The Current State of Advanced Micro Devices

Despite a recent pullback, Advanced Micro Devices (AMD) has seen an 85% increase in its stock price over the last 12 months. The surge can be attributed to the growing interest in its AI chip offerings, particularly the Instinct MI300 Series Accelerators. While Nvidia dominates the market with an 80% share, projections hint at a 38% CAGR in the AI chip market until 2030, allowing AMD to thrive even with a smaller slice of the pie.

Noteworthy financial highlights include a 10% year-over-year revenue growth to $6.2 billion in the fourth quarter of 2023. The data center segment, which encompasses AI chips, witnessed a substantial 38% revenue surge, contributing $2.3 billion to AMD’s top line. The client division experienced the fastest growth, with a 62% revenue increase to $1.5 billion. Although gaming and embedded segments faced declines, they did not impede AMD’s overall fourth-quarter performance.

Looking ahead, analysts predict a 23% revenue boost in 2024 and a robust 26% uptick in 2025, setting the stage for significant net income growth over time, a bullish sign for AMD’s stock price.

Challenges on the Horizon for AMD

Problems are not absent, with full-year 2023 results reflecting an industry-wide cyclical downturn, culminating in a 4% revenue drop to $23 billion compared to the previous year. Operating income took a hit, plunging due to the decline in net income by 22% to $4.3 million.

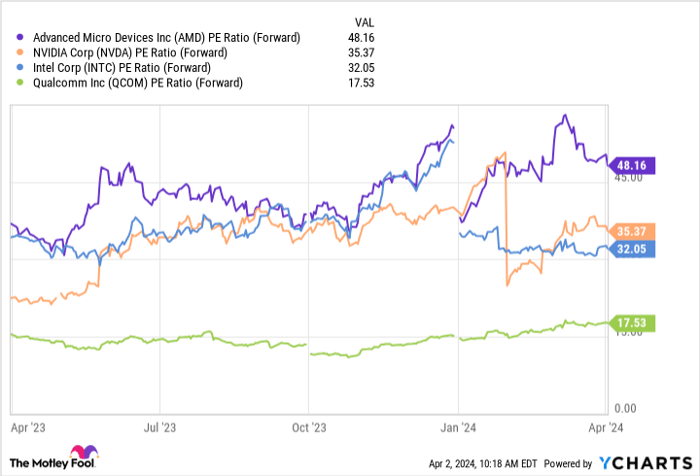

Moreover, AMD’s current P/E ratio of around 350, though inflated by profit declines, might not augur well for investors. Despite a more palatable forward P/E ratio of 48, the stock still appears steeply priced compared to peers like Intel and Qualcomm in the AI chip space, raising concerns about potential profit pressure or even reversals in the future.

Evaluating the Investment Potential Post-Correction

Given the burgeoning AI chip market and AMD’s positive trajectory, the recent stock pullback could offer investment opportunities. The company’s role in meeting the soaring demand for AI chips is likely to propel revenue and income growth moving forward, already evidenced by the fourth-quarter performance.

While AMD’s stock might appear expensive compared to industry peers like Nvidia, the anticipated stellar growth in the AI chip market is expected to benefit all players. With a diverse revenue stream from other sectors, the current stock correction in AMD could be viewed more as a buying chance rather than a deterrent for semiconductor investors.