Shares of electric-vehicle (EV) maker Rivian (NASDAQ: RIVN)

took a tumble in April amidst mounting pressure on the EV sector.

Factors contributing to the decline included intensified price competition from other EV manufacturers, dwindling expectations of a Federal Reserve interest rate cut, and disappointing deliveries and financial performance from industry giant Tesla.

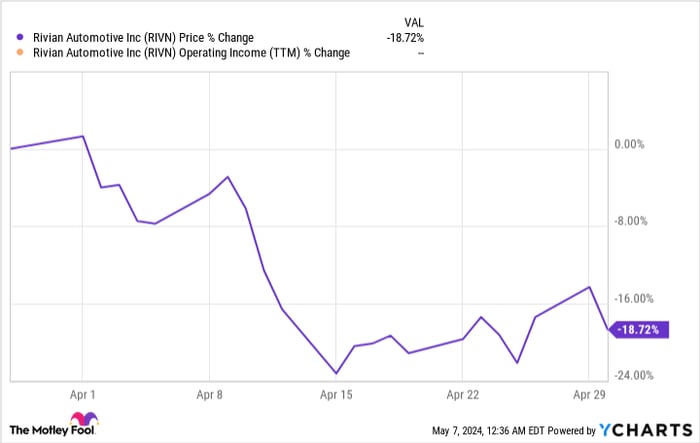

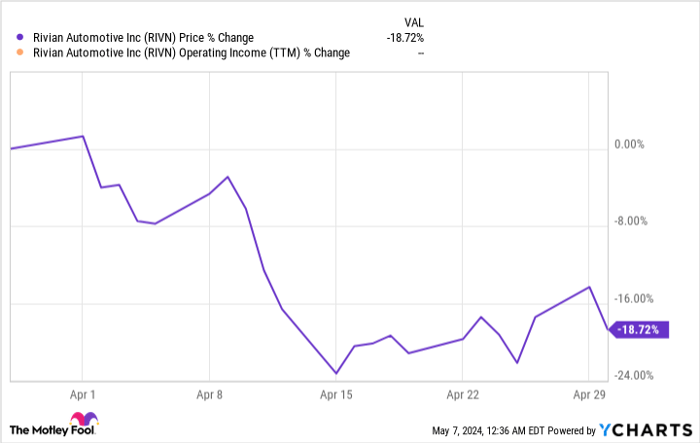

According to data from S&P Global Market Intelligence, Rivian’s stock closed the month with a 19% decrease, with the majority of losses occurring in the first half.

A Bumpy Ride for Rivian

Rivian’s shares started April on a downward trajectory following the company’s delivery numbers that were in line with guidance and reiterated production expectations of 57,000 vehicles for the year.

In the first quarter, Rivian reported delivering 13,588 vehicles, but investors appeared to have anticipated an upward revision in guidance.

Meanwhile, Tesla disclosed a 9% drop in first-quarter earnings, underscoring weaknesses in the broader EV sector.

Midway through April proved to be particularly jarring as Ford Motor slashed prices of the F-150 Lightning EV, heightening the price competition with Rivian, both prominent players in the EV pickup market.

Furthermore, the March Consumer Price Index data, released on April 10, revealed a resurgence in inflation, dampening hopes for a Federal Reserve interest rate reduction later in the year. High-interest rates have curbed demand for expensive vehicles by elevating borrowing costs, and the anticipated rate cut was anticipated to alleviate pressures on high-end automakers like Rivian.

On April 17, Rivian announced a 1% reduction in its workforce, another step in its ongoing effort to trim substantial losses.

Image source: Rivian.

Future Outlook for Rivian

Investors await a significant update from Rivian after-hours on Tuesday with the release of its full first-quarter earnings report.

While positive results could potentially fuel a stock recovery, pivotal uncertainties loom over the company as production growth decelerates and the EV sector appears to hit a plateau.

Analysts anticipate a 76% revenue surge to $1.16 billion and a per-share loss of $1.17, contrasting with a $1.25 loss in the year-ago quarter. Merely surpassing expectations may not suffice to elevate the stock, as investors seek signs of progress towards gross profitability.

Is Investing in Rivian Automotive a Wise Move?

Before considering investment in Rivian Automotive, take note:

The Motley Fool Stock Advisor analyst squad pinpointed what they deem the 10 best stocks for current investment opportunities… with Rivian Automotive not making the cut. The selected 10 stocks have the potential for substantial returns in the forthcoming years.

Reflect on the power of transformative stock picks – for instance, when Nvidia earned a spot on this list on April 15, 2005… an investment of $1,000 at the time of recommendation would have yield an impressive $544,015!*.

Stock Advisor equips investors with a road map for success, offering insights on portfolio construction, regular analyst updates, and two new stock selections each month. The service has outperformed the S&P 500 several times over since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 6, 2024

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.