Investors hopeful for a resurgent Ford Motor Company (NYSE: F) see a potential turnaround from the company’s staggering $4.5 billion in annual electric vehicle (EV) losses. Alas, a recent game-changing decision by Ford raises doubts about the feasibility of realizing that vision within the anticipated timeframe.

A Shocking Turn

The F-150 Lightning’s sales surge of 55% in 2023 to over 24,000 vehicles has positioned it as America’s best-selling EV pickup – a linchpin in Ford’s EV aspirations. Considering the significant share of Ford’s profits attributed to its gasoline-powered F-Series trucks, the pivotal role of the F-150 Lightning cannot be overstated.

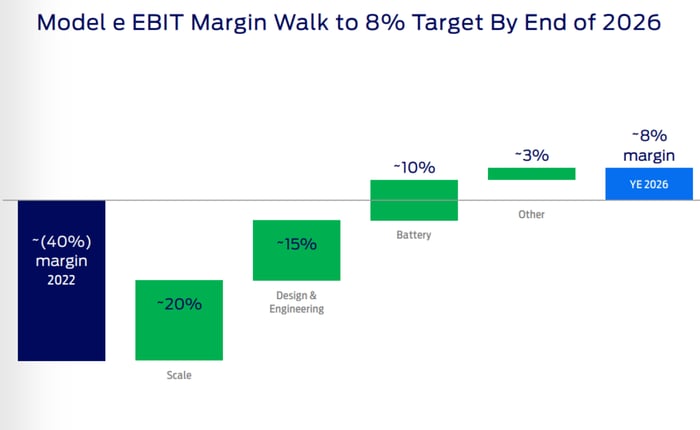

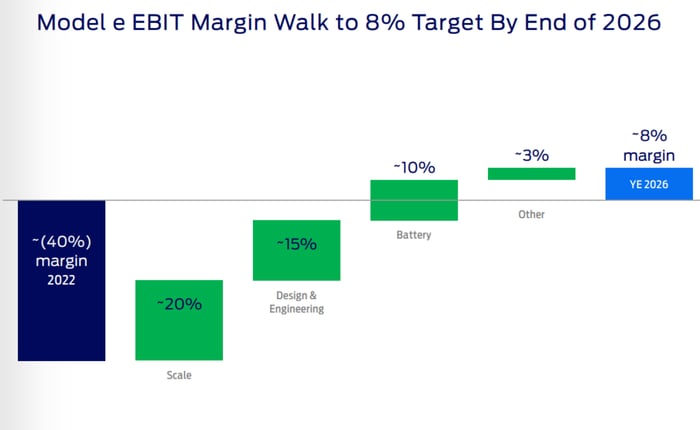

The strategic significance of the F-150 Lightning underscores the gravity of Ford’s recent decision to slash its production capacity, casting a pall over its ambition to achieve sustained EV profitability by 2026.

Image source: Ford Motor Company

A key factor in achieving profitability lies in scaling operations. However, this pivotal scale is set to be reached at a slower pace due to Ford’s production cuts for the F-150 Lightning. Ford’s recent announcement of a two-thirds reduction in jobs at its Michigan plant, along with a downgrade to a single daily production shift from its previous two-shift and three-crew operation, only exacerbates the gravity of its decision.

The Silver Lining

While the dilatory effect of the F-150 Lightning’s production cut on EV scale is palpable, a glimmer of hope emerges as displaced workers are reassigned to bolster production of the more lucrative Bronco SUV and Ranger pickup. Ford’s CEO, Jim Farley, weighed in, elucidating, “We are taking advantage of our manufacturing flexibility to offer customers choices while balancing our growth and profitability.”

Ultimately, Ford’s struggle to attain the requisite scale for EV profitability could play out primarily due to the slower-than-anticipated growth of the U.S. EV market. However, Ford is poised to rapidly achieve the necessary EV scale once the demand materializes.

In the short term, this move is expected to temporarily alleviate Ford’s EV losses by redirecting its focus towards producing more profitable vehicles. Notably, Ford faces substantial losses on each EV unit produced and sold.

Trouble Brewing?

Amidst the ripples caused by Ford’s tactical shift, the EV sales trajectory tells an intriguing tale. Although EV sales hit record volume in the fourth quarter, year-over-year gains seem to be tapering. Is Ford navigating through tranquil waters or bracing for turbulent seas in the capricious automotive industry? Will Ford meet its Model e goals by 2026? The journey ahead seems murky and unpredictable compared to the initial blueprint.

Should you invest $1,000 in Ford Motor Company right now?

Before you buy stock in Ford Motor Company, consider this:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks for investors to buy now. Interestingly, Ford Motor Company did not make the cut. The 10 stocks identified are expected to deliver substantial returns in the coming years.

Stock Advisor provides investors with a comprehensive outline for success, offering guidance on portfolio construction, regular updates from analysts, and two fresh stock picks monthly. Since 2002, the Stock Advisor service has outperformed the S&P 500 by a factor of over three.

*Stock Advisor returns as of January 22, 2024

Daniel Miller has positions in Ford Motor Company. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool adheres to a strict disclosure policy.