European Car Market Analysis

Last week, the European Automobile Manufacturers Association unveiled data on new car registrations for March 2024. The EU car market faced a 5.2% year-over-year drop, totaling 1 million units. Notably, key markets like Germany, Spain, France, and Italy saw declines ranging from 1.5% to 6.2%. On a bright note, registrations in Italy and France posted growth during the first quarter of 2024.

Auto Sector Earnings

The automotive sector’s earnings season started with a bang as Genuine Parts Company (GPC) released its quarterly results. While the company missed sales expectations, it exceeded earnings projections. At the same time, Group 1 Automotive (GPI) sealed the deal to acquire U.K. dealerships of Inchcape for a whopping $439 million.

Analysis of Key Players

Tesla made headlines by laying off 10% of its workforce to streamline operations for future growth. On the other hand, Ford resumed online orders for the 2024 F-150 Lightning pickup after a temporary halt. Additionally, Nissan announced plans to produce electric vehicles powered by next-generation batteries on a large scale by 2029.

GPC’s Quarterly Results

Genuine Parts Company (GPC) reported adjusted earnings of $2.22 per share for the first quarter of 2024, marking a 3.7% increase year over year. While net sales fell slightly short of estimates at $5.78 billion, the company projected a positive outlook for the year ahead.

GPI’s Acquisition of Inchcape

Group 1 Automotive (GPI) finalized a deal to acquire Inchcape’s U.K. automotive retailing business for $439 million, including real estate. This strategic move is expected to bolster GPI’s market presence and add significant value to its revenue stream.

Tesla’s Workforce Reduction

Tesla announced a 10% reduction in its global headcount as part of a cost-cutting strategy to enhance productivity and efficiency for future growth. This move comes as the company gears up for the next phase of innovation and expansion in the electric vehicle market.

Ford’s F-150 Lightning Pickup Updates

Ford reopened online orders for the 2024 F-150 Lightning pickup, introducing price cuts on select trims to enhance affordability and accessibility for customers. The model also underwent technological enhancements to improve performance and functionality.

Nissan’s Venture into EV Production

Nissan outlined its plans to manufacture electric vehicles powered by next-generation batteries by early 2029, aiming to revolutionize the EV landscape with more efficient, cost-effective, and faster-charging battery technology. The company’s foray into solid-state batteries signals a significant leap in innovation and sustainability.

The Power of Evolution: Transforming Electric Vehicle Production

Revolutionary Manufacturing Process

To craft the rear floor of electric vehicles (EVs), NSANY is set to employ heavy-force machines that promise a remarkable metamorphosis. This newfangled process is poised to shear the manufacturing cost and component weight by a staggering 10% and 20%, respectively. As affirmed by Hideyuki Sakamoto, the esteemed executive vice president overseeing manufacturing and supply chain management at Nissan, after a series of innovative forays, the company has settled on utilizing a colossal 6,000-tonnes gigacasting machine to engineer the rear body framework of the vehicle with aluminum casting.

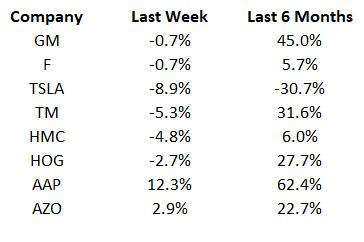

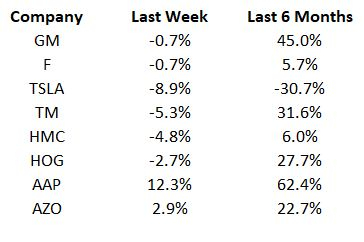

Historical Price Performance Analysis

Diving into the realm of price movement within the automotive sector, a comprehensive tableau illustrates the undulations experienced by key industry players over the past week and a six-month duration.

Exploring the Road Ahead in the Automotive Space

The automotive sector’s earnings season is revving up this week, brimming with anticipation. Stakeholders and industry aficionados eagerly await the quarterly financial disclosures of automotive juggernauts such as Tesla, Ford, and General Motors, among a constellation of others.

What Awaits Stocks Under…If Biden or Trump Triumph?

Transporting us through the corridors of time, an intriguing revelation awaits. Since 1950, not even during the throes of adverse midterm years has the market witnessed a downturn in a presidential election year. Regardless of the prevailing political winds, with an electrified electorate steering the ship, the market has shimmered with bullish exuberance!

The present juncture is ripe for the plucking. Grab Zacks’ illustrious Special Report, showcasing five stocks with stratospheric potential appeal to both Democrats and Republicans:

1. Medical marvel that has burgeoned by a jaw-dropping +11,000% over the last 15 years.

2. Dominant Rental company boldly eclipsing its competition in the sector.

3. A titan in Energy, unfurling plans to upsize its already generous divvy by a heady 25%.

4. The Luminary in Aerospace and Defense has recently clinched a potential contract worth a dazzling $80 billion.

5. The Colossus in Chipmaking erecting mammoth edifices on native shores.