We enter this week with a tech earnings whirlwind. Heavyweights such as Apple (AAPL), Alphabet (GOOG), Meta Platforms (META), and Amazon (AMZN) are all set to reveal their quarterly reports, adding a sprinkle of excitement in an already earnings-laden market. The Fed’s initial meeting of 2024 is fueling anticipation, with nearly a fifth of S&P 500 Index ($SPX) constituents ready to divulge their earnings.

In 2023, Apple stock achieved a commendable 49% surge, outperforming the 44% returns of the Nasdaq Composite ($NASX). Yet, surprisingly, it emerged as the underdog among its FAANG brethren. The company struggled in 2024, trailing behind its FAANG peers who soared to near 52-week highs. Apple also fell from its $3 trillion market cap pedestal, surrendering the title of the world’s most valuable company to Microsoft (MSFT).

Apple is poised to disclose its fiscal Q1 2024 earnings report on Thursday after the bell. Let’s delve into the market’s expectations for the Cupertino-based company’s forthcoming earnings and explore the potential for AAPL stock to regain its $3 trillion market cap.

Apple Fiscal Q1 Earnings Preview

In fiscal year 2023, Apple experienced negative revenue growth in all four quarters, a first since 2001. The company’s outlook for the December quarter failed to instill confidence, as it projected revenues “similar” to the corresponding quarter the previous year. Analysts anticipate a marginal revenue increase of just under 1% in fiscal Q1 and a 3.4% rise for the full year. However, the tech giant’s earnings per share are forecasted to surge by 11.1% in the fiscal first quarter.

The upcoming earnings will be closely watched for insights on several key factors:

- Chinese Market Commentary: With China being Apple’s largest overseas market, the company faces the challenge of a slowdown in the country’s economy, compounded by fierce competition from domestic smartphone players like Huawei and Xiaomi.

- Guidance: Since the onset of the COVID-19 pandemic, Apple halted providing quantitative forward guidance. However, any directional forecast for the next quarter will be scrutinized for signs of a turnaround after disappointing topline declines in the prior fiscal year.

- Update on Vision Pro: Market attention will center on any updates regarding the Vision Pro augmented reality headsets, with deliveries expected to commence imminently.

AAPL Stock Forecast: Analysts’ Outlook

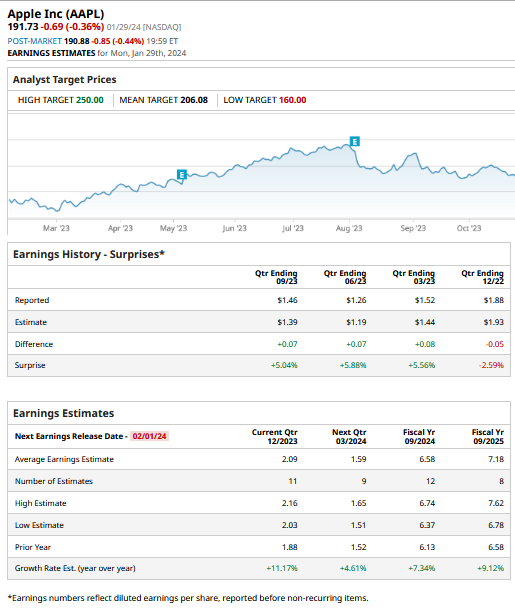

Remarkably, Apple faced three downgrades in January, a rare occurrence for the tech giant. Wall Street analysts have exhibited caution, with Barclays reiterating its “underweight” rating on the stock, expressing concerns over potential soft guidance for the March quarter amid weakening hardware sales. Baird and UBS, while anticipating an earnings beat for the December quarter, remain guarded about the outlook for the subsequent quarter.

Presently, Apple holds a “Moderate Buy” rating from analysts, with the mean target price of $206.08 representing a modest 9.1% increase from current levels. Among AAPL’s FAANG peers, analysts exhibit the most bullish sentiment towards Amazon, while Netflix (NFLX) struggles to win over steadfast bears, despite robust subscriber growth in recent quarters.

Can Apple’s Market Cap Surpass $3 Trillion Again?

As Apple’s market cap hovers on the brink of $3 trillion, an earnings triumph could pave the way for a triumphant return. Conversely, some foresee Microsoft outpacing Apple to remain the preeminent company. A Reuters survey underscores the prevailing sentiment, with all 13 investors, strategists, and portfolio managers anticipating Microsoft to hold a higher value than Apple over the next five years.

Both Apple and Microsoft remain credible contenders for a $5 trillion valuation. This once seemed improbable, yet even Nvidia (NVDA) now harbors ambitions of joining this illustrious club, with its market cap nearing $1.5 trillion, positioning it as the fifth most valuable U.S. company.

Apple needs to chart new avenues for growth, as its bet on the Indian market alone may not compensate for waning sales in China. Similarly, the potential of the new Vision Pro headset may not provide the monumental boost akin to the iPhone’s impact, which Apple ardently craves.