The current market landscape may seem like a dream come true for investors, filled with boundless opportunities. However, navigating this euphoric terrain demands a discerning eye and a strategic approach in choosing the right investment vehicles.

Amidst the noise, one certainty stands tall: sturdy stocks from robust companies weather turbulence and emerge stronger than ever. This resilience propels these stocks to rebound from market dips and fosters sustained growth, offering a haven for investors seeking stability in their portfolios.

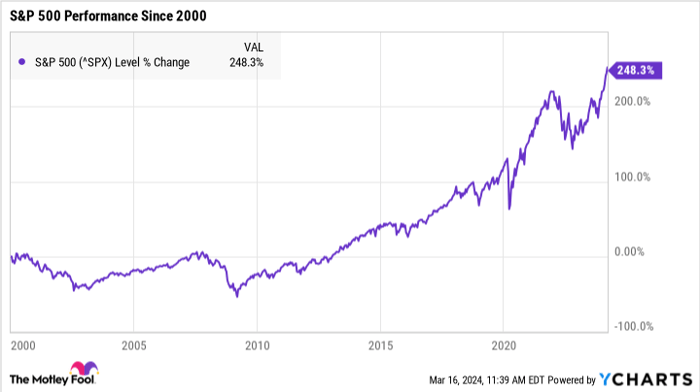

Image source: The Motley Fool.

Given the myriad investment options, an exchange-traded fund (ETF) emerges as a prudent choice if safeguarding one’s savings ranks high on the priority list. An ETF amalgamates a diverse array of securities into a singular investment, offering a slice of multiple stocks via a single share purchase.

While the ETF universe abounds with options, a standout candidate bears the imprimatur of none other than Warren Buffett. This ETF not only shields your capital but also paves the way for substantial wealth accumulation over the long haul.

Fortifying Your Investment Arsenal

Among the safest and most reliable ETFs lurks the venerable S&P 500 ETF. This financial stalwart mirrors the S&P 500, shadowing its constituent stocks for mimicry of its performance.

The S&P 500 roster boasts heavyweight champions of the corporate realm such as Apple, Amazon, Coca-Cola, and 3M. A foray into an S&P 500 ETF instantly confers ownership in all 500 companies housed within the index.

Given the cream-of-the-crop status of S&P 500 inclusions, this investment bodes well for weathering market storms. Over the past two decades, the market witnessed cataclysmic downturns, yet the S&P 500 has demonstrated extraordinary resilience, boasting a nearly 250% surge since the turn of the millennium.

Warren Buffett has vouched for this investment avenue as a means to curtail risk and foster wealth creation. Through his famed holding company Berkshire Hathaway, Buffett stakes claim in two S&P 500 ETFs — the Vanguard S&P 500 ETF (NYSEMKT: VOO) and the SPDR S&P 500 ETF Trust (NYSEMKT: SPY).

In a high-profile 2008 wager, Buffett bet $1 million on the S&P 500 outperforming a cohort of actively managed hedge funds. His investment reaped total profits of nearly 126% over a decade, dwarfing the 36% returns clocked by the group of hedge funds.

While guarantees in the investment realm remain a rare breed, the S&P 500 ETF steers close to such certainty. Boasting a storied legacy of positive total returns spanning decades and housing myriad stocks in each ETF, it ushers effortless portfolio diversification.

The Wealth-Building Potential of an S&P 500 ETF

Although the stock market harbors no certainties, its historical performance paints a rosy picture. Over the years, the market has notched an average annual return of approximately 10%, hinting at stable growth over protracted periods.

Ponder this scenario: funneling a modest $100 into an S&P 500 ETF with a respectable 10% average annual return. The potential value accumulation over time unfolds as follows:

| Number of Years | Total Portfolio Value |

|---|---|

| 20 | $69,000 |

| 25 | $118,000 |

| 30 | $197,000 |

| 35 | $325,000 |

| 40 | $531,000 |

Data source: Author’s calculations via investor.gov.

An early plunge into the investment pool spells enhanced earning potential. Even with modest monthly contributions, the gift of time transforms into a potent ally in amassing substantial wealth.

However, a drawback of the S&P 500 ETF pertains to its limitation in galloping beyond market returns. Tailored to mirror market dynamics, the ETF is incapable of outperforming the broader market. For individuals keen on surpassing market benchmarks, venturing into individual stock selection might present a more enticing strategy.

S&P 500 ETFs hold allure for those seeking a haven in the form of a secure, dependable, and low-maintenance investment avenue. Treading the path of early investment initiation and consistent contribution could unlock previously unforeseen wealth accumulation possibilities.

Is Now the Time to Infuse $1,000 into Vanguard S&P 500 ETF?

Before diving into Vanguard S&P 500 ETF shares, pause for contemplation:

The Motley Fool Stock Advisor analyst collective unearthed what they deem the 10 premier stocks poised for investor embrace… and the Vanguard S&P 500 ETF didn’t make the cut. These selected 10 stocks showcase monumental return potential in the years ahead.

Stock Advisor furnishes investors with a lucid roadmap to prosperity, replete with portfolio construction counsel, analyst updates, and bimonthly stock gems. Since its inception in 2002, the Stock Advisor service has steamrolled the S&P 500’s return thrice over*.

*Stock Advisor returns as of March 18, 2024

John Mackey, erstwhile CEO of Whole Foods Market under the aegis of Amazon, graces The Motley Fool’s directorial board. Katie Brockman has vested interests in Vanguard S&P 500 ETF. The Motley Fool holds positions in and extols Amazon, Apple, Berkshire Hathaway, and Vanguard S&P 500 ETF. The Motley Fool applauds 3M. The Motley Fool abides by a disclosure policy.