The Vitality of Cybersecurity

Amidst the clamor for AI stocks and turbulent swings in commodities markets, the cybersecurity sector stands tall, a fortress guarding against the relentless onslaught of online threats in our progressively digital world. Recent high-profile breaches at UnitedHealth Group and Microsoft serve as stark reminders of the crucial role that cybersecurity plays in safeguarding companies and their invaluable assets. As big tech giants find themselves in the crosshairs of cybercriminals, the demand for robust cybersecurity measures is set to soar for the foreseeable future.

Unveiling CyberArk Software

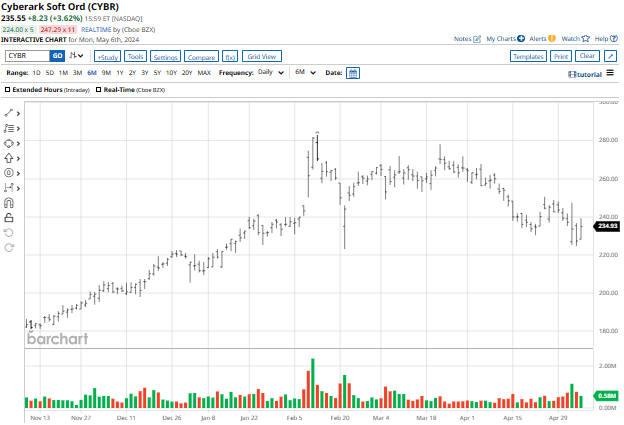

CyberArk Software Ltd. (CYBR) emerges as a stalwart in the cybersecurity realm, offering cutting-edge privileged access security solutions since its inception in 1996. Headquartered in Israel, CyberArk caters to a diverse array of industries, including finance, manufacturing, healthcare, insurance, and retail. The company’s stock has surged by 7.6% this year and an impressive 77% over the past 52 weeks.

Triumphant Q1 Results and Upbeat Outlook

During their Q1 earnings release on May 2, CyberArk reported stellar performance, with revenue reaching $221.6 million, marking a 37% year-over-year surge and surpassing analysts’ estimates. Earnings per share stood at $0.75, far exceeding the expected $0.30. The company’s Annual Recurring Revenue (ARR) spiked by 69% to $156.2 million, with a total ARR growth of 34% to $811 million.

Encouragingly, CyberArk raised its full-year guidance, anticipating revenue between $928.0 million and $938.0 million, representing a robust 23% to 25% growth rate. Non-GAAP operating income is projected to range from $90.5 million to $99.5 million, while non-GAAP net income is forecasted to fall between $1.88 and $2.07 per share.

Looking ahead to Q2, the management foresees revenue in the range of $215.0 million to $221.0 million, suggesting a 22% to 26% year-over-year expansion. Non-GAAP operating income and net income are expected to follow suit with promising figures.

Assessing the Investment Potential

Analysts express unwavering optimism regarding CyberArk’s stock, substantiated by a unanimous “Strong Buy” consensus rating. Out of the 28 analysts tracking the stock, a vast majority of 26 have bestowed it with a “Strong Buy” status, while the remaining two lean towards “Moderate Buy” and “Hold” recommendations. The mean price target of $283.37 by analysts implies a promising 20.3% potential upside from its current valuation.