The anticipation for the SEC’s decision on a spot Bitcoin ETF stirred up the cryptocurrency market, which had been waiting for the regulatory stamp of approval after Bitcoin’s debut on the Chicago Mercantile Exchange (CME) in late 2017. As the news broke on January 10, 2024, and eight spot ETFs began trading, the market’s reaction was not what many had hoped for. The rise in prices up to over $49,000 per token on January 11 swiftly reversed course, leaving investors puzzled by the unexpected decline.

Bitcoin Rallies from the 2021 Lows

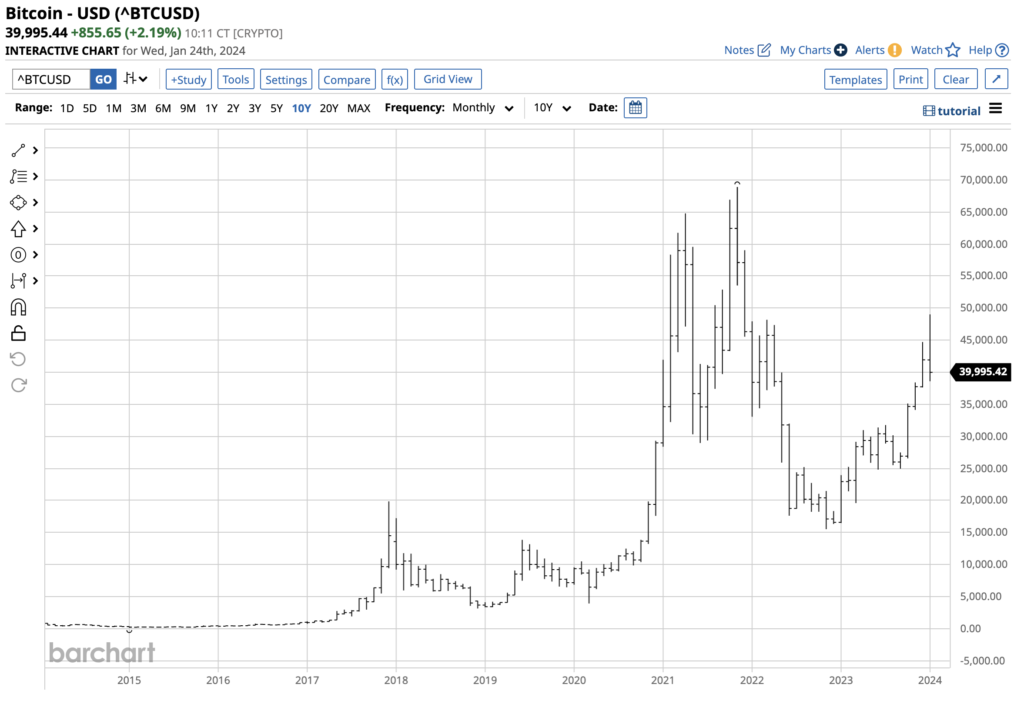

During an extraordinary surge, Bitcoin surged to a record high of $68,906.48 in November 2021 before witnessing a significant correction. Plummeting by 77.5% to $15,516.53 in November 2022, the cryptocurrency found a firm bottom, which marked the beginning of an impressive recovery, with prices up 216% to reach a peak of $49,021.86 in January 2024.

The SEC Approval Launches Eight Spot Bitcoin ETFs

The SEC’s green light on January 10, 2024, led to the swift introduction of eight ETFs: GBTC, BITB, FBTC, EZBC, BTCO, BRRR, HODL, and BTCW. Notably, GBTC, being the most liquid product with over $27 billion in assets under management, attracted significant attention despite its 1.50% management fee.

A Qualified Approval: Chairman Gensler Issues a Stern Warning

Chairman Gensler’s cautionary statement following the approval signified an implicit warning about the inherent risks and perils associated with Bitcoin. Highlighting the speculative and volatile nature of Bitcoin, Gensler’s comments were more of a cautious red flag than a wholehearted endorsement by the SEC.

GLD Is a Model: The Case for Higher Bitcoin Prices Over the Coming Months

The comparison between Bitcoin and the highly successful GLD ETF paints a hopeful picture for the cryptocurrency’s potential. Despite the immediate price action being a classic case of “buy-the-rumor and sell-the-fact” phenomenon, the long-term bullish prospects for Bitcoin are not entirely negated.

The Case for Concerns: Only Invest What You Can Afford to Lose

While the recent turbulence in Bitcoin’s price may have caught some investors off guard, it’s essential to heed Gensler’s warning and recognize the significant risks associated with the cryptocurrency investment. Governing bodies’ reservations toward cryptocurrencies reflect the regulatory challenges that the burgeoning asset class faces, with potential restrictions looming on the horizon.

More Crypto News from Barchart