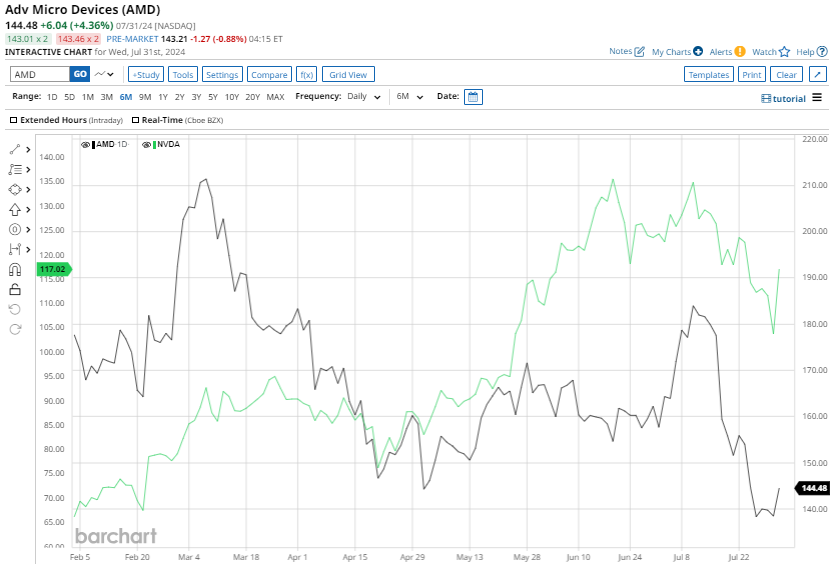

Advanced Micro Devices (AMD) stock has faced a challenging year, trailing behind the S&P 500 Index by approximately 15.8%. The company’s direct competitor, Nvidia (NVDA), has surged ahead, leaving AMD’s stock down by about 2% year-to-date.

While AMD offers a diverse portfolio, including server microprocessors, graphics processing units (GPUs), data processing units (DPUs), and more, its lower growth rate has left investors wanting more and has kept the stock price in check.

One of the major challenges facing AMD is its lower market share in the lucrative artificial intelligence (AI) sector, especially compared to Nvidia. Additionally, stiff competition in the CPU market, macroeconomic headwinds, and softness in the gaming segment have impacted AMD’s financial performance and stock price.

However, AMD has recently shown strength in its second-quarter (Q2) financial results. Management’s positive outlook on AI-related revenues and the increased 2024 data center GPU revenue target are encouraging signs.

Despite the year-to-date challenges, the promising growth prospects for the second half of 2024 present an appealing entry point for investors at current levels.

Reasons Behind AMD Stock’s Potential Outperformance in 2H 2024

- Strong Q2 Results: AMD’s revenue jumped by 9% year-over-year to $5.8 billion in Q2, driven by higher GPU shipments and Ryzen processor sales.

- Growth to Accelerate in 2H: AMD is positioned for significant revenue growth in the second half, with strong momentum in its Data Center and Client segments.

- Expanding Customer Pipeline: AMD’s customer base is expanding, with increased adoption of its EPYC CPUs and collaborations with cloud partners.

- Future Product Launches: AMD is set to launch new products offering enhanced performance and computing capabilities.

- Opportunities in AI: AMD is capitalizing on the growth in generative AI, investing in hardware, software, and solutions to expand its presence in the AI sector.

- Acquisitions and Investments: Recent acquisitions and investments, including Silo AI, are reinforcing AMD’s position in the AI market.

Final Thoughts on AMD Stock

Despite recent underperformance, AMD’s strong Q2 results, growth potential, and strategic investments position it favorably for the second half of 2024.

Analysts are optimistic about AMD’s future, with a majority recommending it as a “Strong Buy,” highlighting the potential for growth ahead.

The average price target for AMD stock sits at $197.78, indicating a potential upside of around 37% from current levels.