Stability and Resilience

As the Q4 earnings season unfolds before the watchful eyes of market participants, a portrait of stability and robustness begins to take shape. Earnings, while not exceptional, have pleasantly surprised commentators who expected dismal corporate profitability. This gradual improvement serves as a welcome balm to alleviate the lurking specter of an imminent earnings precipice, assuaging the fears of many.

Accelerated Growth Trend

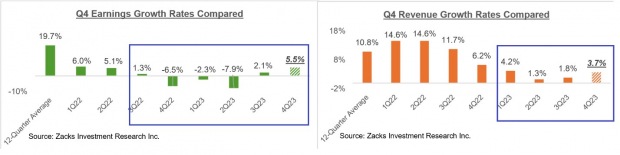

The Q4 financial results signify an uptick in earnings and revenue growth rate, displaying an acceleration from recent quarters. While the absolute levels may not dazzle, this burgeoning momentum is a significant precursor of what lies on the horizon. Out of the 338 S&P 500 members that have disclosed results, total earnings and revenues exhibit a +5.5% and +3.7% increase from the analogous period last year, respectively. The percentages of companies beating EPS and revenue estimates stand at 80.5% and 65% correspondingly.

Robust Margins Progress

Companies have shown commendable progress on the margins front. The reversal of the year-over-year change in net margins to positive territory after six consecutive quarters in the negative represents a crucial impetus for future earnings growth. The Q4 net margins outperform the previous year’s levels for 9 out of 16 sectors, with notable strides observed in the Tech, Consumer Discretionary, Retail, Industrial Products, Utilities, and Finance sectors.

Resurgence of the Tech Sector

The Tech sector has reasserted its growth trajectory with gusto and is anticipated to sustain this momentum in the forthcoming period. For 64.5% of Tech companies in the S&P 500 index reporting Q4 results, total earnings have surged by +21.5% on +6.4% higher revenues, with impressive EPS and revenue estimate beats. The sector, a significant earnings contributor to the S&P 500 index, is forecasted to command 28.5% of the index’s total earnings over the next four quarters, significantly influencing the aggregate growth landscape.

Domination of the Magnificent 7

The so-called Magnificent 7 companies, Apple AAPL, Amazon AMZN, Alphabet GOOGL, Microsoft MSFT, Meta META, Nvidia NVDA, and Tesla TSLA, have exhibited a formidable display of technological prowess in their respective arenas. These companies, which are poised to deliver 20% of all S&P 500 earnings in 2024, have played a pivotal role in preventing a decline in S&P 500 earnings growth for Q4, showing a stark contrast of -3% versus an impressive +5.4%.

Stabilized Revisions Trend

The trend of estimates for 2024 Q1 and full-year 2024 has notably stabilized after a seemingly adverse turn at the outset of 2023 Q4. While some sectors witness downward revisions, they are effectively balanced out by positive revisions from others, reflecting a modest dip in the earnings growth expectation for the period.

Analyzing the Explosive Earnings Potential of a Little-Known Chemical Company

The stock market is a grand arena, a place where companies – some famous, many obscure – vie for the attention and favor of investors. Amid this bustling stage, a little-known chemical company has quietly been making waves, drawing the attention of industry experts and retail investors alike.

The Hidden Gem

This unassuming player, which has seen a remarkable 65% surge over the past year, remains attractively undervalued. With unyielding demand, an upward trajectory in 2022 earnings forecasts, and a $1.5 billion allocation for share repurchases, the company’s potential for explosive growth has not gone unnoticed. In fact, it has been singled out by Zacks experts as their “Single Best Pick to Double,” out of thousands of stocks.

A Track Record of Unmatched Growth

In the realm of stocks set to double, few have matched the potential held by this little-known chemical company. Recent history points to similar Zacks’ picks such as the Boston Beer Company, which soared by an impressive 143.0% in a little over 9 months, and NVIDIA, which experienced a staggering 175.9% surge in just one year. The allure of this chemical company has the potential to rival or even surpass these recent success stories.

Free: See Our Top Stock and 4 Runners Up >>

It’s a rare sight to witness such a modest contender draw the eye of industry enthusiasts and market participants. The company’s growth trajectory, shrewd financial strategies, and widespread potential for robust gains have piqued the curiosity of many, leaving one to ponder – could this crouching tiger unleash a market roar?

To read this article on Zacks.com click here.