Salesforce: Leading the Charge

May brings this illustrious month with Wall Street, where opportunities lurk amidst volatility.

Investors, keen on finding the diamond in the rough, should look no further than Salesforce, the cloud-based behemoth that stands tall alongside SAP, Intuit, and ServiceNow.

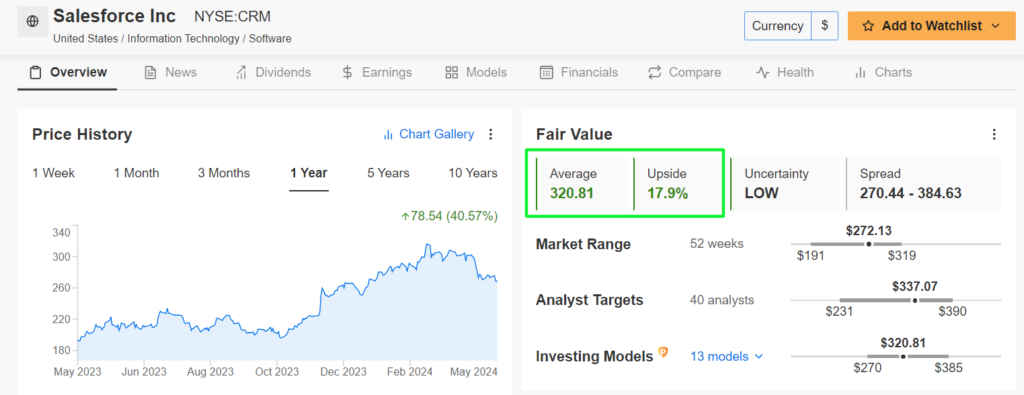

Despite a modest 3.8% uptick in 2024, Salesforce, with a $263.1 billion market cap, beckons intently with a whopping 41% surge in the last year.

The hullabaloo surrounding Salesforce’s stock does not deter the discerning investor – the AI-powered crystal ball whispers of a potential 17.9% upside, while analysts chant a 24% crescendo to $337 a share.

May holds promise as Salesforce gears up for record-high levels, fueled by stellar cloud performance and AI splash.

And lo! The earnings report due on May 28 may very well stoke the flames of Salesforce’s soaring fate.

Defying market gravity, the San Francisco behemoth continues its upward trajectory by thriving in a digital age demanding AI-driven solutions.

Walt Disney: Where Dreams Come True

Walt Disney emerges as another May darling, with shares nudging close to its 2024 peak.

With a market cap of $206.4 billion, Mickey’s abode has seen shares soar by 25% since the year’s dawn, leaving competitors Netflix, Warner Bros Discovery, and Paramount Global eating its magical dust.

Whispers of quantitative models suggest an 8.6% hop for Disney shares, drawing them closer to the ‘Fair Value’ of $122.34.

Optimism swirls around Disney’s stellar earnings prospects, especially as the curtain rises on the fiscal second-quarter results this May 7.

Analysts, the harbingers of hope, have blessed Disney with upward profit revisions, hinting at a promising 18.3% growth in EPS to $1.10.

Further bolstered by a 2% revenue uptick, Disney dances in the limelight, flaunting a robust content portfolio and streaming prowess.

The magic kingdom beckons, promising a bountiful harvest from global performance and streaming triumph.

Okta: Rising Above the Rest

Okta, the identity-and-access guru, beckons the wary investor to look beyond the surface.

With a $15.9 billion market cap, Okta’s shares, off from their year-to-date peak, beckon at $95.48, hinting at the San Francisco savior’s resilience amid tricky markets.

The stock’s 35.8% rise in a twelvemonth is a testament to Okta’s mettle in the identity-and-access realm.

As we step into May’s embrace, Okta stands as a beacon of promise for those willing to ride the wave of its potential.

Looking past the uncertainties, Okta shines as a starry oasis promising growth amidst shifting sands.

The Tech Sector’s Meteoric Rise: Analyzing Okta’s Impending Surge

Revving Up for Earnings: A Promising Forecast for Okta

Spring brings more than just blooming flowers and sunny days—it heralds the arrival of Okta’s anticipated first-quarter results, set to be unveiled after the closing bell on Thursday, May 30. Market spectators are already buzzing with excitement as the tech realm braces for a potential seismic shift in fortunes.

Analysts Aflutter with Optimism

Prepare for your jaw to drop as analysts, in a frenzy of optimism, have whipped the EPS estimates into a frenzy, swirling upwards like a tornado of fiscal fortune. Their fusillade of figures paints a rosy picture, with a 150% jump looming tantalizingly on the horizon.

Revenue’s Ascension: A Ladder to the Clouds

While earnings per share take flight, revenue is also blasting off like a rocket ship, on track for a 16.6% year-over-year ascent. As Okta’s security-software solutions continue to captivate the market, the firm stands at the cusp of a financial stratosphere, fueled by the insatiable appetite of large enterprises for its cloud-based identity and access management tools.

Okta: A Fortress in the Cybersecurity Kingdom

At the helm of the burgeoning identity and access management sector, Okta stands tall like a trusty sentry guarding the gates of cybersecurity. With its cloud software empowering companies to fortify user authentication and developers to embed identity controls across a panoply of digital domains, Okta solidifies its position as a beacon of security in the tumultuous digital realm.

Strategies for Investors: Navigating the Market’s Stormy Seas

As you navigate the tempestuous waters of the market, remember that leveraging InvestingPro is akin to unfurling a treasure map dotted with investment opportunities. Unveil a trove of insights as you explore the labyrinthine domain of stocks and trades—where every dip and surge determines your financial fate.

Beyond the Headlines: Unraveling the Investment Tapestry

Peering beyond this article’s confines unveils a world ripe with investment potential and pitfalls. Delve deep into the market’s intricacies armed with knowledge, guided by the compass of historical context, and weather the storm of volatility with unwavering resolve.