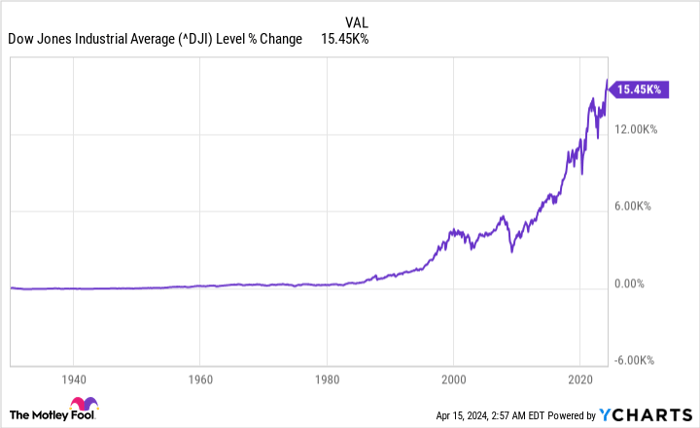

Wall Street, a fertile ground for wealth creators, has stood the test of time against other asset classes in generating unparalleled returns. Among them, stocks reign supreme, with the iconic Dow Jones Industrial Average (DJINDICES: ^DJI) emerging as the ultimate barometer of Wall Street’s pulse over the past century.

Image source: Getty Images.

The Dow Jones recently inched close to the 40,000-point milestone, showcasing a remarkable journey from its humble 41.22 points during the depths of the Great Depression. The burning question now lingers: Can the Dow Jones Industrial Average scale the summit of 50,000? Historical trends hint at a sooner-than-expected ascent.

Insights from Historical Trends

The stock market, with its unpredictable short-term fluctuations, poses a challenge for accurate predictions. Despite this, the Dow Jones and major indexes exhibit a clear upward trajectory over extended timelines. The historical data, stretching back to 1924, underscores a consistent annualized return for the Dow, pointing towards a potential breach of the 50,000 mark by early 2029.

The Dow’s accelerating growth owes much to the internet’s advent three decades ago, sparking a renaissance in historic returns. Despite comprising primarily mature businesses, the Dow’s annualized growth rate over the last 30 years stands at an impressive 8.09%, hinting at a possible rendezvous with the 50,000 milestone by 2028.

Image source: Getty Images.

The Inevitability of Dow 50,000

The Dow’s trajectory towards 50,000 appears all but inevitable, anchored in historical patterns and economic fundamentals. Here’s why this historic milestone seems within grasp:

1. Dow’s Robust Foundation

The Dow’s ascent hinges on its membership of profit-centric, industry-leading entities. While not all of these stalwarts are in their growth prime, their inherent competitive advantages propel the index forward.

Take Walmart (NYSE: WMT) as an example. Through strategic bulk buying and diverse product offerings, Walmart retains a competitive edge in the retail landscape, showcasing a remarkable 964,000% growth over the past 50 years.

2. The Power of Dividend Payers

The Dow’s momentum thrives on the consistent dividends paid by most of its components. Dividend-paying stocks, except for outliers like Amazon (NASDAQ: AMZN) and Boeing, manifest stability and profitability, underpinning long-term growth forecasts.

A historical analysis underscores the hegemony of dividend-paying companies, outperforming their non-paying peers. These companies, including Dow stalwarts, exemplify the index’s resilience and upward surge towards Dow Jones Industrial Average 50,000.

The Dividend Impact on Dow Jones

Dividend Payers Outperform Non-Payers

Analysis from Funds, in collaboration with Ned Davis Research, has revealed that dividend-paying stocks have historically provided investors with an average annual return of 9.17% between 1973 and 2023. Not only did these companies deliver impressive returns, but they also exhibited 6% less volatility compared to the S&P 500. On the other hand, non-dividend-paying stocks lagged significantly, with an average annual return of just 4.27% and 18% higher volatility than the benchmark index.

Coca-Cola: A Beacon of Consistency

One standout example of a Dow dividend stock is Coca-Cola (NYSE: KO). With a presence in almost every country worldwide and a robust portfolio featuring numerous billion-dollar brands, Coca-Cola has raised its annual payout for 62 consecutive years. This consistency reflects the predictability of the company’s cash flow and underscores its commitment to rewarding patient investors.

Maintaining Dow Excellence

The committee responsible for overseeing additions and removals from the Dow, known as S&P Dow Jones Indices, maintains the index’s integrity by ensuring it comprises top-tier, high-performing businesses. Recently, Walgreens Boots Alliance (NASDAQ: WBA) was removed from the Dow due to increased competition from online pharmacies like Amazon, impacting its financial performance. Despite efforts to implement a turnaround strategy, Walgreens was not considered conducive to driving the Dow Jones to new heights.

Replacing Walgreens in the Dow, Amazon’s entry symbolizes a shift towards innovation and growth. While Amazon’s stock price growth may have stabilized, the exponential expansion of its cloud computing service, Amazon Web Services (AWS), is poised to drive substantial increases in operational cash flow throughout the decade.

While the Dow’s trajectory may not always be linear, the possibility of reaching Dow 50,000 before the decade’s end is not far-fetched.

Investment Consideration: Walmart and Beyond

Reflecting on potential investments, it’s essential to consider various factors. For instance, though Walmart is a significant player in the retail industry, recent analyses from the Motley Fool Stock Advisor highlight other opportunities with potentially higher returns. This service has consistently outperformed the S&P 500 since 2002, offering investors insights into lucrative stock picks and portfolio-building strategies.

Investors contemplating their next move can benefit from exploring the top 10 stock recommendations that could yield substantial returns in the foreseeable future, as identified by the Motley Fool Stock Advisor, even if Walmart isn’t on that list.

As of April 15, 2024, John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Amazon and Walgreens Boots Alliance. The Motley Fool has positions in and recommends Amazon and Walmart. The Motley Fool has a disclosure policy.