Industrial Sector Struggles

The Industrial sector faced a challenging midday on Monday, with a 0.5% loss. Leading the decline were Lam Research Corp, tumbling by 3.4%, and Boeing Co. with a 3.2% drop. The Industrial Select Sector SPDR ETF (Symbol: XLI) mirrored this downward trend, down 0.7% for the day but still maintaining a 6.49% increase year-to-date. Lam Research Corp has surged by 17.98% since the start of the year, whereas Boeing Co. has lagged behind, experiencing a 26.30% decline. Notably, BA constitutes approximately 2.9% of XLI’s total holdings.

Tech & Communications Strain

Following closely behind was the Technology & Communications sector, showing a 0.1% loss. Key players in this decline were Advanced Micro Devices Inc, down 4.3%, and Micron Technology Inc., slipping 3.8%. The Technology Select Sector SPDR ETF (XLK) also bore the brunt of this dip, with a 0.3% decrease in midday trading, though still holding a 7.36% gain year-to-date. Advanced Micro Devices Inc saw a significant uptick of 34.66% throughout the year, whereas Micron Technology Inc. experienced a more modest 10.15% increase. Combined, AMD and MU account for approximately 4.3% of XLK’s total holdings.

Comparative Performance Analysis

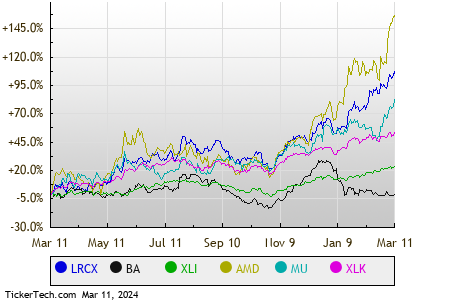

For a comprehensive view of the relative stock price performance of these entities, a detailed chart provides a visual representation, with each symbol depicted in distinct colors, as per the accompanying legend.

Sector Performance Overview

An analysis of the S&P 500 components within various sectors during Monday afternoon trading revealed a mixed performance. While six sectors showed positive gains, two – Technology & Communications and Industrial – encountered setbacks.

| Sector | % Change |

|---|---|

| Consumer Products | +0.8% |

| Services | +0.5% |

| Materials | +0.5% |

| Utilities | +0.4% |

| Financial | +0.2% |

| Energy | +0.1% |

| Healthcare | -0.0% |

| Technology & Communications | -0.1% |

| Industrial | -0.5% |

![]() 25 Dividend Giants Widely Held By ETFs »

25 Dividend Giants Widely Held By ETFs »

Also see:

MDAI shares outstanding history

ETFs Holding PCH

Corteva RSI