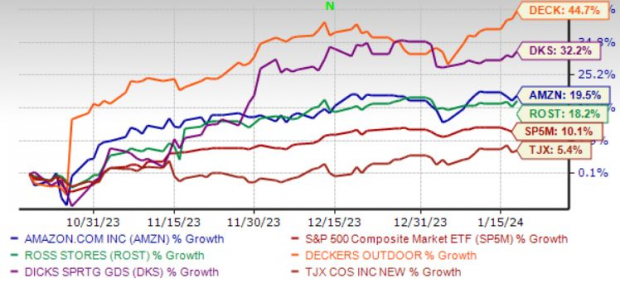

Investors saw a surge in retail sales in December, outpacing expectations and indicating a positive trend in consumer spending. The Department of Commerce reported a 0.6% month-over-month increase, surpassing the estimated 0.5%. This follows a 0.3% rise in November and represents a 5.6% year-over-year increase for December. Furthermore, core retail sales rose 0.4% month over month, exceeding the predicted 0.2%. This upward trajectory in retail sales not only reflects consumer confidence but also allays concerns of an imminent recession.

However, these strong retail sales numbers, coupled with unexpectedly high nonfarm payrolls and inflation, have sparked apprehensions of potential delays to the anticipated rate cut by the Fed.

Retail Titans on the Rise

Among top retail companies, several have demonstrated sturdy potential, evident from positive earnings estimate revisions. Ensuring a strong footing for 2024, these companies boast a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Amazon.com Inc. (AMZN)

Amazon has reaped the benefits of a robust AWS services portfolio and accelerating adoption rates. Notably, its ultrafast delivery services and extended content portfolio have propelled its success, alongside a burgeoning relationship with third-party sellers and a strong foothold in the advertising business. With an anticipated 11.7% revenue growth and 34% earnings growth, Amazon is poised for a promising year.

Deckers Outdoor Corp. (DECK)

Deckers Outdoor has seen substantial gains, driven by the strength of its UGG and HOKA brands and the direct-to-consumer channels. Its solid performance in the global wholesale market, coupled with an 11% projected increase in net sales for fiscal 2024, positions DECK favorably for the year.

Ross Stores Inc. (ROST)

Ross Stores has capitalized on positive customer response to its enhanced merchandise and attractive value offerings. With consistent execution of expansion plans and a proven business model, ROST has maintained its appeal to value-conscious consumers across different economic scenarios. The company is poised for a revenue growth rate of 4.3% and an 8.8% earnings growth rate in the current fiscal year.

The TJX Companies Inc. (TJX)

TJX’s consistent growth in both store and e-commerce channels, strategic store locations, impressive brands, and efficient supply-chain management have underpinned its success. Notably, its Marmaxx segment witnessed strong comparable store sales, signaling improved customer traffic and presenting a promising outlook for TJX in the current fiscal year.

DICK’S Sporting Goods Inc. (DKS)

DICK’S Sporting Goods’ robust performance in the third quarter of fiscal 2023, marked by a strong back-to-school season, market share gains, and healthy transaction growth, bodes well for its future. With an anticipated 1.7% revenue growth and 3.8% earnings growth in the current fiscal year, DKS is positioned for steady progress.

To read this article on Zacks.com click here.

Zacks Investment Research