Tesla, the groundbreaking electric vehicle (EV) manufacturer, has recently experienced a noticeable dip in earnings. Dubbed as the “EV king,” Tesla has historically been a market leader, heralding the revolution in the electric vehicle industry. Despite this, the company’s stock has plummeted by over 50% from its all-time high in 2021, raising concerns among investors. Is this downward spiral an indicator of a larger problem, or does it signify a substantial opportunity for astute investors?

Historical Data: Opportunity Amidst Crisis

Historical analysis has revealed that Tesla experienced a significant rebound every time it faced a 5% or more gap down to a 6-month low. This pattern resulted in a robust recovery, with a median return of 18% over the next 30 days. The recent substantial drop in Tesla’s stock price echoes this historical trend, igniting the question: will history repeat itself?

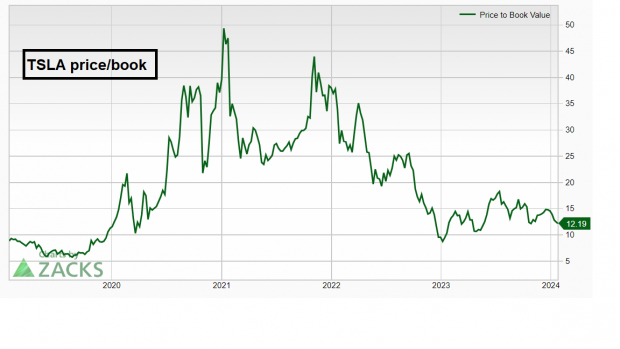

Valuation at Rock-Bottom Levels

Tesla’s price-to-book ratio, a key valuation metric, currently stands at a multi-year low of 12.19. This marks the lowest level since early 2020. Interestingly, the last time Tesla’s price-to-book ratio was this low, the stock soared from $35 to over $400 per share. Such a compelling valuation presents a compelling case for potential growth.

Diminishing Competition

Tesla’s competitors in the pure-EV space, such as Nio, Rivian, and Lucid, have endured dramatic declines. These companies are currently over 90% off their all-time highs, signaling an increasingly favorable landscape for Tesla’s market dominance.

Impact of Chinese Stimulus

Reports have emerged that China is poised to introduce a substantial stimulus package aimed at bolstering its struggling economy. Additionally, the People’s Bank of China (PBOC) plans to allow banks to maintain smaller cash reserves. As China stands as Tesla’s second-largest market, the effectiveness of this stimulus could profoundly benefit the company.

Record Cash Reserves

Notably, Tesla has amassed an impressive cash reserve of nearly $30 billion. This substantial liquidity empowers Tesla’s leadership to consider strategic initiatives like share buybacks or increased investment in production capacity, thereby fortifying the company’s long-term prospects.

The Verdict

Despite facing a downward trend in its stock price for four consecutive quarters, recent data and historical precedents suggest a potential opportunity for investors. The past performance of Tesla in the face of similar challenges, combined with its attractive valuation and robust cash position, paints a promising outlook for the EV giant.