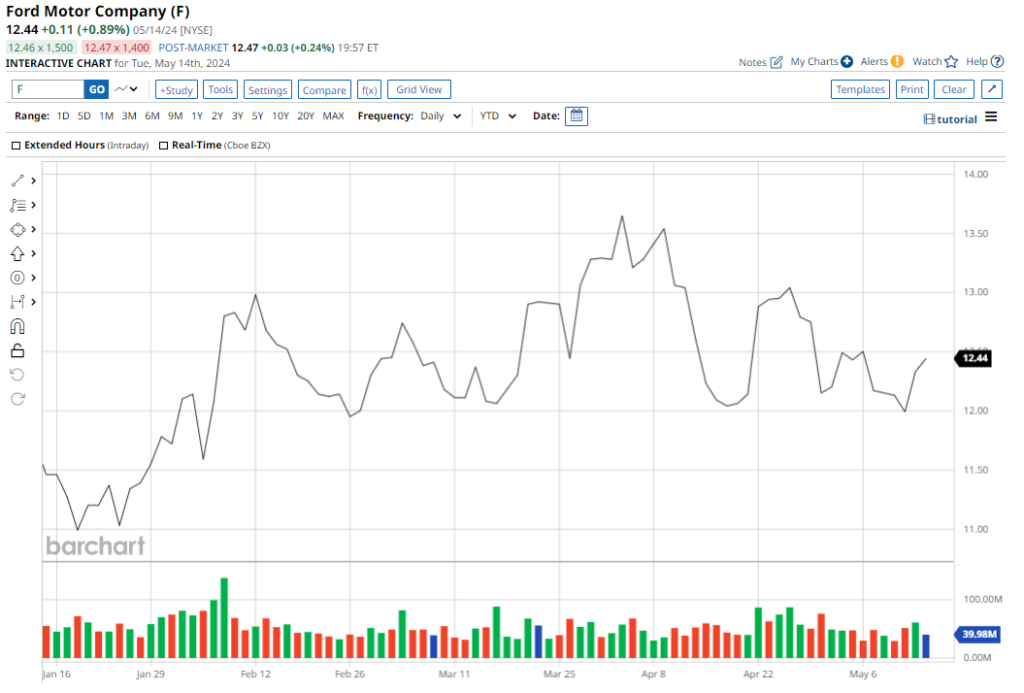

Despite its illustrious history, Ford’s stock has endured a rocky ride, slightly up by less than 1% YTD, trailing the market along the way. Over a five-year span, the shares have only managed a 26.6% climb, failing to keep pace with the S&P 500 Index in every timeframe.

Yet, as Ford readies itself for a resurgence after a period of lackluster performance, its dividend yield emerges as a golden opportunity for income-focused investors venturing into the world of dividend stocks.

Ford’s Dividend Appeal

At present, Ford boasts a forward dividend yield of 4.82% – a generous figure that eclipses the consumer discretionary sector median of 2%. Comparatively, Ford’s dividend yield shines brighter than General Motors (GM) at 0.87% and Honda Motors (HMC) at 2.51%.

Moreover, when considering special dividends, Ford’s trailing 12-month payout even edges past the 6% mark for loyal shareholders. What’s more, with a comfortable payout ratio of 31.75%, Ford’s dividend seems well-shielded by earnings, paving the way for potential future increases.

Quarterly Performance Insights

Following its Q1 earnings revelation in late April, Ford’s financial landscape reflects a mixed bag of results. Revenue for the quarter ticked up by 3.2% to $42.8 billion, slightly shy of analysts’ projections. The commercial arm, Ford Pro, spearheaded growth with a 36% revenue surge to $18 billion. However, the traditional Ford Blue segment witnessed a 13% revenue decline, while the Model E division continued to incur losses.

Despite a 24% yearly dip in first-quarter EPS to $0.49 (on an adjusted basis), Ford boasts a robust cash reserve of $34.46 billion, substantially higher than its $149.42 billion debt load.

Ford’s Diverse Business Model

Delving deeper into Ford’s operational stratagem, its diverse enterprise framework provides a cushion against turbulent consumer preferences. Spanning four key segments, Ford’s diverse focus encompasses gasoline and hybrid vehicles alongside EVs in the Ford Blue and Model E divisions, respectively. Meanwhile, Ford Pro caters to commercial, government, and rental markets, ensuring a broad customer reach.

Although Ford Credit might not be the revenue juggernaut, this finance arm remains the financial bedrock, fueling vehicle sales across all segments. Crucial in an industry still grappling with diminished sales figures, Ford Credit’s role in providing financing solutions is paramount.

Assessing the Investment Landscape

Despite analysts’ tepid outlook, branding Ford stock as a “Hold” with a mean target price of $13.96, showcasing a 13.4% upside potential, the high-yielding automaker appears to be a gem at bargain prices. Priced at 6.24x forward earnings and 0.29x sales, Ford’s valuation offers a substantial discount compared to peers and its own historical averages, making it an appealing prospect for dividend seekers.