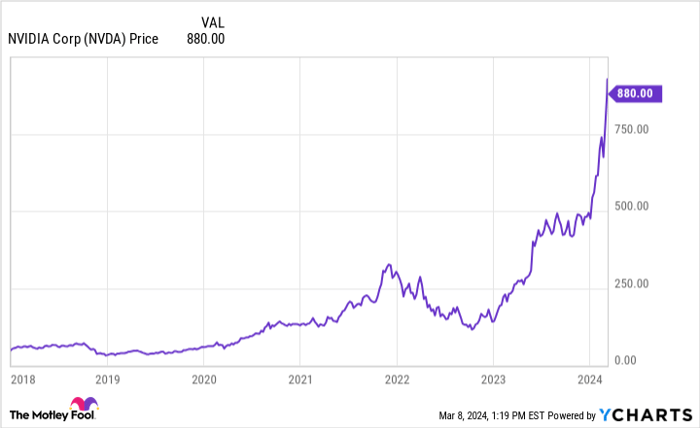

Nvidia(NASDAQ: NVDA)stock continues its meteoric rise in the financial world. With a near 300% surge in the past year, driven by the company’s AI-focused chips and the soaring demand for technological advancements, the stock’s current price hovering around $1,000 prompts investors to ponder the likelihood of an imminent stock split.

The History of Nvidia and Stock Splits

The narrative of Nvidia’s stock history presents a compelling case for anticipating a stock split in the near future. Having undergone five splits since 2000, including a recent 4-for-1 split in July 2021, Nvidia’s momentum has surpassed expectations, with remarkable growth rates this year alone.

Key Question on the Horizon

While the potential of another split looms, the pivotal question remains the ratio at which it will be executed. Given Nvidia’s historic choices, including two 2-for-1 splits and a 3-for-2 split in the 2000s, the recent surge could push the company’s board to strategize for future growth and index considerations.

The market dynamics, with a projected 81% revenue increase and considerable profit jumps on the horizon, could dictate the company’s split decision as a means to balance out potential price movements.

Factors Influencing a Decision

Another factor to contemplate is Nvidia’s potential inclusion among the 30 stocks constituting the Dow Jones Industrial Average. With S&P Dow Jones Indices currently not indicating any plans for this move, the escalating market cap of Nvidia and its technological significance may tip the scales in its favor.

Furthermore, as a price-weighted index, the Dow 30 necessitates a vigilant approach to nominal stock prices; a stock split might be a strategic maneuver to enhance Nvidia’s consideration for index inclusion.

Interpreting the Implications of a Stock Split

Gauging from Nvidia’s historical trajectory, investors can anticipate a split sooner rather than later. The critical decision of the split ratio underscores the company’s profound market influence and Dow 30 aspirations.

While a stock split, on the surface, may seem to have minimal direct impact on Nvidia’s value, shareholders should brace for potential shifts in market interest and engagement.