Goldman Sachs recently dissected Tata Power’s Q4 FY2024 performance, noting a slight dip in adjusted profit after tax (PAT) to INR 4.7 billion, missing their estimate of INR 5 billion. The coal business bore the brunt of profitability decline, influenced by the global coal price downturn. Despite efforts to counter this via the Mundra (CGPL) segment, challenges endured, amplified by the Section 11 imposition.

Renewable capacity addition was lackluster in the quarter, with 254MW supplemented, totaling 597MW for the fiscal year. Management’s projection of a 4.5GW pipeline by end FY2026 or early FY2027 holds promise. Opportunities from the domestic module usage mandate (ALMM) and the government’s rooftop scheme could fortify Tata Power’s cell and module manufacturing. Nevertheless, Goldman Sachs maintains a Sell rating, citing an unfavorable 35x FY26E P/E risk-reward ratio.

Tata Power’s consolidated adjusted PAT fell below Bloomberg consensus by 47% year-on-year in Q4. Profit depreciation in the coal mining division, down by about 26%, chiefly caused this shortfall due to the coal price normalization. Even with blending efforts, CGPL witnessed losses due to the global coal price slump. Notably, the one-time dividend of INR 3.3 billion from its Zambian subsidiary and INR 2.2 billion tax credits cushioned the quarter.

On a bright note, Tata Power’s solar EPC business exceeded expectations with a 45% revenue surge year-on-year and an 84 basis points EBITDA margin rise. Optimism surrounds the domestic rooftop solar scheme and ALMM revival, potentially propelling segment growth.

Goldman Sachs adjusted earnings estimates, foreseeing a 10% earnings CAGR for FY23-26E. Despite, retaining a Sell rating on Tata Power with an unchanged INR 240 per share target, citing prevailing valuation metrics. Upside risks include a global coal price upswing and Mundra issue resolution.

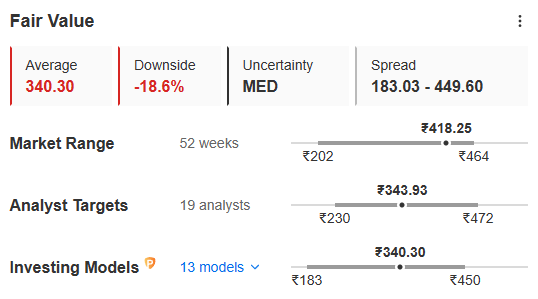

Image Source: InvestingPro+

For a stock like Tata Power, calculating the fair value using various financial models yields INR 340 per share, signifying an 18.6% overvaluation. Additionally, considering both Goldman Sachs and InvestingPro models adopting a bearish stance toward the stock, cautious investing is advisable.