- Rate cuts are on the horizon—discover which sectors are poised to benefit.

- Defensive stocks could thrive as lower interest rates boost profitability.

The first rate cut of the coming policy easing cycle is imminent. However, the big question persists: will it be 25 or 50 bps?

As easing and the labor market slow, attention shifts from combating inflation to stimulating growth.

Lower rates loom ahead, prompting investors to consider portfolio rebalancing.

Let’s explore sectors and stocks that may benefit from lower rates, particularly undervalued ones.

Optimal Sectors for Gain

During rate cuts, defensive sectors like utilities, healthcare, and industrials have historically prospered. Companies in these sectors can reduce debt burdens, elevate profitability, and surpass market expectations.

Enhanced profits often drive stock prices upwards, especially for dividend-paying companies with yields surpassing government bonds.

Lower rates also aid indebted mid- and small-cap firms. Amidst heightened volatility, bigger companies with market caps exceeding $5 billion offer more stability.

Identifying Promising Stocks

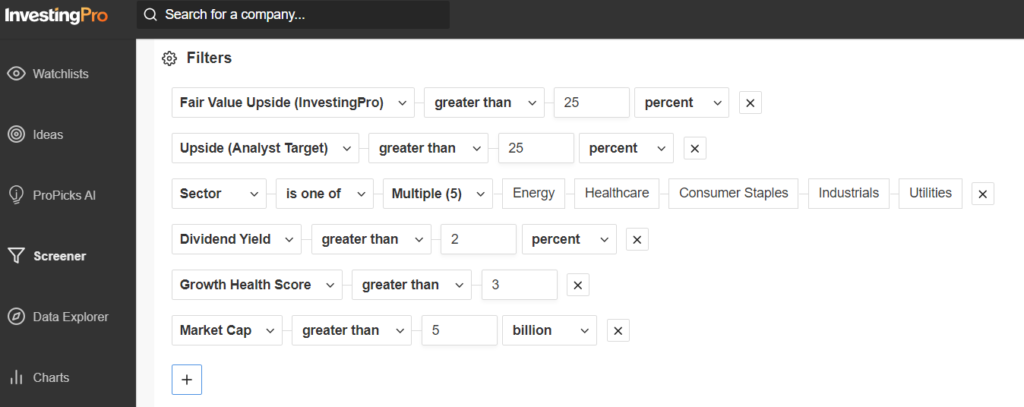

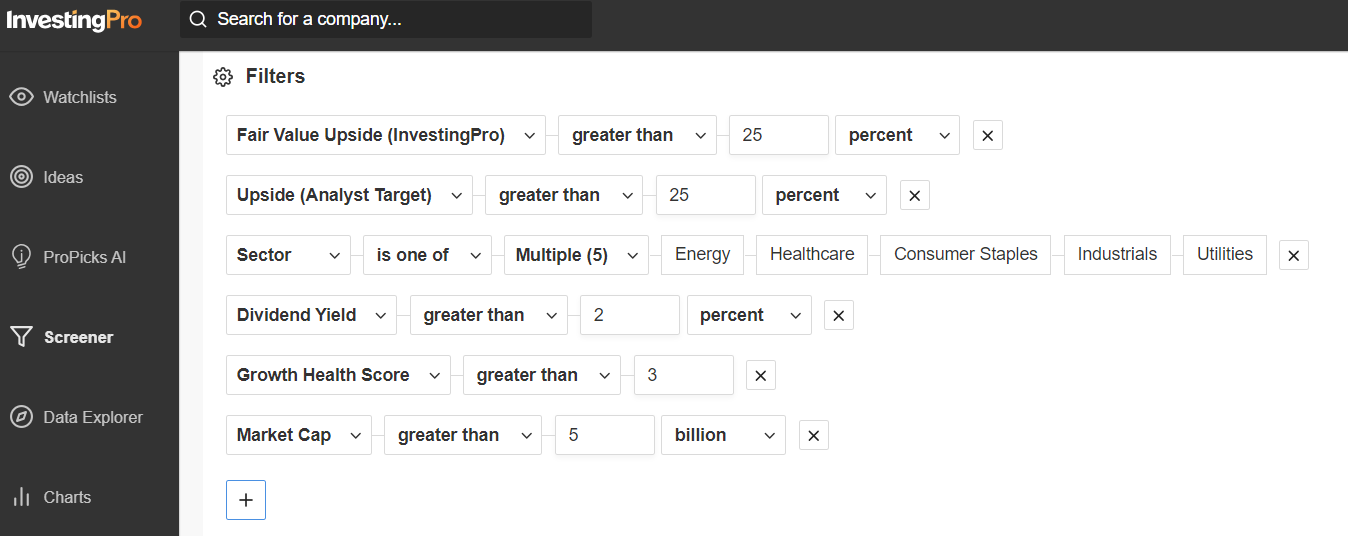

After studying key sectors, leverage InvestingPro’s stock screener to pinpoint stocks set to gain from rate cuts.

By applying filters like Fair Value, target price growth, and financial stability, discern the most promising opportunities.

Screening parameters include a Fair Value increase of 25%, target price increase of 25%, sectors like energy, healthcare, basic consumer goods, industrials, and utilities, a financial health score of 3 out of 5 or higher, and a market capitalization exceeding $5 billion.

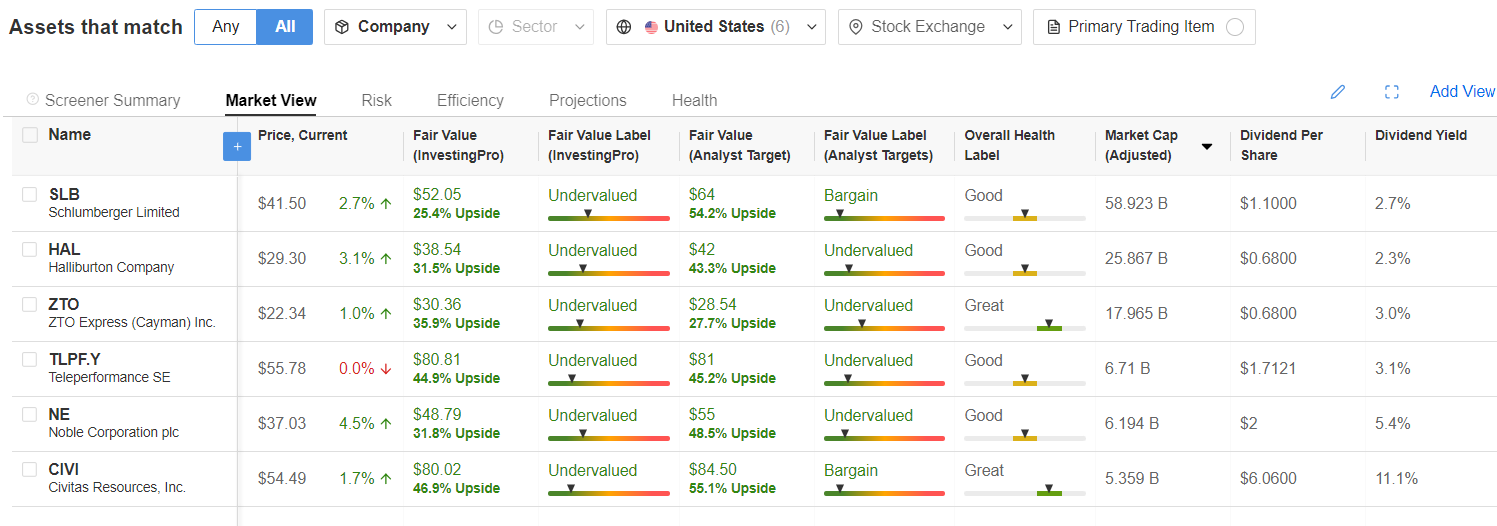

Post-screening, six strong stocks emerged:

- Schlumberger NV (NYSE:): Current price $41.50, Fair Value upside 25.4%, analysts’ target up 54.2%

- Halliburton Company (NYSE:): Current price $29.30, Fair Value upside 31.5%, analysts’ target up 43.3%

- ZTO Express (Cayman) Inc (NYSE:): Current price $22.34, Fair Value upside 35.9%, analysts’ target up 27.7%

- Teleperformance SE (EPA:): Current price $55.78, Fair Value upside 44.9%, analysts’ target up 45.2%

- Noble Corp (CSE:): Current price $37.03, Fair Value upside 31.8%, analysts’ target up 48.5%

- Civitas Resources Inc (NYSE:): Current price $54.49, Fair Value upside 46.9%, analysts’ target up 55.1%

InvestingPro subscribers can replicate this screening or customize parameters to align with specific investment objectives.

Gain access to InvestingPro today with exclusive benefits such as InvestingPro Fair Value, AI ProPicks, Stock Screener, and Top Ideas.

***

Disclaimer: This article is for informational purposes only. It does not advise asset purchases and is not a solicitation, offer, recommendation, or investment suggestion. All assets, viewed from varied perspectives, hold high risks. Any investment decision and associated risks are at the investor’s discretion. We do not offer investment advice or services. We do not contact for investment or advisory services.