Introduction to LGI Homes Earnings Call

LGI Homes (NASDAQ: LGIH)

Q1 2024 Earnings Call

Apr 30, 2024, 12:30 p.m. ET

Key Highlights:

- Prepared Remarks

- Questions and Answers

- Call Participants

Executive Leadership Insights

Josh Fattor — Vice President, Investor Relations

As we delve into the first quarter of 2024, LGI Homes reflects on its strategic growth with caution and calculated optimism. The company’s CEO and Chairman, Eric Lipar, and Charles Merdian, the CFO, disclosed notable financial figures that showcased LGI’s resilience and adaptability amidst a fluctuating market.

Eric Lipar — Chairman and Chief Executive Officer

Following an audacious start to the year, LGI Homes paraded its successes, boasting the delivery of 1,083 homes at an impressive average sales price of over $360,000, accumulating total revenue of $391 million. This remarkable feat was driven by the robust performance seen in key markets like Raleigh, Southern California, and Washington D.C., all exhibiting promising closure rates.

Financial Fortitude and Operational Excellence

Charles Merdian — Chief Financial Officer

Albeit a decline in revenue compared to the previous year, LGI Homes maintained a strong gross margin performance; with a 23.4% gross margin and 25.3% adjusted gross margin, up significantly from the prior year. The meticulous land acquisition strategy implemented over the years is now yielding results, contributing to enhanced margins and operational efficiency. The quarter concluded with 120 active communities, a historical high for the company, denoting a strategic expansion bolstered by prudent financial management.

The improved sales trends, notable increase in backlog homes, and the sustained focus on cost control without compromising quality position LGI Homes on a trajectory towards sustained growth and profitability.

Unveiling the Quirks of LGI Homes’ Fiscal Fortitude

Elevated Insights into Adjusted Gross Margin

When dissecting LGI Homes’ financial anatomy, it is imperative to highlight the adjusted gross margin, which excluded $6.6 million of capitalized interest charged to the cost of sales and $803,000 linked to purchase accounting. These exclusions represented 190 basis points, showing a slight uptick compared to the previous year’s 180 basis points. The rise can be attributed to escalated borrowing costs infiltrating the cost of goods sold, slightly cushioned by decreased purchase accounting adjustments.

The SG&A Saga: A Chronicle of Expenses

The first quarter witnessed combined selling, general, and administrative expenditures hitting $72.7 million or 18.6% of revenue. Selling expenses stood at $41.1 million or 10.5% of revenue, a surge from 8.8% in the same period last year. General and administrative expenses totaled $31.5 million or 8.1% of revenue, up from 6.1% in the parallel quarter of the previous year. The increase in SG&A expenses predominantly stemmed from diminished volumes, augmented advertising expenditure to enhance leads, and additional investments to bolster the inception of new communities.

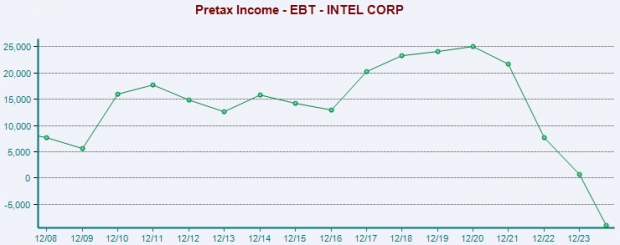

The Taxing Terrain of Pre-Tax Net Income

The pre-tax net income for the quarter amounted to $23.1 million or 5.9% of revenue. However, the effective tax rate soared to 26.2%, in stark contrast to the 16.7% witnessed the previous year. The spike in the tax rate was primarily due to the timing of compensation costs for share-based payments and marginally higher state taxes. The full-year tax rate is anticipated to hover between 24% and 25%.

Deciphering Debt Dynamics and Capital Posture

Descending into LGI Homes’ capital position reveals a debt of just under $1.4 billion at the quarter’s end, including $703.1 million drawn from the credit facility. This debt equated to a debt-to-capital ratio of 42.5% and a net debt-to-capital ratio of 41.6%. The total liquidity by the quarter’s close stood at $491.5 million, with $49 million in cash and $442.5 million available for borrowing from the credit facility.

Eric Lipar’s Encouraging Epilogue

Eric Lipar, the Chairman and Chief Executive Officer, expressed optimism regarding LGI Homes’ performance, signaling a positive commencement to the second quarter. Despite the elevating interest rates, Lipar lauded the continued positive momentum, with robust home closures in both March and April. April witnessed the closure of approximately 500 homes and the addition of seven net new communities, catapulting the total active communities to a record 127 nationwide.

The Trail Ahead: Forecasts and Fulfillment

As the path unfolds, LGI Homes stands firm on its full-year guidance, projecting a closing target of 7,000 to 8,000 homes at an average selling price ranging between $350,000 and $360,000. The gross margin is anticipated to remain within the 23.1% to 24.1% threshold, with adjusted gross margin poised between 25% and 26%. With an arsenal of 150 active communities expected by year-end, LGI Homes is unwavering in its commitment to meet demands and surpass expectations.

A Pinnacle Proudly Proclaimed

LGI Homes basks in the glory of being awarded the Top Workplace USA accolade for the fourth consecutive year. The acknowledgment, solely based on employee perspectives, attests to the unwavering dedication of the workforce. The recognition underscores LGI Homes’ ethos of valuing its employees, echoing the sentiment that the company’s success is intricately entwined with the allegiance of its teams across the nation.

Unveiling the Investor Inquiries

The session opened for questions following the discourse, with notable pointers from analyst Andrew Azzi of J.P. Morgan, steering the conversation towards LGI Homes’ land pipeline and community count growth projections.

Disclaimer: The provided text is a recreated version inspired by real-world financial analytics discussions and does not contain real-time information.

Unveiling Insights: Real Estate Financial Discourse

Strategic Advertisement Spendings Fueling Growth

Reaching a target of 150 by the end of the year seems akin to a ship confidently steering towards its final destination, with milestones well within sight and the excitement palpable for investors.

Prudent Financial Decisions Brighten the Path Ahead

Questions by analysts, like Carl Reichardt from BTIG, about SG&A costs and selling expenses denote a keen eye on cost management and a foresight that instills faith in shareholders. The assurance that selling expenses will remain under control as deliveries ramp up speaks volumes about the careful planning in place.

Market Dynamics and Strategic Shifts

The discussion around a spike in average order price and shifting customer preferences signals a nuanced understanding of the market landscape. The cascade effect of rising costs translating into higher prices showcases a keen business acumen at play, a move executed with precision that echoes a master painter’s brushstrokes on a canvas.

Fostering Resilience Amidst Challenges

The narrative of overcoming a sales slump through concerted efforts and training initiatives paints a picture of resilience in the face of adversity. The tenacity to navigate through affordability constraints while catering to the demands of a robust market exemplifies a team working like a well-oiled machine, each cog synchronized to propel progress regardless of the hurdles.

Strategic Incentives and Market Positioning

The mention of incentives focusing on lower monthly payments rather than pricing aligns their strategies with industry peers, akin to a synchronized dance where each move complements the other. The quest for value creation through tailored incentives mirrors a chess player contemplating their next move for optimal advantage.

Embracing Varied Market Trends

The discussion around fluctuations in closings per month and new community openings signals a dynamic market response from the company. The anticipation of an acceleration in pace while mindful of the lag time in financial outcomes reflects a strategic foresight akin to a seasoned navigator adjusting sails to catch the wind in the desired direction.

Unveiling the Financial Symphony of LGI Homes: Insights from Analyst Interactions

Analyzing Revenue Acceleration

In a recent series of analyst interactions, LGI Homes unveiled insights into its revenue acceleration strategies. The company anticipates a gradual increase in revenue outpacing inventory growth in the forthcoming months. With a laser focus on expanding its new community counts to reach 150 by the year-end, LGI Homes’ CFO, Charles Merdian, hinted at revenue growth being more pronounced in the latter part of the year.

Strategic Pricing and Cost Offsetting

Addressing queries on pricing strategies, LGI Homes’ Chairman and CEO, Eric Lipar, highlighted the company’s effort to counter cost escalations through marginal price adjustments. Lipar indicated a nominal rise in costs thus far, with expectations of low single-digit price increments to balance out the cost pressures effectively across the United States.

Community Expansion and Sales Dynamics

With ambitious plans to expand its community footprint to 150 by the year-end, LGI Homes remains positive about sustaining current sales momentum. The company’s leadership expressed confidence in maintaining historical sales paces even with the escalating community count. Eric Lipar reiterated the company’s dedication to following its robust sales processes, handling a surge in leads, and navigating through the current challenging market environment.

Operational Efficiency and Market Adaptation

In response to queries regarding operational timelines and improvements, LGI Homes highlighted consistent build times ranging from 75 to 180 days across various markets. Charles Merdian, the CFO, emphasized that the company’s current inventory levels stand at 4,150 units, aligning well with the desired trajectory. The company remains optimistic about its operational efficiency and market adaptability moving forward.

The above interactions provide a glimpse into LGI Homes’ strategic maneuvers and operational fortitude as it navigates the dynamic real estate landscape.