In a move reminiscent of the changing of the seasons, HSBC upgraded Advanced Micro Devices (AMD) from Hold to Buy on April 16, 2024, signaling green pastures ahead for the chip giant.

The Future Looks Bright

With an average one-year price target of 194.57, representing a potential 21.36% upside, the outlook for AMD seems to be basking in a warm, golden glow of investor optimism.

Financial Growth Prospects

Projections indicate an anticipated 27.78% increase in annual revenue for AMD, with a projected non-GAAP EPS of 4.82, painting a picture of financial strength and stability.

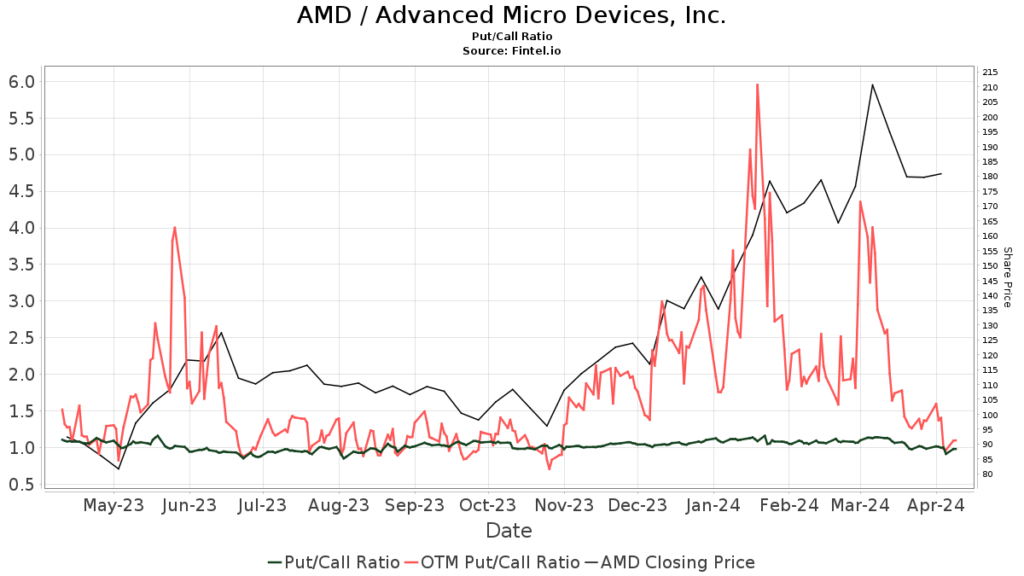

What does the crowd have to say about this? Well, it seems that 3615 funds or institutions have thrown their hats into the AMD ring, marking a 9.98% increase in ownership in the last quarter. Moreover, with a bullish put/call ratio of 0.97, the sentiment around AMD appears to be as sunny as a summer day.

Actions of Other Shareholders

Vanguard Total Stock Market Index Fund Investor Shares, VFINX – Vanguard 500 Index Fund Investor Shares, Jpmorgan Chase, Geode Capital Management, and Invesco Qqq Trust, Series 1 have all significantly raised their stakes in AMD, like enthusiastic bakers adding an extra pinch of sugar to their cakes.

Peering Into AMD’s Roots

With a legacy of more than 50 years, AMD has been a beacon of innovation in high-performance computing and graphics, catering to a global audience ranging from consumers to Fortune 500 companies. Their unwavering focus on pushing boundaries and delivering top-notch products has made them a reliable cornerstone in the technological landscape.