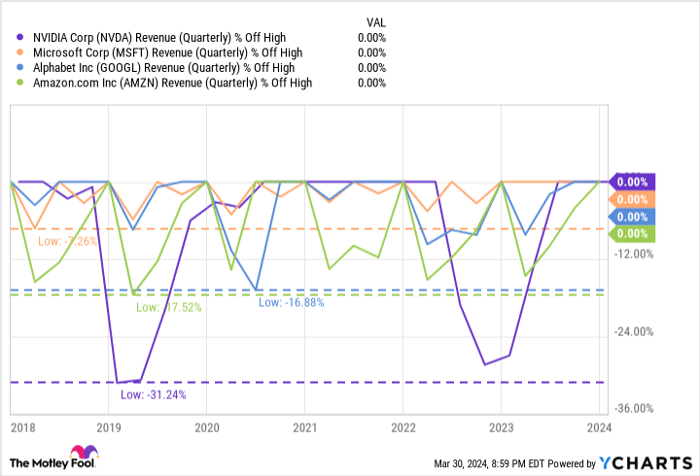

Nvidia has been a market darling, soaring 520% since the start of 2023. Such impressive growth is a hallmark of cyclicality in businesses like Nvidia’s.

Unlike subscription-based models that guarantee recurring revenue, Nvidia must constantly chase new sales to maintain momentum. This boom-or-bust dynamic, while historically viable, lacks the dependable revenue streams synonymous with subscription services.

Embracing the Subscription Trend

Cloud computing, championed by tech giants like Amazon, Microsoft, and Alphabet, relies heavily on Nvidia’s GPUs to power data centers. These companies rent out computing power, embodying the subscription model’s virtues: consistent revenue, scalable services, and reduced risk of technology obsolescence.

The shift towards AI-driven solutions has further boosted Nvidia’s GPU demand, albeit with inherent risks of market saturation. While Nvidia thrives on initial sales, cloud providers ensure sustained revenue through ongoing subscription fees.

Riding cloud computing’s meteoric growth trajectory, Amazon, Microsoft, and Alphabet are well-positioned to capitalize on a projected $1.55 trillion market by 2030. Their subscription-based revenue model offers stability compared to Nvidia’s sales-dependent cycle.

The Software Subscription Advantage

Software companies broke ground by pivoting to subscription models over a decade ago, compelling consumers to commit long-term or forfeit access. This strategic shift bolstered revenue predictability and customer loyalty, steering clear of the one-time sales pitfalls.

While Nvidia navigates cyclical markets, the subscription-oriented strategies of Amazon, Microsoft, and Alphabet present a more reliable long-term outlook, especially with cloud computing’s ascendancy. Despite its significance among Nvidia’s offerings, data center buildouts open a path to sustained revenue for cloud computing giants.

Investors eyeing the future focus not just on Nvidia’s peaks and troughs but on the enduring appeal of cloud computing and software subscriptions. The subscription economy thrives on stability, a stark contrast to Nvidia’s perpetual chase for the next sale.