General Motors (GM) is revving up its engines, boasting a YTD gain of nearly 27% and securing its spot among the top 50 gainers in the S&P 500 Index. This success stands in stark contrast to rival automaker Ford, which has been hovering around a flat performance for the year. But where is GM headed next? Will this Detroit powerhouse steer its course towards the coveted $100 mark? Let’s delve into the details.

GM’s Financial Resilience in Q1

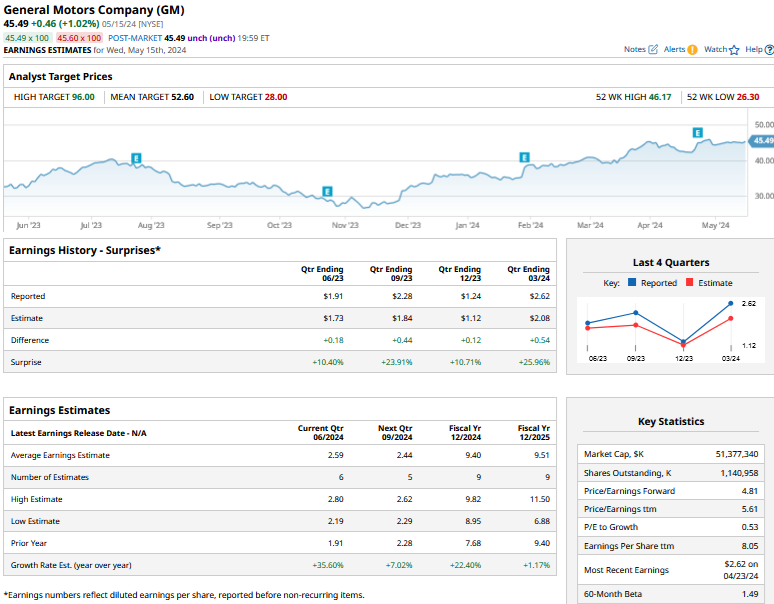

In the first quarter, GM exceeded expectations with revenues reaching $43.01 billion – a 7.6% YoY increase that outpaced analysts’ projections. The company’s adjusted earnings per share (EPS) of $2.62 comfortably surpassed the anticipated $2.08. GM’s robust pricing environment during the quarter helped maintain strong average selling prices, defying initial expectations.

Buoyed by a solid Q1 performance, GM has raised its full-year guidance, anticipating an adjusted EPS between $9-$10 in 2024, up from the previous range of $8.50-$9.50. Additionally, the company has adjusted its automotive free cash flow guidance, now expecting it to fall within $8.5 billion-$10.5 billion for the year.

Despite these positive developments, GM’s stock continues to trade at a modest next 12-month (NTM) price-to-earnings (PE) multiple of 4.76x. This valuation appears notably depressed when compared to both historical levels and peers in the industry.

Analysis of GM’s Valuation Metrics

GM’s current NTM PE ratio stands at a substantial discount to its three-year average of 6.45x, lingering only slightly above its lowest value of 4.2x during that period. Curiously, despite these appealing valuations, renowned value investor Warren Buffett divested his GM holdings last year, reflecting a broader trend where investors have shown restraint in seizing opportunities presented by GM’s discounted metrics.

During the Q1 earnings call, GM acknowledged its comparatively low PE multiple, with CFO Paul Jacobson expressing a commitment to enhancing the company’s valuation. Despite these efforts, GM’s stock price struggle to reflect its fundamental strength, leaving potential gains unrealized.

Potential Pitfalls and Promising Prospects

GM faces several risks that contribute to its modest valuation. Concerns revolve around potential profit saturation in North American markets, escalating inventory levels, challenges in the electric vehicle (EV) segment, international market losses, and hurdles in its Cruise self-driving unit operations.

However, despite these apprehensions, the scenario may not be as dire as it seems. The resilience of the U.S. economy, optimistic forecasts for GM’s EV business, the corporation’s commitment to the Chinese market, and potential margin improvements offer glimpses of hope amidst prevailing uncertainties.

Charting a Course for GM Stock

With 13 analysts rating GM as a “Strong Buy” and a mean target price of $52.60, the stock appears poised for significant growth. The highest target price on the street stands at $96, a level that would mark more than a doubling from current levels. Such projections hint at untapped potential within GM’s valuation metrics, suggesting a looming reevaluation of the stock.

GM’s undervaluation presents a compelling opportunity for investors. The stock’s imminent rerating, coupled with promising prospects in its EV segment and sustained performance in traditional markets, could propel GM towards the much-anticipated $100 milestone in the years ahead.