Unleashing the Power of Technology

In the ever-evolving landscape of the stock market, technological innovation stands out as a beacon of hope for investors seeking substantial returns. From artificial intelligence to cryptocurrencies, cloud computing to e-commerce, the realm of technology continues to push the boundaries of both society and financial growth.

Despite a brief retreat, the resurgence of technology stocks has reignited confidence among investors as we navigate through the latter half of the year. Tech stocks have once again proven their prowess in leading the market and emerging as the most promising growth assets that investors can lay claim to.

Coinbase Global: Stepping into the Crypto Limelight

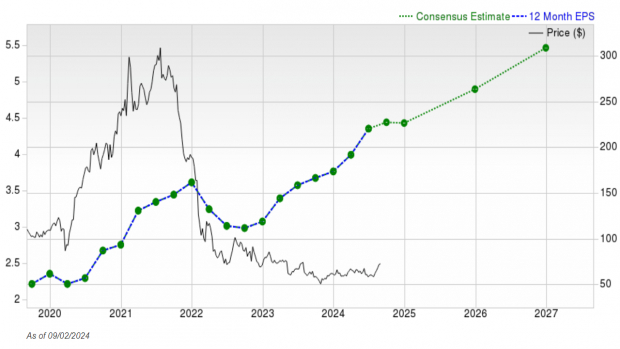

Recently, analysts at U.S. bank Citigroup (NYSE:C) boldly elevated the status of cryptocurrency exchange Coinbase Global (NASDAQ:COIN) from neutral to a buy rating. This upgrade was coupled with a significant increase in the price target for Coinbase stock, catapulting it to $345 per share from $260. The strategic move was underpinned by anticipations of a more favorable regulatory environment in the U.S., along with heightened trading activity spurred by the introduction of new cryptocurrency exchange-traded funds (ETFs).

As spot Ethereum (ETH-USD) ETFs commenced trading on U.S. exchanges, the stage was set for Coinbase Global to potentially soar to new heights. Being the largest crypto exchange in the U.S., Coinbase stands to benefit from increased trading activity driven by the ETFs. The bullish outlook also cites the expanding adoption of cryptocurrencies, providing a tailwind for Coinbase stock, which has witnessed an impressive 160% surge over the past 12 months.

Amazon: Prime-ing for Success

E-commerce behemoth Amazon (NASDAQ:AMZN) has been basking in the glow of success following its recent “Prime Day” sales extravaganza, which raked in a staggering $14.2 billion in online spending. The two-day event witnessed an 11% surge in sales compared to the previous year, surpassing the estimates of analysts and even outperforming Amazon’s own forecasts for $14 billion in sales.

The Prime Day frenzy was fueled by back-to-school shopping, electronics purchases, and a spike in sales of household essentials and apparel. With shoppers exhibiting a preference for higher-value purchases, the average order size surged to $57.97 from $54.05 last year. Amazon’s biannual Prime Day events have evolved into a significant revenue generator, propelling the company to newer financial heights. The impending release of Amazon’s financial results on August 1 holds the key to unveiling its continued success trajectory, with its stock having surged by an impressive 45% over the past year.

Netflix: Streamlining Towards Prosperity

The streaming giant Netflix (NASDAQ:NFLX) recently unveiled its second-quarter financial results, surpassing the expectations of Wall Street on both the revenue and earnings fronts. Bolstered by a remarkable 34% surge in ad-supported memberships, Netflix reported an EPS of $4.88, trumping the analyst projection of $4.74. Revenue soared to $9.56 billion, registering a robust 17% year-over-year growth.

The surge in total memberships to 277.65 million worldwide in June, up by 16.5% from the previous year, heralds a promising future for Netflix. The company’s increased focus on advertising revenue from its streaming platform and the expanding subscriber base for its ad-supported tier have bolstered its financial standing. With Netflix witnessing a 50% surge in its stock value over the past 12 months, including a remarkable 37% climb this year, the streaming giant stands as a testament to the growth potential within the technology sector.

In conclusion, the whirlwind journey of tech stocks underscores the essence of embracing innovation and technological prowess as driving forces behind market-beating returns. As we witness the spectacular rise of companies such as Coinbase Global, Amazon, and Netflix, investors are poised to ride the technological wave towards financial success and prosperity.