Key Insights:

- Lenovo’s profit dropped 23% in its third fiscal quarter to $340 million

- The PC maker is betting on the success of its new AI PC models to drive future revenue growth

Shares of Lenovo Group Ltd.‘s LNVGF and LNVGY tickers faced turbulence last month following the announcement of its third fiscal quarter results. Despite a 3.3% decline at HK$8.55, the company’s revenue for December was up sequentially, but year-over-year figures were less appealing.

The downward spiral in Lenovo’s stock value underscores concerns among analysts about the company’s long-term trajectory. Heightened skepticism stems from pessimism surrounding Lenovo’s server business, predicted to remain in the red due to hefty investments in new product development.

Amidst the gloom, HSBC stands as a lone proponent, raising its target price on Lenovo and maintaining a “buy” rating, citing better-than-expected operating margins and a positive outlook on the global server business.

Embracing AI for Future Growth

While market sentiments may be lukewarm, expectations are high for Lenovo’s foray into the realm of AI-powered PCs. A surge in demand for AI-optimized models catapulted rival Dell’s stock, signaling the potential for growth in this segment. Lenovo’s CEO, Yang Yuanqing, envisions a future where over half of all PCs boast AI capabilities by 2026.

With considerable stakes on the line, Lenovo is ramping up efforts to dominate the upcoming AI era, planning substantial investments in research and development to bolster innovation. The company’s unveiling of two AI PCs in April is anticipated to be a pivotal moment, drawing industry-wide attention.

Doubts Linger Amid AI Hype

Despite the enthusiasm surrounding AI PCs, skeptics cast shadows on hopes of a sales renaissance in the mature PC industry. IDC’s modest growth projections paint a subdued picture for the global PC market, raising doubts on whether AI PCs can truly invigorate overall sales.

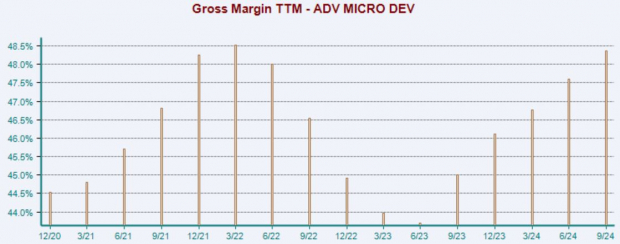

Furthermore, the potential revenue windfall from AI PCs may not necessarily land in Lenovo’s lap, as supply chain players like Nvidia and AMD could emerge as the primary beneficiaries. Geopolitical tensions threaten to complicate matters, with concerns over U.S. restrictions on chip sales to China potentially affecting industry players.

Amid geopolitical uncertainties and industry doubts, Lenovo finds itself treading cautiously in a landscape fraught with challenges. The path forward remains uncertain, with Washington’s watchful eye on Chinese tech companies adding to investor apprehensions.