After an impressive surge in both corporate growth and stock performance throughout the previous year, Tesla (NASDAQ: TSLA) has encountered a tough beginning in 2024. The stock that had doubled in value over the course of 2023 has plummeted by 25% within the first six weeks of the new year. As a consequence, the stock has recently reached its lowest point since the previous spring, raising the question of whether this downturn presents a favorable opportunity for investors to consider purchasing it.

Implications of an Electric Vehicle Growth Slowdown

Tesla achieved its electric vehicle (EV) production target in 2023, resulting in a 35% growth compared to 2022. The Model Y SUV, one of Tesla’s flagship offerings, emerged as the best-selling model globally last year. However, there were indications of a slowdown in overall EV demand as the year progressed.

One contributing factor has been the impact of interest rates. During Tesla’s third-quarter conference call with investors in October, CEO Elon Musk underscored the challenge, stating, “If interest rates remain high or if they go even higher, it’s that much harder for people to buy the car. They simply can’t afford it.”

Furthermore, a possible benefit from the deceleration in EV demand growth lies in the fact that major competitors such as Ford and General Motors have scaled back their EV production plans. For Tesla, this slowdown offers a competitive advantage on costs, potentially leading to an improvement in sinking profit margins through increases in average selling price (ASP).

Expanding Focus on Solar and Energy Storage

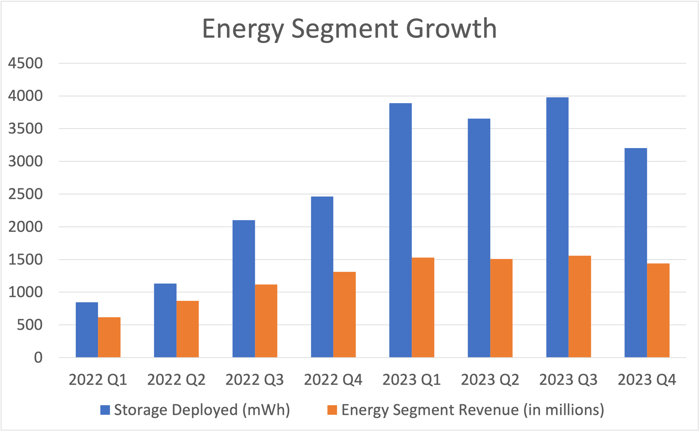

Tesla’s energy storage segment enjoyed significant growth in 2023, with a surge of over 130%. This upsurge in deployed Megapack storage capacity and energy generation resulted in revenue exceeding $6 billion last year.

Data source: Tesla. Chart by author.

Elaborating on the growth potential, Musk expressed optimism during a recent conference call, stating, “I think we’ll continue to see very strong growth in storage, as predicted.”

The Influence of Elon Musk

Owning a stock carries its inherent risks, compounded by the unpredictable nature of Tesla’s CEO, Elon Musk. Musk’s quirks have introduced some additional uncertainty to Tesla as an investment, with his expressed desire to acquire more control over the company and its endeavors in artificial intelligence technologies. Moreover, the recent nullification of Musk’s nearly $56 billion pay package by a shareholder lawsuit has prompted concerns about Tesla’s corporate governance and raised questions about potential changes in leadership. Any decision by Musk to prioritize his other major projects could potentially impact the stock.

For investors willing to assume these added risks, Tesla’s recent drop below $200 per share may offer an appealing opportunity to gain exposure to this multifaceted EV leader. If EV growth continues, albeit at a slower pace, Tesla is likely to emerge as the primary beneficiary in the ensuing years.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now, and Tesla made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of February 6, 2024

Howard Smith has positions in Tesla. The Motley Fool has positions in and recommends Tesla. The Motley Fool recommends General Motors and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.